The government has today (Friday, April 5) published a bill which would see around 800,000 workers, including those on farms, be automatically enrolled into a new retirement savings scheme from January 2025.

The legislation, which still needs to be approved by the Oireachtas, would mean that employees aged between 23 and 60 years old, who earn over €20,000 per year, and who are not already paying into a pension scheme, will be automatically enrolled.

At present, around 35% of workers in the State who have no occupational or private pension meaning they will be solely reliant on the State Pension when they retire.

Under automatic enrolment, employees will have access to a workplace retirement savings scheme which is co-funded by their employer and the State.

Retirement savings scheme

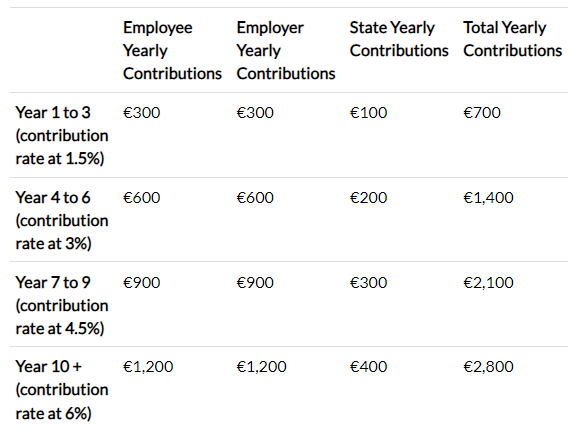

Under the proposed retirement savings scheme every €3 an employee contributes will be matched by their employer, and the state will top up with a further €1.

That means for every €3 an employee puts in, €7 will be invested in the retirement savings pot.

Employee contributions will start at 1.5% of gross pay, this will increase to 3% in year 4, to 4.5% in year 7 and to the maximum rate of 6% in year 10.

The government said that this steady phasing-in allows time for employers to budget and plan and for employees to adjust to the new system.

Contributions will be fixed and employees will not be able to contribute less or more than the set rate.

Employees who are enrolled will have to stay in the system for six months, but they will be free to opt out in months 7 and 8 if they so wish.

They will also be able to suspend or pause their contributions at any time outside of the mandatory initial six-month participation period.

It is estimated that a worker on the national average wage contributing consistently for 40 years could build up a savings pot of nearly €750,000, including investment returns, over the course of their working life.

The Department of Social Protection offered the following example for someone earning €20,000 per year:

Employers will be required to match employee contributions up to an eventual maximum of 6% subject to an earnings threshold of €80,000.

Employer contributions will be deductible for corporation tax purposes.

If an employer fails to meet their auto-enrolment obligations they will be subject to penalties and possibly to prosecution.

The government said that the initiative will benefit employers as they will not have to set up or administer a company pension scheme.

Minister for Social Protection, Heather Humphreys said “this represents one of the biggest reforms of the pension system in the history of the State, and is an important milestone in supporting people in their retirement years.”

The minister said that Ireland has been an outlier in terms of pension coverage for too long.

Ireland is the only country in the OECD that does not yet operate this or a similar system as a means of promoting pension savings.

“This landmark legislation is about protecting our workers, and particularly our young people, when it comes to reaching their retirement years.

“Automatic enrolment has been talked about for decades, and today is a clear sign that we mean action.

“This legislation will provide the foundation for the most radical shake up of the pensions landscape in Ireland for generations,” she said.

The minister said that the legislation will be brought before the Oireachtas immediately after the Easter recess.

The bill also provides for the establishment of a new State body, the National Automatic Enrolment Retirement Savings Authority, to administer the scheme and act as a buffer between participants and the financial investment companies who will be tasked with growing their savings.