Succession plan: What are the tax implications?

Given that average farm value is potentially €740,000, it is important farmers take the first steps to formalising their succession plan. While the tax side of matters is vitally important this cannot be explored in detail until farmers have considered a number of factors including their will.

These were just some of the matters that were discussed in detail during the launch of IFAC’s Irish Farm Report 2019 which took place in Co. Laois on Thursday, June 20.

The report details the views of over 2,133 Irish farmers and also contains a comprehensive analysis of 21,755 sets of farm accounts over four years.

Speaking during the event, Declan McEvoy IFAc’s head of tax said there were a number of factors that farmers needed to take on board when considering their succession plan.

‘The way forward’

McEvoy also pointed to the fact that regardless of age – or whether the farm is viable or not – having a plan is the best way to protect a farmer’s family’s future.

“Regardless of age or whether the farm is viable or not having a plan is the best way to protect a farmer’s family’s future,” he continued.

“86% of farmers in Ireland do not have a succession plan while 26% have not considered succession yet.”

Considering the options

McEvoy says that – at a minimum – it is vital for all farmers to have a will in place before discussing a succession plan. He also points to the importance of meeting with the experts so farmers can ensure they have access to all the information and advice they need.

“Farmers should meet with their accountant and solicitor to discuss options and they would also be advised to seek feedback on the plan from their agricultural advisor or a trusted family friend,” he added.

“The succession plan must be written down – farm succession is a specialised area and it is very important to get the proper advice. An advisor dealing with agri-business on a day-to-day basis is the best person to use.”

The key questions with tax

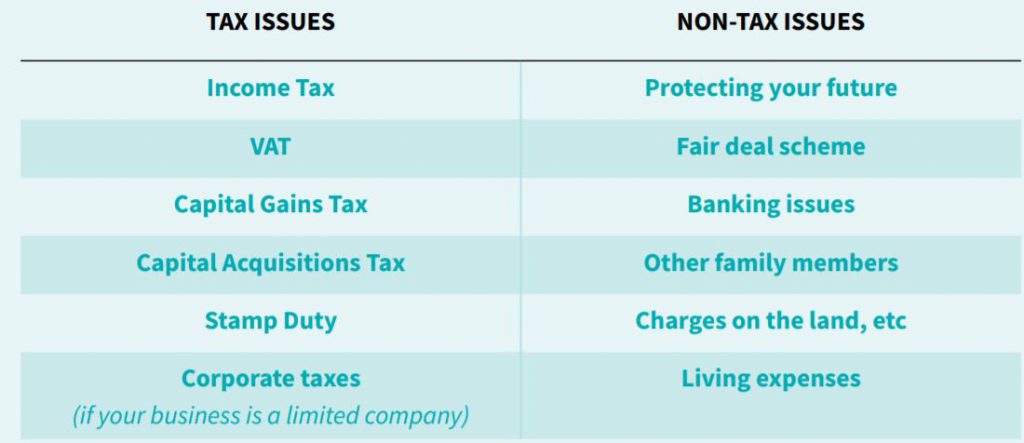

Meanwhile, farmers are being advised that when they have the plan in place and are happy with their decision the next area to examine is tax.

There are a number of areas to examine and key questions that need to be asked when considering the whole area of tax.

Concluding, McEvoy said that basic payments should also be looked at and all farmers must ensure that they update their will.

“Remember to update your will and ask your legal advisor about Powers of Attorney. Farm succession is a specialised area and it is very important to get expert legal, financial and tax advice,” he added.

“An advisor dealing with agri-businesses on a day-to-day basis is the best person to use. Contact your local IFAC partner/office to help put your succession plan in place.”