One year ago today, the milk quota regime finally came to an end in Ireland and in EU Member States.

30 years after they were introduced by the European Commission, in 1984, to try and address the oversupply of milk on the EU market, dairy farmers were finally relieved of them.

It was this oversupply that led to the infamous milk lakes and butter mountains.

Under the milk quota regime, every dairy farmer worked under a set amount of milk volumes that they could produce and faced a superlevy fine if they exceed their quota.

So, 12 months on from the abolition of milk quotas what’s changed?

Milk production has increased in both Ireland and across Europe. However, this, coupled with increased production in the US, New Zealand and Australia has caused an oversupply of milk on the world market.

Furthermore and with the worst possible timing, the Russian embargo on food imports and the underperformance of China’s economy have depressed world markets.

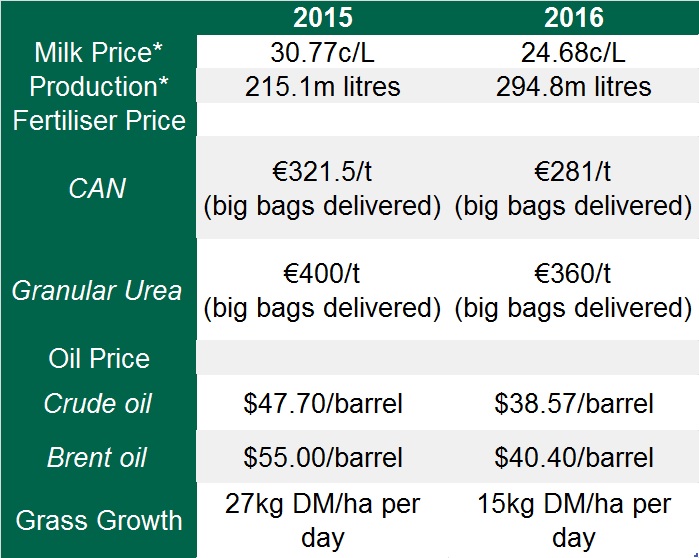

Irish milk prices for March 2015 averaged at 30.77c/L (including VAT). The average milk price farmers received for February milk was 24.68c/L, also including VAT a fall of 20%.

With co-ops expected to set their milk prices for March in coming weeks. Current indications suggest that things are unlikely to improve.

While milk prices over the past 12 months have fallen, post-quota production has soared.

Meanwhile, dairy cow numbers in Ireland are also on the increase post-quota. The latest CSO census information is for December 2015.

The figures show that the number of dairy cows in Ireland increased by 10% on December 2014 to 1.24m.

Ahead of the spring flush, the EU’s Milk Market Observatory has released its latest figures on EU milk production, which are for January 2016.

EU milk production increased 5.6% in January compared to the corresponding month last year.

As well as low milk prices, farmers found themselves struggling with higher costs for some inputs and high debt on farms. In order to try and relieve some of the pressure on farmers, the European Commission introduced an aid package of €420m in September.

However, things didn’t improve in the following months and, if anything, dairy markets showed further declines.

The increase in milk production led to high increases in SMP and butter production with around half of this production being offered to the EU storage aid scheme, public intervention.

In recent weeks the European Commission announced a second package of measures to help the dairy sector, one of which was increasing the quantity ceiling of intervention from 109,000t to 218,000t.

Furthermore, under the package, the Commission will activate, for a limited period of time, the possibility to enable producer organisations, interbranch organisations and co-ops in the dairy sector to establish voluntary agreements on their production and supply (Article 222).

The Commission has concluded that the strict conditions for the application of this article to the dairy sector are fulfilled in the current circumstances.

French farmers were the most vocal, blocking the roads in France while in Brussels, farmers converged twice on the city, spraying milk and setting bales on fire in protest.

If things weren’t bad enough after a long grazing season in 2015, followed by a very wet winter and spring, grass growth rates for March are back 50% on last year’s levels, according to Teagasc’s George Ramsbottom.

Teagasc’s PastureBase shows that the average grass growth rate on a number of dairy research and commercial farms is 15kg DM/ha per day.

He said that typically at this time of year it would be expected that grass growth rates would be almost double this at 25-30kg DM/ha per day.

What lies ahead for dairy farmers?

Industry analysts are giving mixed views on when dairy markets and prices will pick up.

The CEO of Ornua, Kevin Lane, said earlier this year that Ornua expects the average milk price for 2016 to remain around the 24c/L mark.

According to Rabobank’s Dairy Senior Analyst, there may be no bounce back in international dairy prices until next year.

We did say that prices should improve in the latter half of 2016, but as time goes on it becomes more difficult for us to see dairy prices react.

He said that a lot of people are saying the recovery may take place very late in 2016, or else may not happen at all [this year].

Fonterra has said that it expects dairy prices to pick up at the end of the year.

Chief Executive Theo Spierings said that current global economic conditions remain challenging and are impacting dairy demand and prices.

“The balance between available dairy exports and imports has been unfavourable for 18 months following European production increasing more than expected and lower imports into China and Russia.”

He said that this imbalance is likely to continue in the short term, with prices expected to lift later this calendar year.