The much-talked-about low-cost loan scheme will be available at the start of 2019, according to Minister for Agriculture Michael Creed.

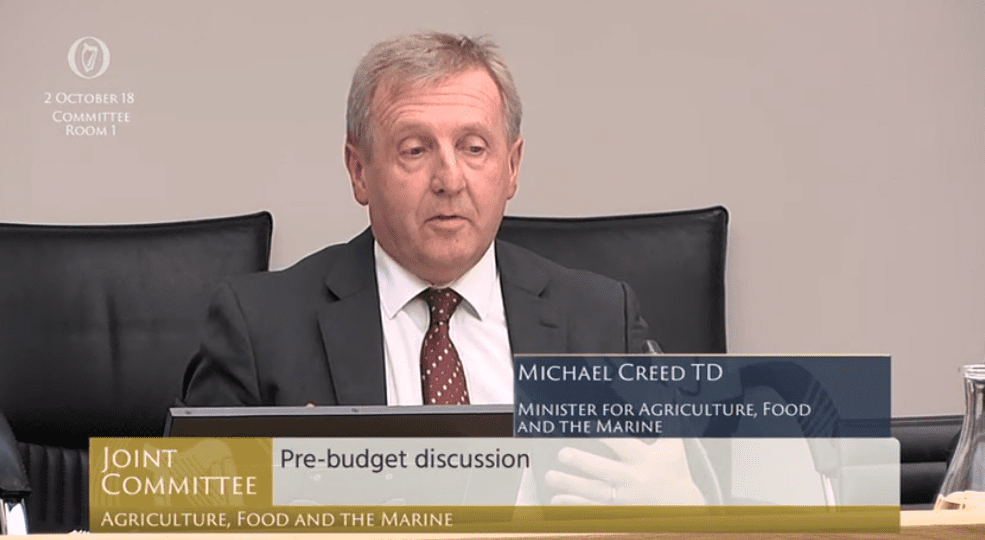

Speaking to the Oireachtas Joint Committee on Agriculture, Food and the Marine earlier today (Tuesday, October 2), Minister Creed outlined details of the incoming scheme.

The initiative will allow long-term unsecured loans for farmers of up to €500,000 over an eight to 10-year period, the minister explained.

Minimum loans will be set for €50,000, according to current plans, he added.

The money we’ve secured will be paid over in terms of securing the availability of the fund – but the product won’t be in the market for draw-down until the start of the year.

“The details of it are available now and we will work with the remaining steps that need to be taken to deliver it to marketplace,” Minister Creed added.

2019 scheme

“We got €25 million and we are working with a number of strategic partners to deliver a product in the area of capital investment,” the minister explained.

“We’re talking about unsecured borrowing over a period of eight to 10 years, both of which are not currently available at a competitive rate and what we are envisaging within those two parameters to have a product that would be available at less than 5%.

“The unsecured is up to a cap of €500,000 and a minimum of €50,000 – that’s the parameters of the product that we would develop.

‘Moving levers’

“There are so many moving parts in this latter scheme that we don’t control all the levers on it; if we did we probably would have a product in the marketplace already but we’re dealing with a number of partners including SBCI, European Investment fund, etc.

So, we will have that product, it will be different; it’s not repetition of the previous one because competition has been leveraged by the previous initiative we took in that space.

Commenting on last year’s low-cost loan scheme of €150 million at an interest rate of 2.95%, the minister said that product was a success.

While 4,249 farmers benefited directly from the scheme, Minister Creed contended that the benefit of it was far greater than just those who actually drew down loans, stating that it generated competition in the market for other products and other financial institutions to respond.