Factory agents are quick to quote prices of 395c/kg for steers and 405c/kg for factory-fit heifers this week. Following the trend of recent weeks, processors have knocked another 5c/kg off base quotes.

Over the past four weeks, beef processors have reduced base quotes by a massive 20c/kg. This results in severe reductions on a per head basis for the farmer.

If we take a bullock with a carcass weight of 400kg and apply a base price of 395c/kg, we’re looking at a price of €1,580 for this animal.

If we rewind four weeks previous, when steers were quoted at 415c/kg, farmers were looking at €1,660 for the same 400kg carcass. This is a difference of €80/head and leaves the profit margins extremely thin – if any at all.

While the factories have been criticised for using the drought to apply these severe cuts, procurement managers have noted that cattle supplies are plentiful – both for prime cattle and cows.

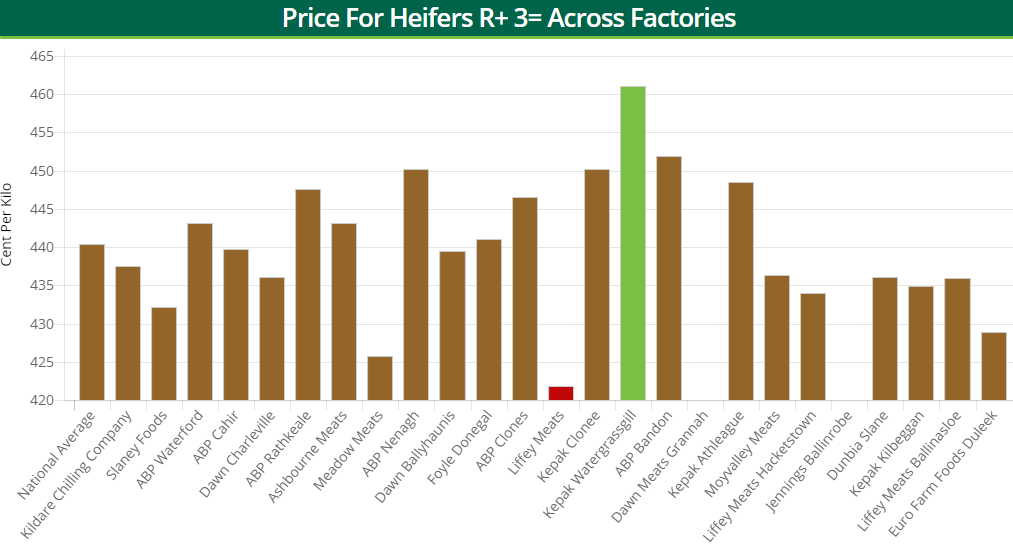

During the week ending July 1, in-spec, R+3= heifers made a top price of 461.02c/kg, while the average price paid stood at 440.36c/kg.

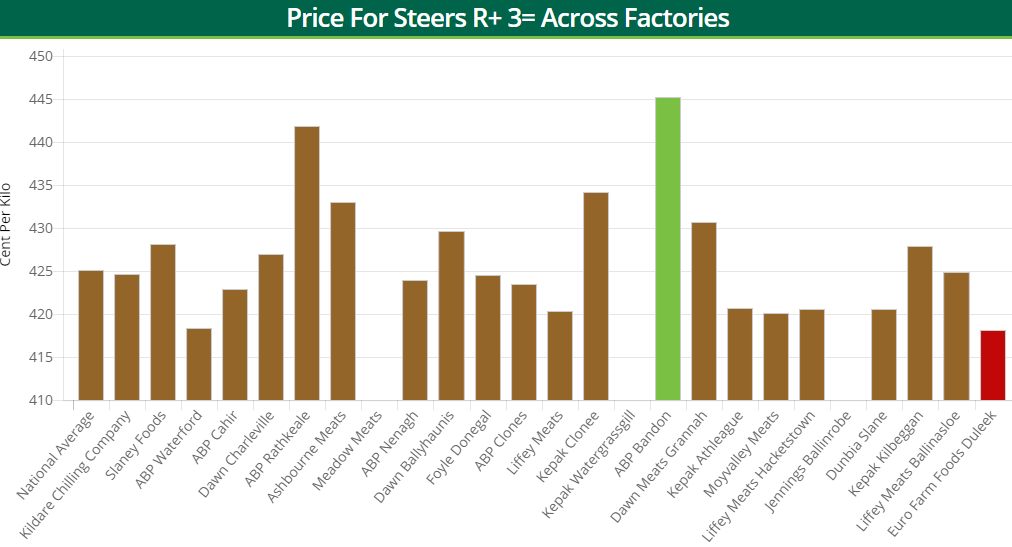

Furthermore, a top price of 445.21c/kg was achieved for R+3= steers; the average price paid for these animals stood at 425.08c/kg.

One manager outlined that they were at full capacity for this week, while another noted that they were “blocked with stock”.

Farmers or specilised finishers – especially those with large numbers of in-spec stock to sell – are finding that 5c/kg on top of the base quotes is achievable. Farmers need to dig deep and bargain hard for the best possible deals, while the factories are employing these tactics.

Looking forward to next week, the early outlook doesn’t look great and many procurement managers are noting that more price cuts are in the pipeline.

The cow trade

The trade for cows is also struggling; supplies of these animals are extremely plentiful. During the week ending July 1, the number of cows processed stood at 9,038 head – an increase of 617 on the previous week’s kill.

Due to the weather conditions and lack of grass growth, some farmers have no other option but to market some of their cows to reduce feed demand.

The fact that many dairy farmers – who are under pressure for feed – are sending cows to the factories without even been quoted is having a negative effect on the trade.

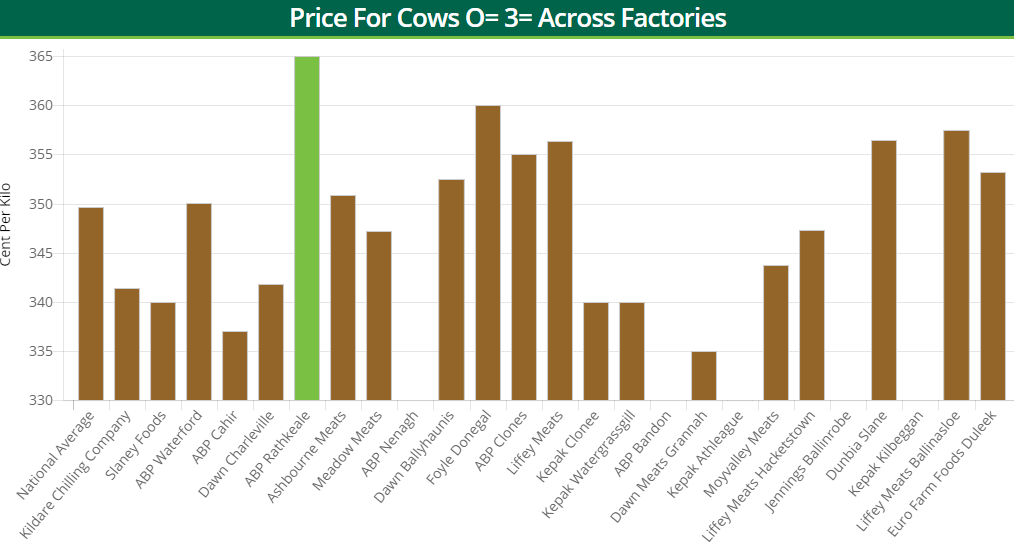

Quotes for P-grade animals start at 300-310c/kg, negotiations for O-grade animals open at 320c/kg and prices for R-grading animals begin at 330c/kg. Location and demand of individual processing plants also has a big role to play when it comes to cow prices.

During the week ending July 1, O=3= cows made a top price of 365.00c/kg, while the average price paid stood at 349.61c/kg.

Cattle throughput

Some 33,843 cattle were processed in Department of Agriculture approved beef export plants during the week ending July 1. When compared to the week previous, the total weekly kill climbed by just three head.

Throughput increases were witnessed in the steer (+41), cow (+617) and heifer (+299) categories. However, young bull and aged bull throughput declined by 764 and 160 head respectively.

- Young bulls: 4,302 head (-764 head or -15%);

- Bulls: 511 head (-160 head or -23%);

- Steers: 11,127 head (+41 head or +0.3%);

- Cows: 9,038 head (+617 head or +7%);

- Heifers: 8,865 head (+299 head or +3.5%);

- Total: 33,843 head (+3 head or 0%).

‘Hijacking drought conditions’

Last week, the Irish Farmers’ Association’s (IFA’s) president Joe Healy accused the factories of hijacking the drought conditions to cut beef prices and undermine the market.

“Factories are taking advantage of the drought conditions and imposing unjustified price cuts ahead of the market,” he said.

Healy warned the factories to stop price cutting and undermining the beef market. He also outlined that Minster Creed needs to get tough with the factories and demand they stop the unnecessary price rot.

He also said that the minister can no longer remain silent on the factories; he must demand that they show some level of respect for his work on market access and he cannot allow them to throw it all back in his face with unjustified price cuts.