Phase two of the Teagasc Green Acres Calf to Beef Programme commenced in spring 2019.

Over the past year or so, participants in the programme have been busy implementing the six key pillars on which a successful dairy calf-to-beef system is structured.

While at current beef prices there is no fortune to be made from rearing and finishing dairy-origin calves; the farmers enrolled on the programme have made some positive progress in terms of gross and net margins.

At the beginning of the programme, there was a wide variation across all farms in terms of profitability, and farmers had come through a hard year in 2018 – with a terrible spring weather wise presenting animal health issues which led to increased costs on farm.

Farmers were then exposed to a summer drought, which halted grass growth and led to spiraling feed costs on many farms, resulting in a rise in variable costs.

In some cases, the results of these weather events will play its role in terms of mortality, reduced thrive and lower carcass weights.

Some of the farmers have made changes to systems; all farmers will bring stock through to finish as opposed to selling weanlings or store cattle in the mart.

But during 2019, one of the most crippling factors which affected farmers was beef price, which reduced by 24c/kg (source: Bord Bia) when compared with 2018 prices – a drop of 7% (€3.84-3.60/kg).

Additionally, prices so far in 2020 have continued with the trend of running below the cost of production for Irish farmers.

So, where do the farmers stand now?

Despite the poor returns at the factory gate, performance on the Teagasc Green Acres Programme farms has improved on a profitability basis; a major positive that can be taken for year one of the second phase.

At farm level, gross margins on a per hectare basis on comparable farms from 2018-2019 show margins have increased from €658/ha to €684/ha – an increase of 4%; net margins rose very slightly also.

Gross output is the key driver of profitability on these farms. Gross output is the amount and value of beef sold off the farm and this beef is a product of the stocking rate, performance of each animal and beef price received.

Across the farms involved, gross output on a €/ha basis increased marginally from €1,788/ha to €1,794/ha.

*Important: This data excludes subsidies such as basic payments, GLÁS or any other scheme payments.

In terms of productivity, stocking rate increased on the farms from 1.95LU/ha to 2.08LU/ha, while liveweight output in kg/ha increased from 1,020kg/ha to 1,053kg/ha.

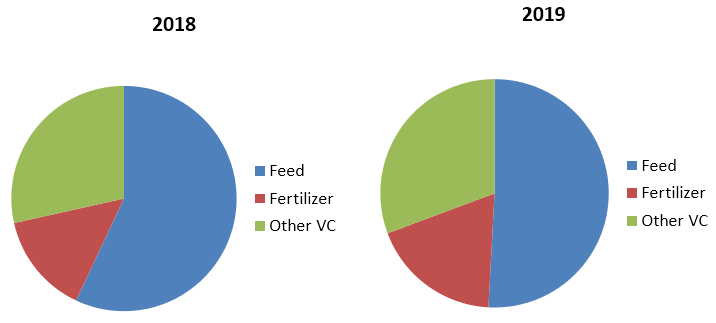

Variable costs reduced from €1,130/ha to €1,111/ha.

Looking into these figures, purchased feed costs (concentrates and forage) reduced from €644 to €565/ha – a reflection of the weather trends and favourable grass growth (which we will examine at another article) throughout the year.

Fertiliser costs increased from €164/ha to €205/ha, with a substantial amount of this extra cost being incurred by focusing on increasing phosphorus (P) and potassium (K) levels, along with some reseeding.

Going forward, on-farm costs are expected to maintain this year, with every cost examined.

Vet costs increased from €81 to €95, with a proportion of this increase accredited to an increased emphasis on vaccination of calves for pneumonia with a view to reducing use of antibiotics.

Moreover, contractor bills increased from €132/ha to €145/ha reflecting a building of silage stocks in 2019 and the earmarking of paddocks – which have gone too strong to graze – for baling; reseeding costs will have played a role here too.

The drop in beef price reduced output value by €142/ha; although calf purchase prices have reduced slightly also over the same period.

Fixed costs increased from €602/ha to €617/ha. This may increase slightly over the next year or two depending on the level of investment in infrastructure required to develop grazing infrastructure and housing for stock.

Comment and outlook

As we progress into year two, farmers are positioned to make further increases in output this year.

As the debate continues, realistically for beef farmers, calf prices need to reduce substantially below last year’s levels – given the circa 7% drop in beef price – to allow scope to invest further on farm; this would equate to a drop of circa €70-80/calf based on carcass values in 2019.

While some individual farmers performed very well – with up to a 40% increase in gross margin – a small number of farmers experienced a decline in profits from last year.

These farmers have and still are making significant investment in land reclamation and soil fertility/reseeding.

Factors such as Brexit and beef price are out of the farmers’ control; however, efficiencies inside the farm gate will continue and – in return – this will have a positive effect on the farms’ bottom line going forward.