Agri, forestry, fishing paid environment taxes worth €97m in 2024 - CSO

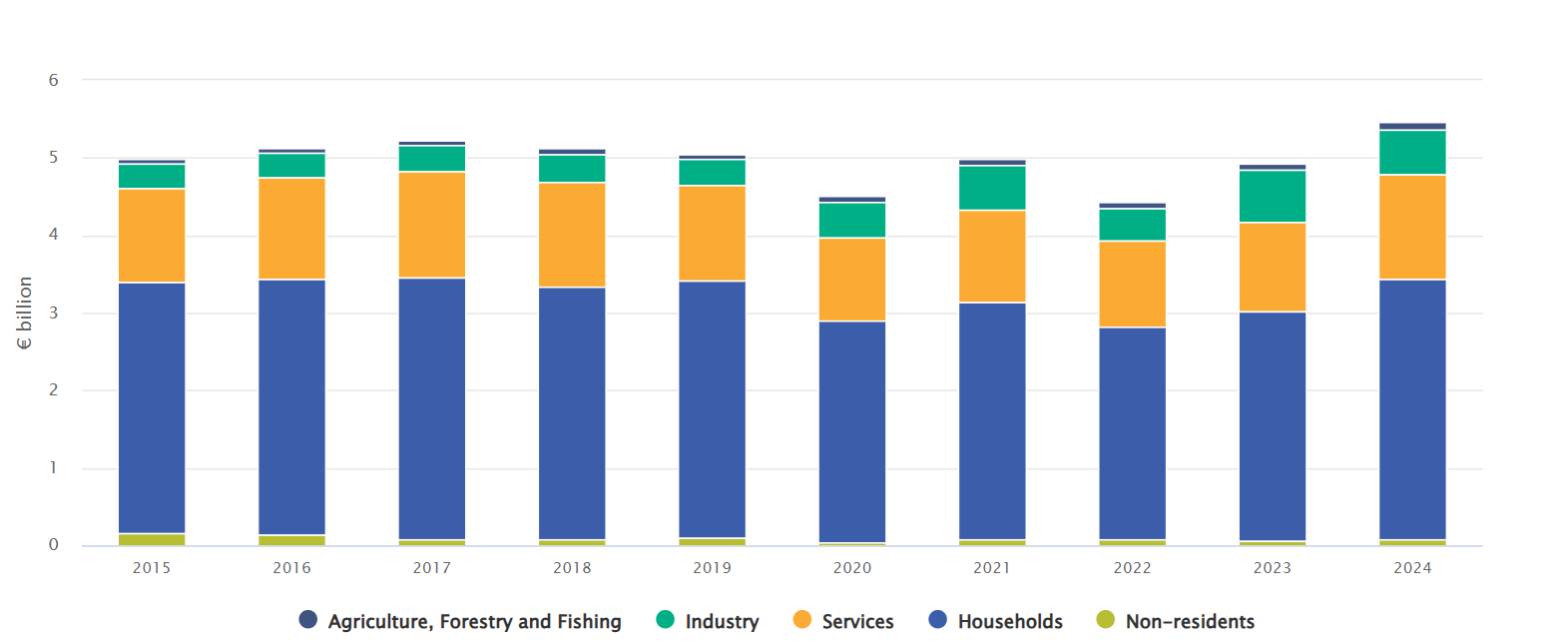

In 2024, €5.5 billion was collected in environment-related taxes, new figures from the Central Statistics Office (CSO) show.

This was an increase of 11% on 2023 and the highest amount collected between 2015 and 2024.

The share of taxes levied on the agriculture, forestry and fishing sector was worth 2% of the overall figure, around €97 million, a significant increase from the year before.

In 2023, the sector paid €74 million, compared to €70 million in 2022 after a 10-year high of €78 million in 2021.

Most environment taxes were taxes on energy products, with the sector paying €90 million towards these, while €6 million went to transport taxes and around €100,000 to pollution and resource taxes.

Share of environment taxes

Energy taxes accounted for 63.5% of all environment taxes, or €3.5 billion, in 2024.

Transport taxes (including motor tax and vehicle registration tax) accounted for 36% in 2024.

Pollution and resource taxes, such as the plastic bag levy, made up 0.5% of environment-related taxes in 2024.

Environment-related taxes were 4.3% of total taxes in 2024.

The share of environment taxes in total tax revenue was down from 7.9% in 2015.

Households paid the largest share in 2024 at 61% of the total, or €3.4 billion.

Commenting on the release, Clare O'Hara, statistician in the environment division, said: "Environment taxes went up by 11% in 2023. This followed an 11% drop in 2022, when taxes were €4.4 billion, the lowest value between 2015 and 2024.

"The decrease in 2022 was due to a temporary reduction in excise duty on fuels introduced in April 2022 due to rising energy costs.

"The rise in 2024 resulted mainly from a recovery in excise receipts as the temporary reduction ended, and higher carbon tax receipts as the carbon tax rate increased.

"As a percentage of total taxes, environment taxes were 4.3% in 2024, down from 7.9% in 2015."

Energy taxes in 2024 were €3.5 billion, an increase of 15% on 2023, O'Hara said.

"Excise duty on hydrocarbon oils such as petrol, road diesel, and marked gas oil was the main source of revenue, accounting for €2 billion or 57% of energy tax receipts," she explained.

"Carbon tax made the next largest contribution at 31%. Carbon tax receipts rose by 16% to €1.1 billion in 2024."