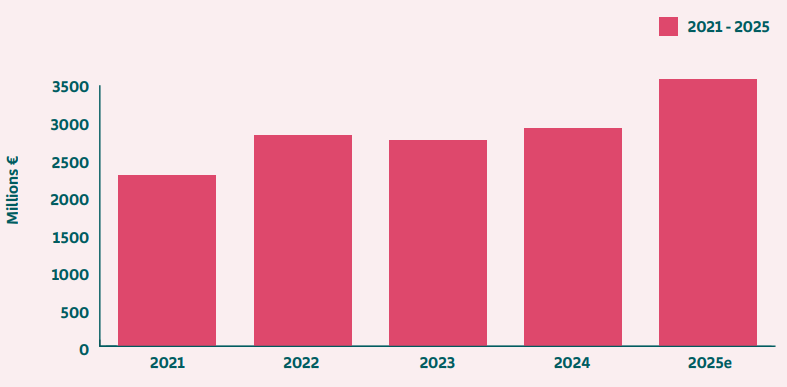

Value of beef exports up despite drop in export volumes

The total value of primary beef exports in 2025 is estimated at €3.4 billion, up 24% on 2024.

Beef offals were valued at €155 million, up 12%, according to Bord Bia's Export Performance and Prospects Report 2025/2026, published today (Wednesday, January 7).

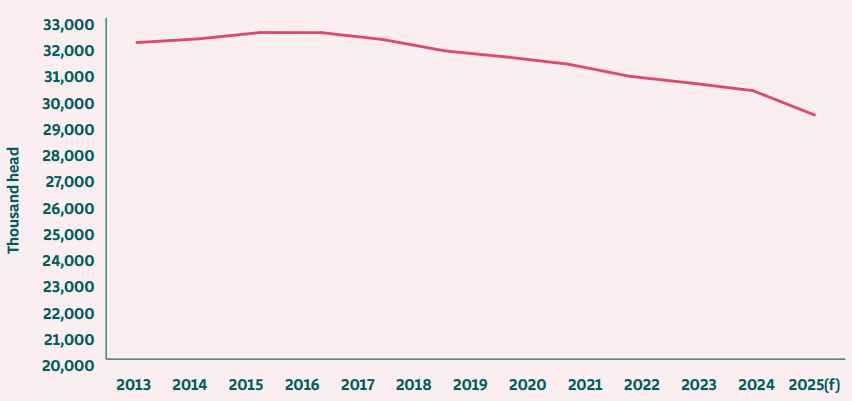

This is despite cattle throughput at Irish meat plants estimated to have decreased by 180,000 head. Volumes exported fell by 5% (474,000t).

Beef supplies were impacted by a recovery in carcass weights, which were up an estimated 1.5kg, while stock carryover from 2024 to 2025 had a further positive effect on volumes, especially in the first half of the year.

While stock carryover from 2024 into 2025 had a positive impact on volumes in the first half of the year, strong declines in cattle availability in the second half offset this.

There was some improvement in carcass weights particularly toward the end of the year.

The strong live trade in 2023 and 2024 was a significant contributor to the tighter cattle supplies in 2025.

Cattle throughput was also affected by structural changes in the dairy sector with a contracting cow herd, according to the Bord Bia report.

Beef overall performance

EU beef production fell by 2.5% due to a 2.2% reduction in the EU cow herd according to European Commission data.

In addition, the impact of diseases like bluetongue on animal breeding and finishing meant that supplies were exceptionally tight in the second and third quarter of 2025.

Sector manager with Bord Bia, Joe Burke outlined how consumer demand weakened as the year progressed, with price increases starting to be passed on to consumers.

This resulted in beef sales losing ground to more competitively priced proteins.

Downtrading within the beef category resulted in very strong demand for manufacturing beef.

EU young bull prices increased by 25% to €6.44/kg in 2025. By comparison, Irish R3 steer prices averaged €7.10/kg, which represented a 37% improvement year-on-year.

The European Commission estimates that EU beef consumption decreased by 0.9%, while beef imports increased by 5%.

UK beef market

Irish beef exports to the UK increased by 25% to reach €1.6 billion, accounting for 47% of the total.

In volume terms, exports to the UK were down by 5% for the year to September 2025.

UK beef imports in the year to August decreased by 2.5% in volume terms, while the value of imports increased by 22%, data from AHDB indicates.

Consumer prices at retail level continued to rise from the first quarter onwards, registering an 18% increase for the year.

Overall spending at retail on beef increased by 9.5% during the 12 weeks ending October 2025, while volumes were 7.2% lower.

Roasts saw the greatest impact as high unit prices proved challenging for many consumers, with volumes down 20%. Steaks and mince also declined by 10% and 9% respectively in volume terms.

High prices impacted beef demand at foodservice, with volumes declining by 5.4%. Take-away and on-the-go formats saw the greatest declines.

The foodservice channel utilised increasing volumes of imported beef, with Australian, New Zealand and South America origins all making gains.

Other destinations

Exports to EU markets were 28% higher, reaching an estimated €1.6 billion in 2025 and accounting for 49% of overall values.

Trade increased to many markets due to lower domestic beef production (-3%), especially in the first half of the year.

Demand was strongest for forequarter, mince and manufacturing beef, due to the tightness in supply.

Higher-value primal cuts declined as the price gap between beef and other meats such as pork and poultry became more evident.

Bord Bia’s Meat Shopper Insight Tracker Q3 2025 found that consumers increasingly saw cost as a barrier to beef purchase.

Overall, consumers reported reduced beef purchases with declines in: Ireland (-1%); the Netherlands (-4%); Sweden (-2%); Belgium (-2%); while Italian consumers reported an increase of 2%.

Exports to international markets decreased to €135 million as clients prioritised markets closer to home.

This reflected the growing gap between prices in Ireland and the EU relative to other suppliers.

Global consumption declined by one million tonnes to 72 million (GIRA, 2025), reflecting lower demand from Asian markets, especially China.

Beef exports to North America decreased by 14% to reach €25 million, with €20 million destined for Canada.

Despite record high prices in the United States, access for Irish beef under the tariff-free quota remained a major challenge for exporters.

Beef prospects

Demand for beef imports is expected to remain strong in 2026, supported by income growth.

A continued tightening of beef supplies in Europe will continue to create import demand across the UK and Europe, according to Bord Bia.

EU beef production is forecast to decline by a further 1% in 2026, with a reduction of 2.2% in the European cow herd in 2025 suggesting a longer-term structural decline in the sector (GIRA, 2025).

UK calf registrations are showing an overall decline, albeit with some growth in dairy calf registrations.

Global beef supply is set to remain constrained, supporting higher prices. GIRA forecasts that consumption will show growth of just under 1% annually up to 2029, driven by Asia, South America and the US.

EU imports are forecast to increase in response to lower domestic production. While imports will put some downward pressure on prices, consumers’ continued preference for beef, although price-sensitive, is likely to underpin demand for European beef,

Despite the challenges faced by exporters, the ongoing tightness in beef supplies across the EU, combined with resilient consumer demand, will help support a positive market environment for Irish beef in 2026, according to Bord Bia.