A number of farmers featured in a list of tax defaulters published by Revenue for the second quarter (Q2) of 2018.

This relates to the period of April 1, 2018, to June 30, 2018, according to Revenue, which published the list today (Tuesday, September 11).

The tax defaulters list is published in two parts. Part one includes persons in whose case the court has determined a penalty relating to a settlement – or has imposed a fine, imprisonment or other penalty in respect of a tax or duty offence.

The second part includes persons in whose case Revenue has accepted a settlement offer instead of initiating court proceedings, or where a settlement has been paid in full.

Settlements

The second section included a total of 66 cases – with the total settlement amount in these cases equating to just under €8.88 million. A number of cases related to the agri-sector.

By the end of the third month of this year, settlements had not been fully paid in 17 cases – with the amount left unpaid equalling nearly €2.63 million at that time, Revenue explained.

Galway agri-business Agri and Industrial Rubber Ltd was ordered to pay a total of €314,427 following a Revenue audit case for under-declaration of Corporation Tax and a combination of PAYE/PRSI/USC.

Meanwhile, Laois business Costello Farm Feeds owed €213,663 for under-declaration of PAYE/PRSI/USC and VAT.

Since paid, this amounted to €145,029 in unpaid tax, €25,126 in interest and a €43,509 penalty.

Following a Revenue audit case, Cork farmer and instrumentation engineer Fintan Canty was ordered to pay €196,584 due to the under-declaration of income tax.

John Clifford from Co. Kerry was told to pay €91,314 following a Revenue enquiry case due to the under-declaration of Capital Gains Tax. This came in the form of €34,765 in unpaid tax, €47,0667 in interest and €9,481 in penalties. €91,072 remained unpaid at the end of June.

Clare business Coolawn Dairies also found itself in hot water with Revenue due to under-declaration of Income Tax and VAT, and was handed a bill of €51,764. Comprised of a tax bill of €35,287, interest of €6,677 and penalties of €9,800; all of this has been paid.

Longford cattle exporter Padraic Fox owed €54,527 to Revenue as a result of VAT under-declaration.

Leitrim farmer Gerard Shannon paid off a total of €45,918 following an under-declaration of VAT and Income Tax. He paid tax of €25,772, interest of €12,972, and a penalty of €7,174.

Finally, following a Revenue enquiry case for the non-declaration of Capital Acquisitions Tax, Donegal farmer Ivor Stewart paid a total bill of €117,627. €44,137 was paid for tax, with interest of €29,353 and penalties of €44,137.

Court-determined penalties

Revenue also published a list of penalties determined by the courts relating to the under-declaration or non-declaration of tax.

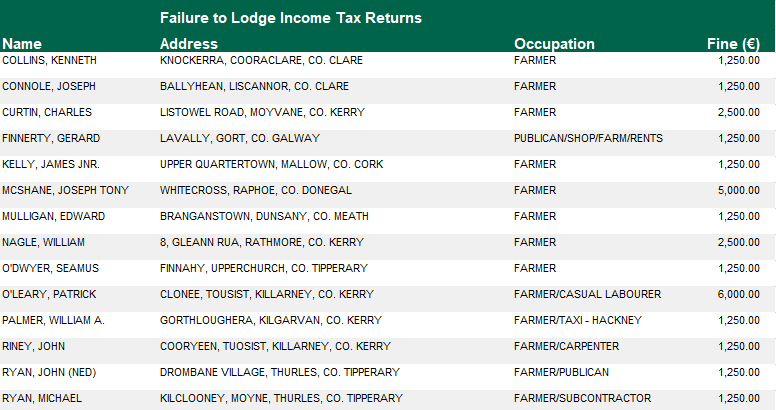

A number of farmers and agricultural contractors featured on the tax defaulters list for failing to lodge income tax returns.

Fertiliser salesman John O’Mahony from Co. Cork was also fined €3,750 for three charges related to failure to lodge Income Tax returns.

Misuse of green diesel

In addition, two farmers and an agricultural contractor were fined for the misuse of marked mineral oil (green diesel) during the second quarter of 2018.

Meath contractor Dixon Brothers was fined €5,000 for this offence, while Wexford farmer Fergus Redmond was fined €3,000.

Galway farmer and taxi driver Patrick Mullen was also fined €2,500.