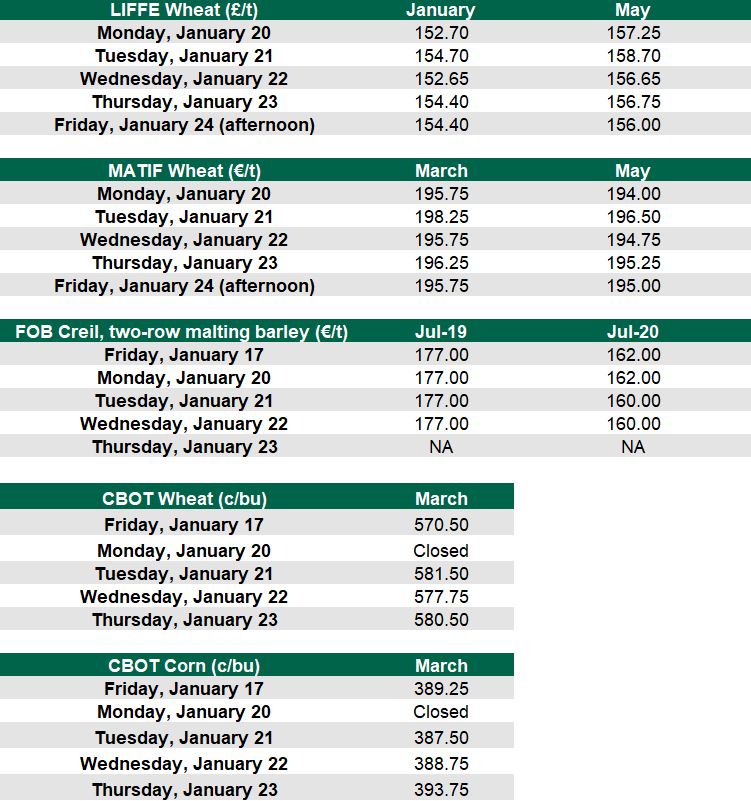

Wheat prices have been rallying in the past few weeks. LIFFE wheat for May hit £158.70/t on Tuesday of this week, while MATIF wheat for May hit €196.50/t.

Strikes by transport workers in France are having an impact on grain movement. If grain is left sitting at ports or cannot be moved quickly buyers may look somewhere else.

Reduced planted area in many EU countries is helping to contribute to the rise, while it’s unclear what effect a proposed non-tariff export quota on 20 million tonnes of Russian grain will have.

Some estimates show nearly 22 million tonnes of wheat had been exported from the country by the end of December, meaning that approximately 12 million tonnes of estimated exports remain.

Maize imports may put pressure on wheat prices. While Ireland has seen an increase in the amount of maize being imported to the country the EU has also seen an influx.

The majority of this maize was coming from Ukraine and one of the biggest importers of the crop to the EU was Spain, who had imported 5.2 million tonnes by January 20.

Grain markets

Wheat markets looked positive in Europe this week, while malting barley took a hit. Chicago Board of Trade (CBOT) wheat and corn was also in the green.

Looking ahead to new crop prices, LIFFE wheat for November was at £165.25/t on Friday morning, January 24, while MATIF wheat for September was at €188.50/t.