A number of farmers and contractors featured in a list of tax defaulters published by Revenue for the second quarter (Q2) of 2010.

This relates to the period of April 1, 2019, to June 30, 2019, according to Revenue, which published the list today, Tuesday, September 10.

List

The tax defaulters list is always published in two parts. Part one includes persons in whose case the court has determined a penalty relating to a settlement – or has imposed a fine, imprisonment or other penalty in respect of a tax or duty offence.

The second part includes persons in whose case Revenue has accepted a settlement offer instead of initiating court proceedings, or where a settlement has been paid in full.

In the second quarter of this year, no farmer had an offer accepted by Revenue; however, 20 farmers were brought to court by the Revenue Commission.

Another penalty of note was issued against Seamus Breen, from Gorey, Co. Wexford, who was fined €3,000 for the obstruction of a Revenue officer.

Meanwhile, some 13 farmers were issued fines for a failure to lodge income tax returns.

The majority of these fines were for €1,250; however, one fine was for €2,500 – while another fine – also to Bríd Ní Dhubhghaill from Wexford – amounted to €17,500.

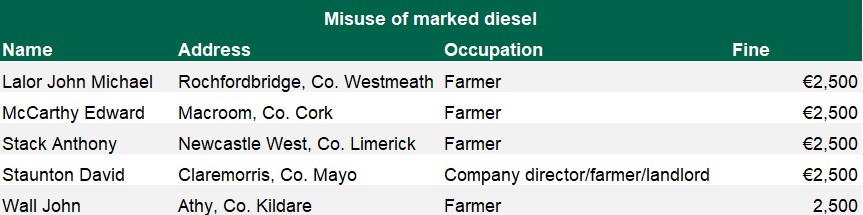

Finally, the remaining five farmers on the list were brought to court for the misuse of marked (green) diesel.

Each of the farmers was fined a penalty of €2,500, according to Revenue.