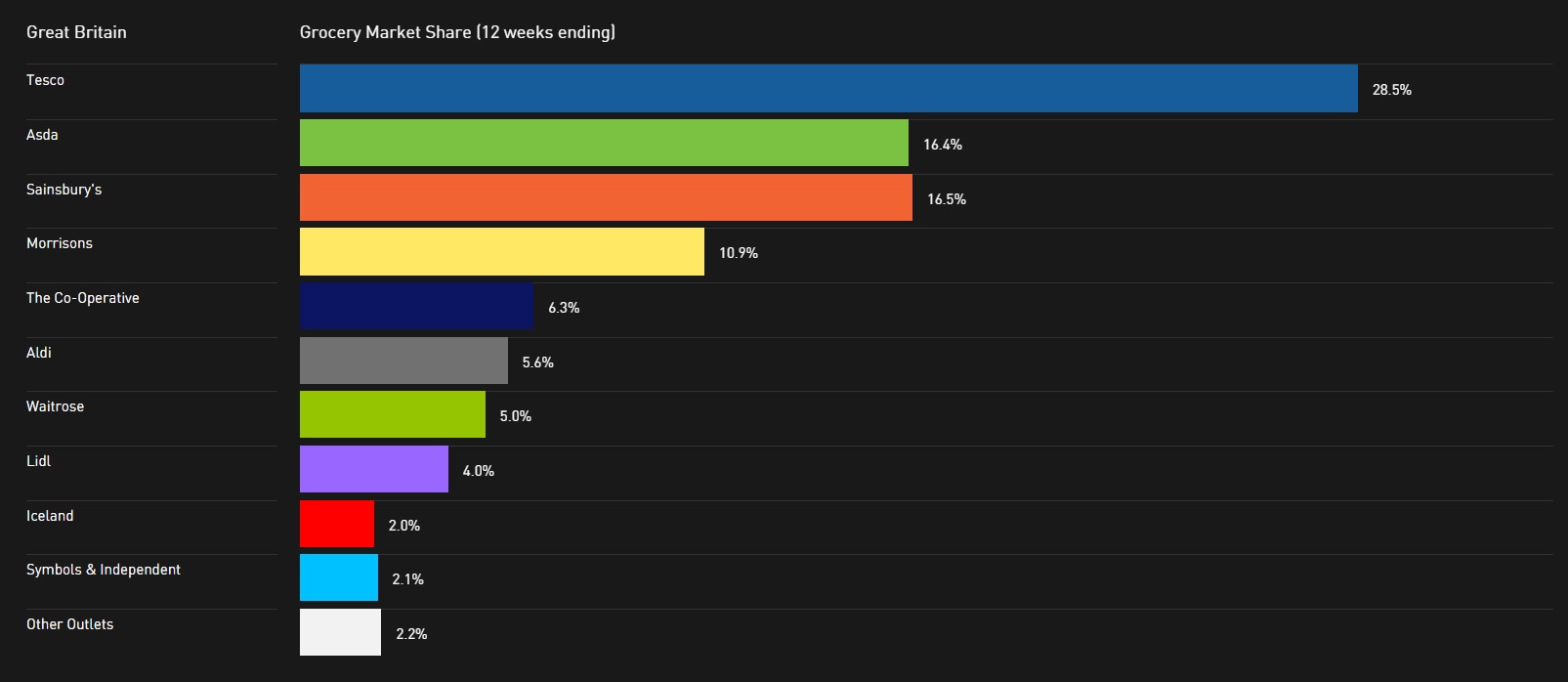

Sainsbury’s has edged ahead of Asda with it share of the UK grocery market, the latest data from Kantar Worldpanel shows.

Sainsbury’s now holds 16.5% of the UK grocery market share compared to Asdas 16.4% share, the figures show.

Despite a fall in sales of 0.3%, Kantar says that Sainsbury’s has returned to its position as the UK’s second largest supermarket for the first time since January, boosted by non-food sales, its Sainsbury’s Local outlets and faster market growth in the south of the country, where it operates a larger number of stores.

The latest grocery share figures from Kantar are for the 12 weeks ending July 19 2015, show a slow growth in the UK grocery market.

It says that overall sales have increased by 0.8% compared with a year ago, with stronger growth being enjoyed by the smaller retailers.

Meanwhile, The Co-operative has returned to growth for the first time since July 2014, increasing its sales by 1.0%, Fraser McKevitt, Head of Consumer and Retail Insight at Kantar, says.

“The Manchester-based grocer’s focus on its convenience offer has been rewarded with an increase in shopper numbers, which have risen by 133,000.

“While The Co-operative’s growth is slightly ahead of the market, its overall share of 6.3% has remained the same as last year,” he said.

Waitrose has also seen growth with sales rising by 3%, Kantar says.

Looking to the discounters, Kantar says that Aldi sales grew 16.6% while Lidl saw growth of 11.3% meaning that both have moved to new market share highs of 5.6% and 4.0% respectively.

Morrisons was the best performer among the ‘big four’ retailers, it says although sales fell back by 0.1%.

Meanwhile, sales at Tesco fell by 0.6%, at Asda by 2.7% and at Iceland sales were up by 3.0%, coinciding with its recent ‘Power of Frozen’ advertising campaign, it says.

“The continued slow growth of the overall market can be explained by minimal volume growth and lower like-for-like prices, both as a result of cheaper commodity prices and the fierce competition between supermarkets.

“Comparable groceries are now 1.6% cheaper than a year ago, meaning prices have been falling since September 2014, although they are projected to start rising again by early 2016,” McKevitt says.