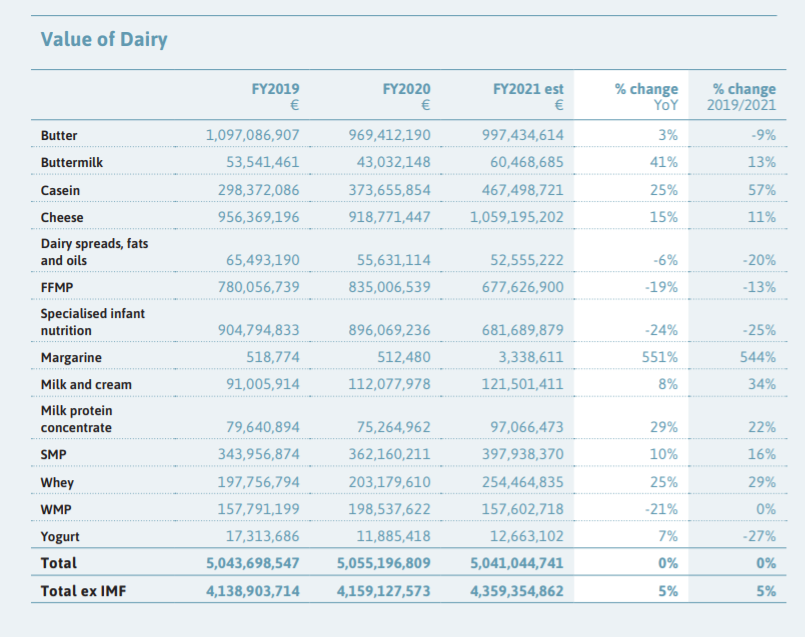

Bord Bia’s export performance and prospects 2021-2022 report published today (Wednesday, January 12) has revealed that Irish dairy exports again exceeded €5 billion in 2021.

Dairy products were exported to 147 markets worldwide, while over half of all exports were outside the UK and EU for the first time in 2021, with strong market returns for butter, cheese and powders.

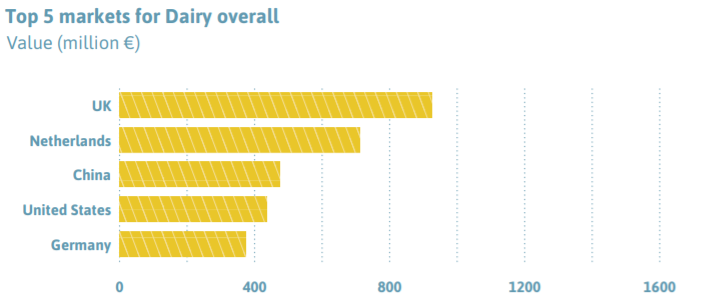

Exports to the UK have remained stable at 18% (€926 million), while exports to the EU have decreased slightly at 31% in 2021.

International destinations accounted for 51% of exports, up three points than the year previous. Export values to the Middle East dropped by €34 million.

Exceptional growth was reported in exports to North America (+ €90 million) and Africa (+ €74 million), while Asia and Europe were impacted by declining demand for specialised infant nutrition and fat-filled milk powders.

Exports of Irish dairy to the EU declined by 11% to a value of €1.57 billion in 2021, or 32% of all exports. However, butter, cheese and casein to the region all performed strongly, with exports of these categories exceeding €1 billion, growing by an estimated 14%.

The Bord Bia report indicated an increase in farmgate milk prices in most of 2021 with an estimated 10% jump between January and May.

Irish milk collections grew to approximately 8.8 billion litres in 2021, representing growth of 6% on 2020.

Cheese and butter

For the first time Irish cheese exports exceeded €1 billion in 2021, which is a 15% increase in export values. This was particularly driven by better overall pricing return from the marketplace with the value/kg growing by 13% year on year, according to data from the CSO.

The top five markets for cheese in 2021 were the UK, which was far head of the Netherlands, Germany, the US and Japan.

Irish butter exports increased slightly by 3% in 2021, reaching a value of almost €1 billion. There was a strong demand from Europe where exports grew by 16% to €625 million, particularly to Germany, the Netherlands and France.

Powders

For the first time in over ten years, Ireland saw export values of specialised nutritional powders below 100,000t, at around €680 million in export value. The demand for specialised infant nutrition declined by over €200 million.

This decline was strongly impacted by China where demand shifted towards favouring its domestic brands.

Overall, dairy powders have preformed well in 2021, with notable gains in prices achieved across whole milk powder, skim milk powder, whey powders, casein and fat-filled milk powders.

Dairy exports in 2021 have particularly benefitted from high demands for casein and caseinates, with exports soaring by around €60 million.

Despite slightly less volume of skim milk powder being exported in 2021, due to the strong pricing, the value of the exports exceeded 2020 values at approximately €370 million.

Export of fat-filled milk powder declined by 19%, a drop of €160 million which was partly due to the industry’s strategic utilisation of the milk pool to maximise value return.

This drop in output affected Europe most severely, with volumes falling back to less than 50% of 2020 volumes. This was strongly affected by the soaring costs of component ingredients required for production.

According to the Bord Bia report, Irish exporters strategically prioritised alternative product mixes to whole milk powder, consequently resulting in export decline by almost 20,000t at a value of €41 million in 2021.

Exports of whey powder recorded a strong performance in 2021, with a 16% increase in value exceeding €235 million, caused by sustained high prices and steady demand from the UK and the EU especially, as established markets for Irish whey.