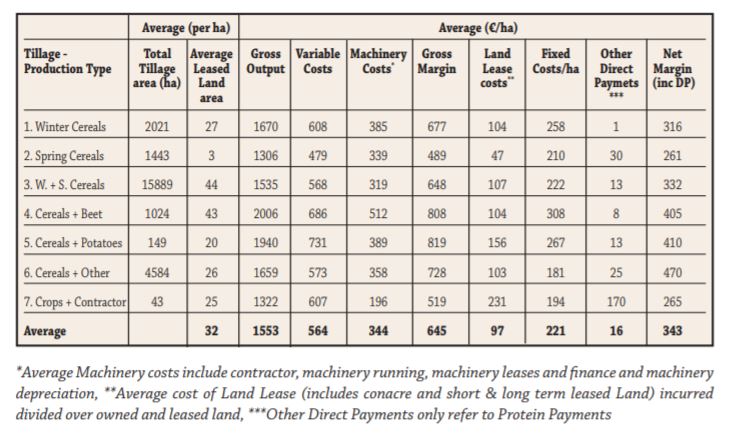

Data from the 2017 Teagasc E-Profit Monitor for tillage shows that the average net margin on farms increased by €237/ha to €343/ha from the 2016 level – when it stood at €106/ha.

Effect of farm size on net margin

Teagasc reported that while fixed costs would be expected to reduce with farm size the difference in profitability on the farms did not reflect this due to land rental costs.

Land rental costs were a major contributor to this. Larger growers did have lower fixed costs; however, land lease costs were much higher (increased area). The average area of land rented on farms over 200ha in size was 73% of the land, compared to 22% on farms below 100ha.

Tillage farms with a land base of between 101ha and 200ha leased 44% of the land – on average – and had the highest average net margin at €404/ha.

Crop choice plays a big part in profits

Farmers growing crops like beet and potatoes – along with cereals – had significantly higher returns than cereal growers, despite having higher machinery costs.

Farmers with a mix of both winter and spring cereals fared best of the cereal-based farms, finishing at an average net margin of €332/ha – €29/ha above the average cereal group. This is despite having land rental costs of approximately €107/ha.

Growers who were producing spring cereals only had the lowest return of the entire group with an average net margin of €261/ha. This is due to a lower crop output and the reality of having similar machinery and fixed costs to other groups. Land lease costs in this group were lower.