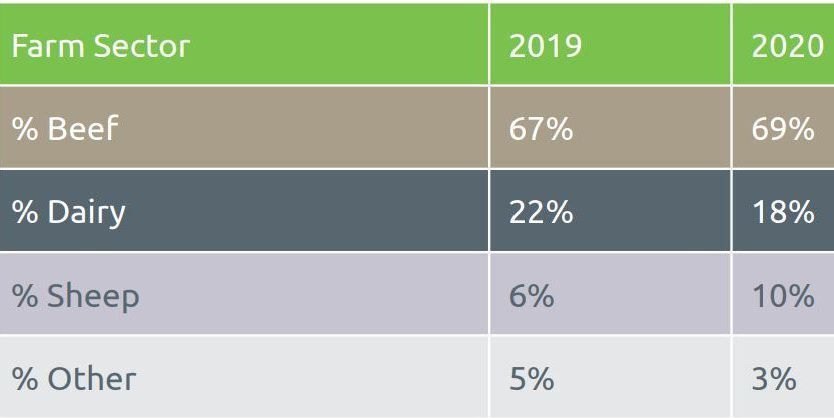

Beef farmers accounted for 69% of Credit Union Cultivate farm loan applications in 2020, according to new analysis.

Cultivate, the Credit Union farm loan initiative, has reviewed loan application data comparing the seven months from March 1 to September 30, 2020, with the same period in 2019.

With the disruption and uncertainty of Covid-19, loans remained “broadly stable”.

Dairy farmers have more debt in comparison to beef farmers, with the most common debt level for beef farmers at €50,000, while dairy farmers are managing over double that, at €123,000.

Beef farmers accounted for 69% of Cultivate loan applications in the period (as shown in the table below), an increase of 2% versus the same period last year, while dairy farmers applied for 18% of the loans, down 4% year-on-year.

The average loan to a dairy farmer was €30,242, in comparison to €23,092 for a beef farmer.

Dairy and beef loans

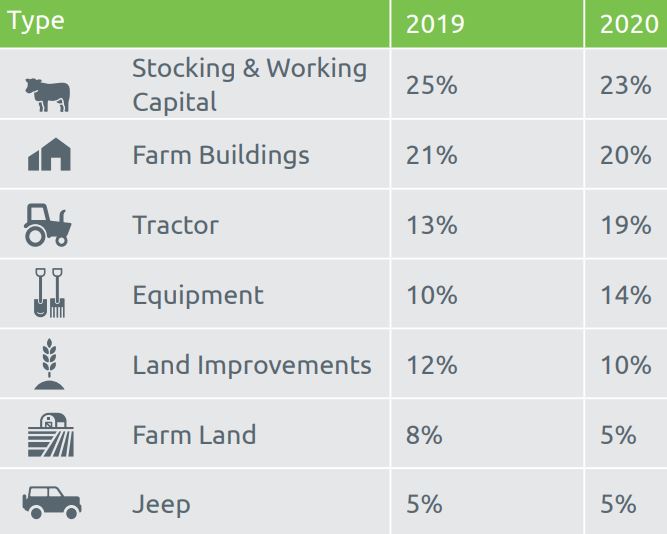

The most common loans for dairy farmers in 2020 was for farm buildings (23%), consistent with 2019 where farm buildings accounted for 24% of all dairy loan applications.

The most common loan term for dairy loans in 2020 was seven years (84 months) – the maximum loan term available for Cultivate loans – consistent with the same period in 2019.

The most common loans for beef farmers in 2020 was stocking and working capital (23%), consistent with 2019 where stocking and working capital accounted for 26% of all beef loan applications.

The most common loan term (median) for beef loans in 2020 was almost seven years at 83 months, up from five years or 60 months for the same period last year.

According to the analysis, this 38% jump “reflects the changed environment with beef farmers looking to spread repayments over a longer period”.

Average debt continues to rise

The average debt for farmers looking to access Cultivate farm loans “continues to rise”.

The average farm debt was up 4% on the same period last year, up to €108,117.

The average debt on a dairy farm is 83% higher than a beef farmer, at €167,225 versus €91,556.

The average Cultivate loan application between March 1 and September 30, 2020, was for €24,120, given to a farmer over 5.6 years, who owned a farm of circa 33ha and had €108,117 debt on their farm.

There is a high prevalence of off-farm income, with over nine in 10 beef farmers highlighting that they had off-farm income.