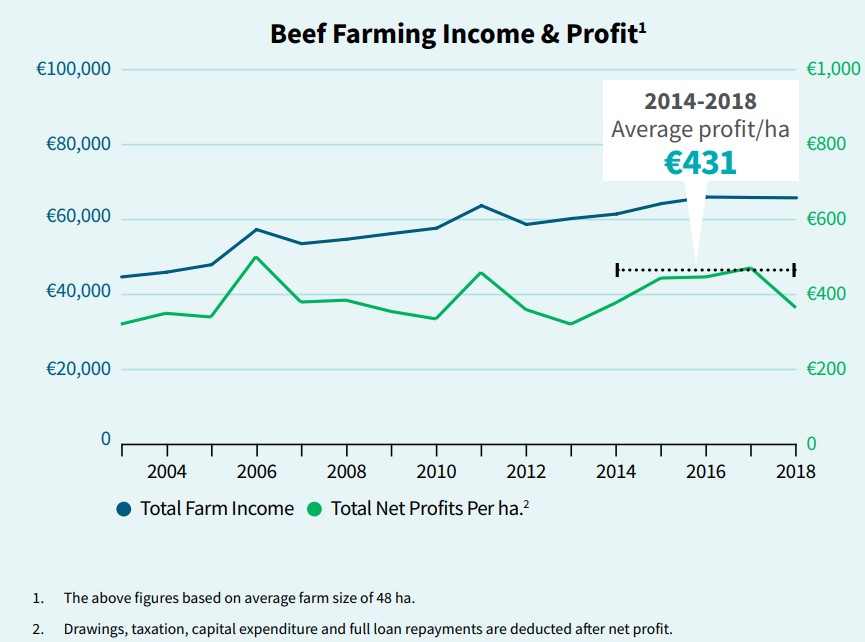

Profitability in the beef sector remains volatile, with most farms struggling to achieve a profit before EU subsidies. Meanwhile, the average debt on beef farms averages out at €44,345.

These were the sentiments expressed by the author of IFAC’s Irish Farm Report 2019, Philip O’Connor, during the publication’s launch this morning, June 20.

The report details the views of over 2,133 Irish farmers and contains a comprehensive analysis of 21,755 sets of farm accounts over a four year period.

O’Connor also pointed out that in 2018, 61% failed to achieve a positive net margin, while the average beef farm made a loss of €116/ha (excluding farm subsidy payments).

The latest research from the report, he added, also indicates that the top 10% are achieving positive net margins – excluding EU substitutes. He also said that cost control is key.

- There are over 951,000 suckler cows in Ireland today;

- The average IFAC beef farm is 48ha;

- Between 2015 and 2018 beef calf registrations dropped by 6.7%;

- 1.79 million cattle were slaughtered in 2018; this was the highest kill for over 15 years.

‘No rewards with profit’

Meanwhile, the report also points to cost control and explains that the top 10% of beef farms have seen their cost base rise by 6.5% since 2015.

“While beef farms excel at keeping costs down – they are not rewarded for this in terms of profit,” added O’Connor.

“When looking at beef farm data over a long period of time there has been little increase in profitability; the average beef farmer’s total income in 2003 – based on 48ha – was €13,801 compared to €17,520 in 2018.

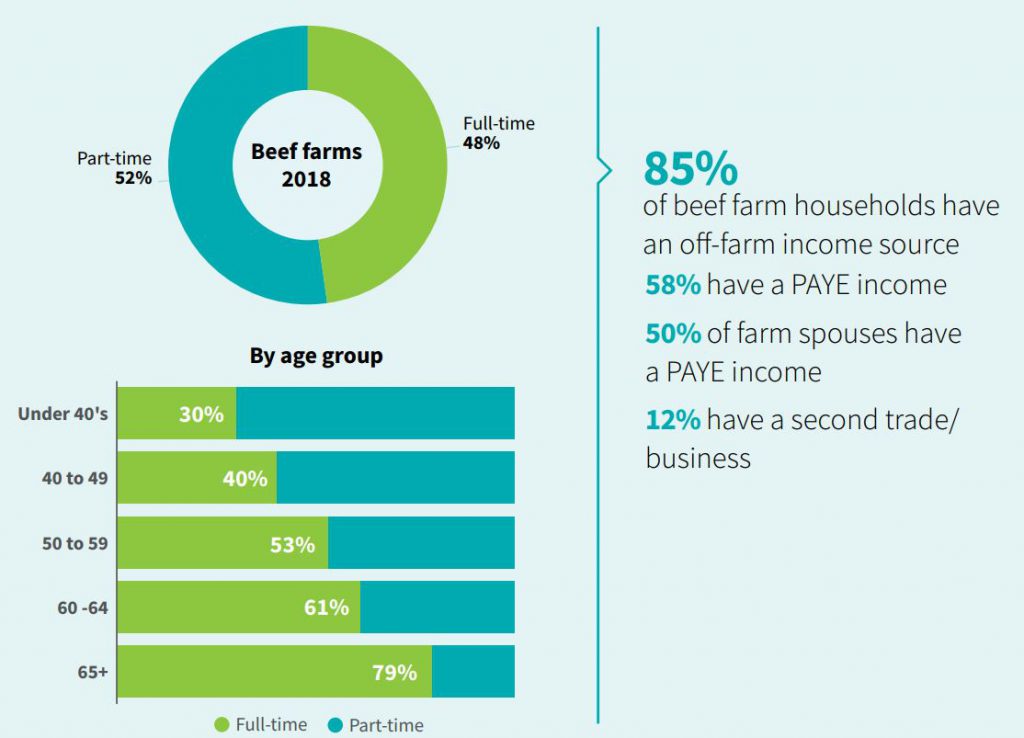

“A deeper dive into the data shows that over the last four years 59% of beef farms were losing money before EU subsidies. It is not surprising, therefore, that so many beef farms require off-farm income.”

‘Driving farm development’

The report also goes on to point out that between 2017 and 2018 creditors rose by 36% and the average financial borrowings per beef farm in 2018 was €44,345.

Overdrafts increased by 6% and the average capital investment on beef farms in 2018 was €9,113.

Production-based beef farming no longer generates the profit required to drive farm development.

O’Connor continued: “The average dairy farm is investing 150% more per hectare while there is little increase on output on beef farms.

“Indeed, among the top 10% of beef farms, investment actually decreased over the last four years, and debt levels remained at an average of €44,345.”