Milk prices in the European Union are currently in the middle of a “large price correction” which will result in “tighter on-farm margins from quarter two onward”, according to Rabobank.

In its latest global dairy quarterly report, Rabobank states that “pay-out prices stayed high for too long” in Europe.

The Dutch financial services giant said that these high prices led to a “mismatch between dairy farmers optimising milk production on the back of strong margins and dairy companies accumulating loses on the surplus milk”.

According to Rabobank, the main challenge in the EU is not the milk supply, but the “lack of demand” to absorb the surplus milk.

Its latest research shows that including the EU-27 and the UK, milk deliveries increased by 1.6% year-on-year – equivalent to 593,000t – in quarter four 2022 (Q4), which was higher than had been previously anticipated.

Ireland topped the list of countries which recorded the “most notable gains” according to Robobank, with a 7.5% year-on-year increase or 106,000t in Q4.

Next was the Netherlands with a 4.7% increase or 153,000t, and then Germany with a 2.5% year-on-year increase which was equivalent to 187,000t in Q4.

However, there were also countries which reported lower outputs including Italy, which saw output fall by 3.5% or 110,000t in Q4.

Rabobank said it expects both UK and EU milk deliveries to be up by 1.2% year-on-year for quarter 1, 2023.

“We anticipate farm margins to remain strong until the start of pasture season and year over year comparables are still weak,” it outlined in the latest global dairy quarterly report.

Rabobank also highlighted that farmgate margins in the EU “are better than expected” because of higher milk prices, easing input costs and milk winter weather conditions.

“We still expect that dairy farmers will continue to experience profitable margins until the start of the pasture season in early quarter two,” it stated.

However, Rabobank has warned that it expects milk prices in the major producing countries in the EU to drop back because of lower dairy commodity prices.

It also indicated that from a global perspective, dairy market price uncertainty remains across all regions and dairy products.

Rabobank’s latest research report outlined that farmgate milk prices are catching up to global commodity market trends and have moved lower.

“Expensive input costs remain a clear headwind worldwide and, combined with lower milk prices, are resulting in farm-level margin pressure. In response, dairy cow slaughter rates have escalated,” it stated.

According to the bank, all dairy chain participants – from producer, to processor, to end user – are now being “squeezed”.

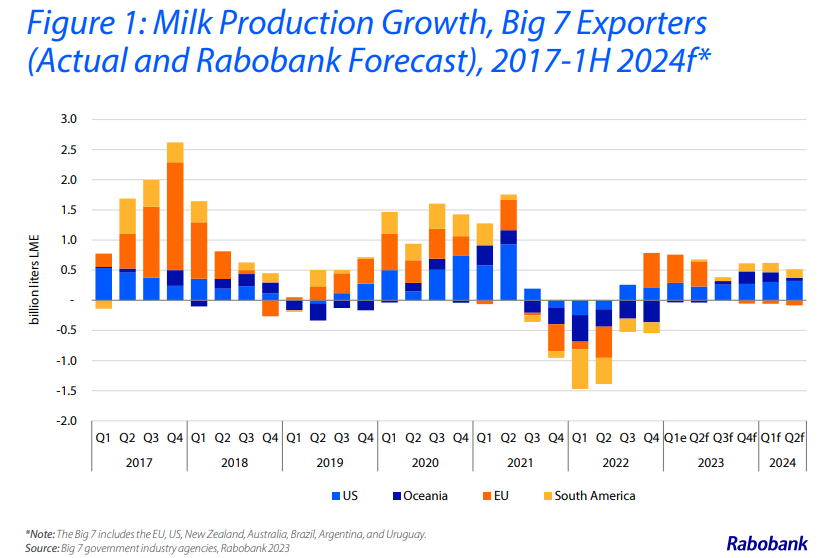

But Mary Ledman, global sector strategist for dairy at Rabobank, said that milk production from the ‘Big 7’ export regions – the US, the EU, New Zealand, Australia, Brazil, Argentina, and Uruguay – is still anticipated to grow by 0.7% year-on-year in 2023, following 2022’s decline of 0.9%.

“Rabobank downgraded its 2023 forecast from last quarter’s estimate of 1%. This slower growth is attributed to increased culling in the US and weather-related production challenges in New Zealand, Brazil, and Argentina,” Ledman added.