Ifac has advised farmers to agree wages with their employees on a gross basis to avoid additional costs due to tax changes.

42% of farmers who took part in a survey for the Irish Farm Report 2022 stated that they agree payment on a ‘net’ rather than ‘gross’ basis with their workers.

‘Gross pay’ is used to describe the total amount of money an employee receives before taxes and deductions.

‘Net pay’ is the final amount of money that a person is paid after all taxes and deductions are subtracted.

Ifac advice

“When hiring employees, it is important to agree wages on a ‘gross’ rather than a ‘net’ basis so as to avoid unforeseen costs if the employee’s tax status changes,” Mary McDonagh, head of human resources (HR) and payroll with Ifac, explained.

If payment is agreed on a ‘net’ basis it can make budgeting difficult as the cost to the farmer can vary depending on an individual employee’s tax allowances.

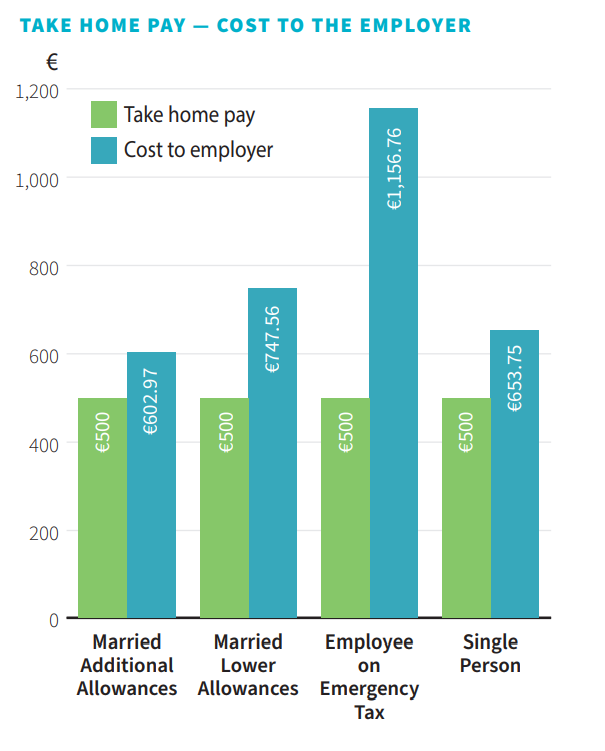

For example, Ifac outlined that a ‘take home’ wage of €500 could cost an employer just over €600 for a married worker with additional tax allowances.

A staff member who is on emergency tax could cost the employer almost twice that amount.

Almost 164,000 people are employed in the Irish agri-food sector including farm owners and their families, along with non-family full-time, part-time and seasonal workers.

Ifac noted that labour and skills shortages are an issue for farmers, particular those relying on seasonal workers.

In the Ifac survey, 31% of respondents explained that finding available employees is a major challenge. 77% of those planning to recruit would consider hiring non-EU employees.

Meanwhile, almost a third of farmers use technology to increase farm efficiency, with 21% using technology to reduce labour.

52% said that the biggest barrier to improving technology on their farm is cost.