Grocery price inflation has reached 2.4% marking the seventh month of rising food prices in February, according to new data from evidence-based insights and consulting company Kantar.

Grocery market share figures for the past 12 weeks ending on Sunday, February 20, show that inflation is up by 2.4% when compared to the same period in 2021 – the highest inflation level since June 2020, according to Kantar.

Commenting on rising prices affecting grocery products, senior retail analyst at Kantar, Emer Healy said:

“We’re now starting to see this reflected in shopper behaviour, with people increasingly opting for private label lines over branded products in an attempt to drive down the cost of their weekly shop.”

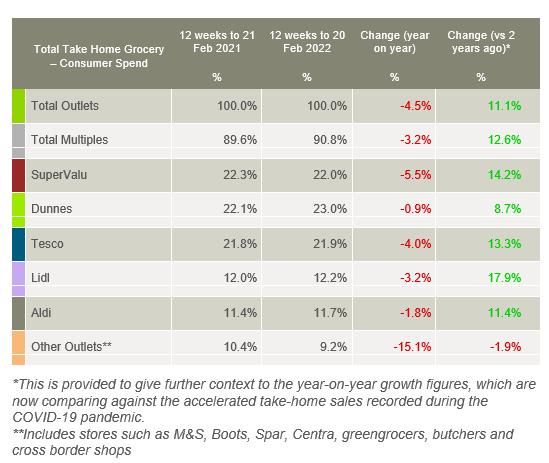

Latest figures indicate that take-home grocery sales in Ireland fell by 4.5% affecting all major retailers, however spending still remains 11.1% higher than before the pandemic.

The number of products sold on promotion declined by 10.9% year-on-year as retailers aimed to deal with increasing supply costs, the Kantar report stated.

Along with their recent advertising campaign on “inflation buster” prices, Lidl now accounts for a 12.2% share of the grocery market and received an additional €4.1 million to overall sales due to new shoppers during the specified period.

Senior retail analyst Healy stated that amid inflation affecting grocery prices and consumer behaviour, special tactics are needed by retailers to retain their share of consumer spending. She explained:

“Supermarkets have been quick to respond to growing concerns over the cost of living through targeted ad campaigns and voucher schemes.”

Dunnes Stores has retained its position as Ireland’s largest grocer accounting for 23% of the total market share, followed by SuperValu (22%), Tesco (21.9%) and Aldi (11.7%).

Change in consumer behaviour

The further easing of Covid-19 restrictions contributed to the overall fall in supermarket sales during the 12 weeks ending on February 20, as people returned to office settings.

Consumers chose chilled convenience items and ready meals on which they spent an additional €4.3 million, while sales of flour (-27.6%), eggs (-20.6) and chocolate spreads (-35%) declined, Healy added.

Figures also reflect a change in consumer location as the share of online sales fell to 5.7% from 6.2% in February 2021, while grocery sales of purchases made online declined by 15% to €9.4 million, according to data from Kantar.

“The growth of online grocery which we saw during the pandemic is now beginning to stabilise and has reached a natural ceiling as we ease back into life out of lockdown.”

Kantar further reported that online sales in the Munster region were down by only 7% due to bad weather throughout the past month which, Healy stated, led to a “much softer decline than the rest of the country”.