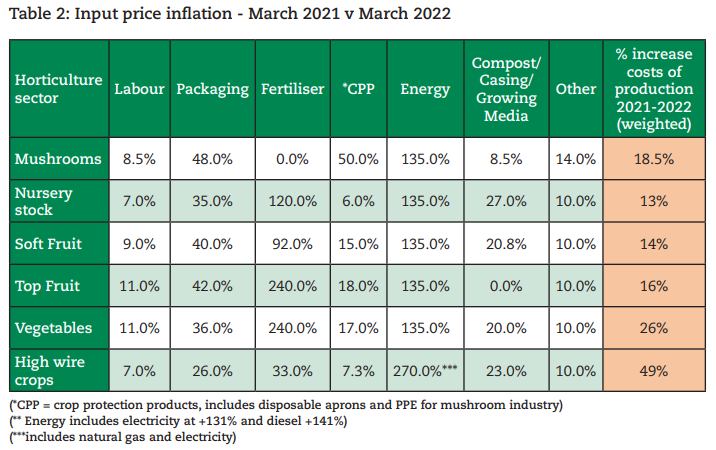

Horticultural input-price inflation continues to “squeeze growers’ margins” as total input costs rose by between 13% and 49% within one year, according to a new report by the Teagasc Horticulture Development Department.

The report, Horticulture Crop Input Price Inflation 2022, reflects the full extent of inflation in the past twelve months up to March 31, 2022.

Over the past year, horticultural crop-input prices have significantly risen, initially due to external macro-economic factors, but more recently due to the Russian invasion of Ukraine, according to Teagasc. The report read:

“Across all enterprises, there has been a sharp increase in the cost of energy, labour, packaging materials, fertiliser and a range of other inputs that are key components of production.”

Reaching a margin over costs this year is becoming more challenging for many horticultural enterprises due to the rapid pace of inflation, despite retail-price increases for some primary producers over the past year, Teagasc said.

Energy, besides fertiliser, labour and packaging, is a key input across most sectors in horticulture, Teagasc explained, especially where crops are grown in glasshouses and protected greenhouse structures.

This has led to significant increases in production costs of typically 18.5% in the mushroom sector.

The impact on overall production costs for field vegetables is stark, where, Teagasc said, margins are already extremely tight, leading to increases in the order of 26% since March 2021.

The production of high-wire glasshouse tomatoes, cucumbers and peppers, according to the report, depends specifically on natural gas and is therefore significantly exposed to the increase in the price of gas.

Valued at €477 million at farmgate level, horticulture is the fourth-largest sector in Ireland after dairy, beef and pigs in terms of gross agricultural-commodity output value, Teagasc said.

Head of Teagasc Horticulture Development Department, Dermot Callaghan said:

“Over the winter, producers have been negotiating with their customers for price increases based on the first wave of inflation reported in the fourth quarter of 2021.

“As these were concluding, a second significant wave of input-price inflation, linked to energy inflation and the Ukrainian invasion, started to manifest itself,” Callaghan explained.

He added that without a timely market response, margins will, in some cases, be completely eroded by this latest wave of input-price inflation.