Chinese intervention purchasing has seen its state maize stocks rocket in recent months, according to Jack Watts, Lead Analyst, AHDB Market Intelligence.

In a bid to support rural income and maintain domestic supply, the Chinese government has been providing artificial high prices to the country’s maize farmers.

However, according to Watts it appears that the policy has been too successful (in terms of boosting production) with swelling state reserves.

At the same time, he says with falling world markets, imports have had to be regulated and the livestock sectors are at a disadvantage due to artificially high domestic maize prices.

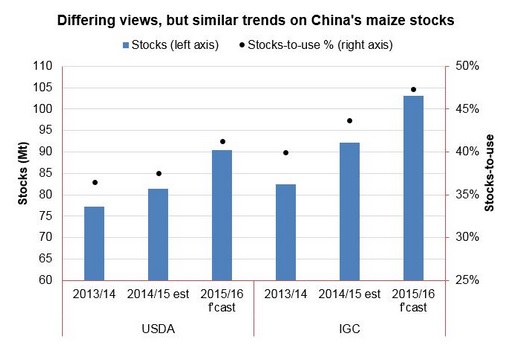

Watts says as the graph below show, stocks are trending higher.

“The stocks-to-use ratio (stocks as a proportion of demand) is now in excess of 40% – a level that can only be achieved in an intervention-esk market.

“By comparison, the US maize stock-to-use is forecast at around 12% in 2015/16,” he said.

In response, Watts said the Chinese government is expected to cut state maize prices by as much as 10% according to latest reports.

He said if this happens, Chinese state prices are still expected to be above global market levels, but the incentive to import alternatives to maize, such as sorghum or barley, might be reduced.

Longer-term, Watts said how Chinese maize farmers react to lower state prices will be key, but may not be fully transparent given the nature of available data.