The Irish Grassland Association (IGA) held its dairy conference, titled ‘Future-proofing Irish dairying’, yesterday, Wednesday, January 6.

Jim Woulfe, chief executive officer (CEO) of Dairygold Co-op, opened the conference with his presentation titled ‘Can we sell our milk?’

Milk supplies

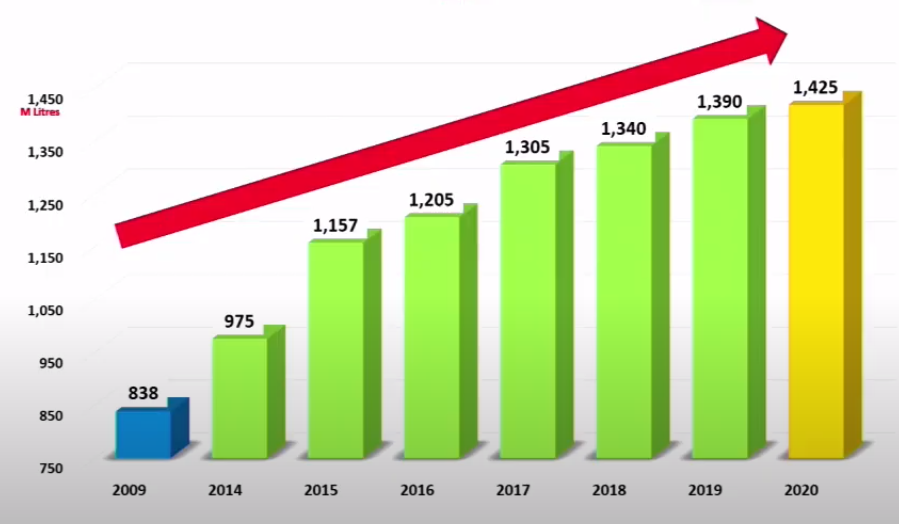

Jim highlighted that Dairygold has seen a 70% increase in milk volume supplied over the last decade, from 838m/L in 2009 to 1,425m/L in 2020.

”Along with the increased volume, the co-op has seen solids supplied increased by 80%, with the average producer supplying milk at 4.20% fat and 3.60% protein, levels that would not have been expected 10-15 years ago.”

Jim says that ”Dairygold’s revenue in the milk is supplied by the solids not the 87% water that is in the milk, with cheese accounting for 42% of its sales followed by casein/butter (24%). In terms of future markets for dairy products, health and nutrition are the key areas of focus for Dairygold.”

‘Steady milk price in 2020’

Jim described the milk prices seen in 2020 as “steady” and said that Dairygold saw an increase in supplies as well.

He added: ”The steady milk price seen in 2020 was due to buyers of dairy products willing to buy extra stock, moving away from ‘a just in time, to a just in case scenario’ – this was mainly due to Covid-19 restrictions seen in countries around the world.

”Dairygold saw supplies in 2020 increase by a further 2.5% in what was a good year for grass growth. We [Dairygold] believe we are coming into a more steady-state in terms of milk supply than what we’ve seen since the removal of quotas back in 2015.”

Challenges

Jim highlighted some of the challenges that will be faced by the Irish dairy sector in the near and distant future.

Jim believes that ”the worst of the challenges faced by Covid-19 have been dealt with”, with vaccines coming into play and markets beginning to return to more normal trends.

Brexit is more complicated, there is nothing good about Brexit from a milk processor/producers point of view. It is going to add cost to the milk supply chain, which means products will become more expensive in the market. All we can do at this moment and time is deal with what lays ahead the best we can.

”Climate change has to be accepted and embraced by farmers, and the dairy sector as a whole must play its part in reducing emissions.

”Global forces that may affect the Irish dairy sector include political uncertainty, economic sustainability, tariff wars and alternatives to dairy.”

Milk producers

For milk producers, Jim said: ”Yes we can sell our milk, but think of the consumers when producing your milk, don’t worry about selling your milk. What does the modern consumer want to see in dairy products? Currently, milk produced from grass-fed cows is very attractive to consumers on the global market.

”We operate in one of the most sustainable dairy producing regions globally, but credibility is very important within the market.

”Globally, 850m/t of milk is produced annually. 82% of this is consumed within the geography region of production, which means that the global milk market trades 150m/t of which Ireland contributes 8m/t – so maintaining our grass-based image is very important.”

Jim suggested that ”dairy farmers should consider joining Bord Bia’s national grass-fed standard, which is currently being developed’.’

Some of the key areas required for certification:

- Sustainable dairy assurance scheme (SDAS) certified;

- 180 days at grass;

- 90%+ of grass in diet;

- 95% milk pool must be from grass;

- Annual verification inspections to maintain certification.

Jim says ”farms must continue to operate sustainable practices to ensure that we maintain our image within the dairy sector”.

”We must maintain our high levels of animal welfare; embrace and adopt to changes that are coming to the sector, such as: the adoption of dry cow therapy and reduced antibiotic usage; reducing the sectors carbon footprint; and maintaining water quality.”

Takeaway points

Finally, Jim highlighted that ”the national and global milk markets will continue to grow but at a slower rate than what we have seen in the previous decade”.

He added: ”Milk price volatility will continue in the future, which comes with trading goods on the global market, continued promotion and verification of our grass-fed products is key.”