Banking services in rural Ireland are now approaching extinction, the Irish Farmers’ Association (IFA) has claimed.

The comments follow the announcement that 70 AIB branches will no longer be offering cash and cheque services from October 21.

Night safes; foreign exchange; bank drafts; drop safes; or external ATMs will also no longer be available at the selected locations.

The bank is to expand its partnership with An Post which it said will allow customers to access more extensive services in 920 post offices.

AIB cited reduced demand for cash and cheque services, along with the huge rise in digital banking as the reason for the move.

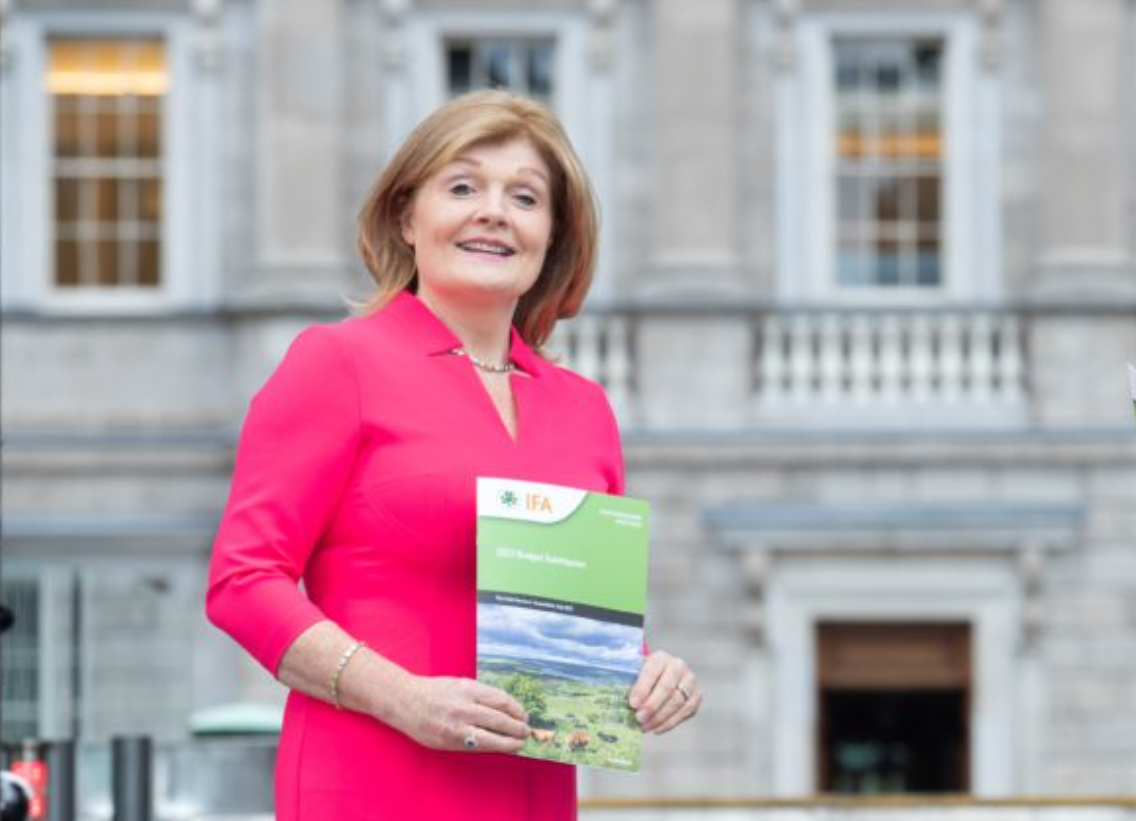

IFA Farm Business Committee chair Rose Mary McDonagh claimed that AIB has abandoned more farming and rural customers, adding that more than half of its branch network will be cashless in the coming months.

“At what point does a bank become irrelevant? AIB must be sailing close to the wind at this stage for Irish farmers and rural dwellers,” she said.

“How else could demand be anything other than down with Covid-19 lockdowns gripping the country for the last number of years and the banks closing branches or withdrawing services left, right and centre?

“It just suits their wider agenda and, if past history tells you anything, the move is probably only a precursor to eventual branch closures, which must not be allowed happen.

“The Central Bank, and indeed government – given that AIB is a majority state-owned bank – need to intervene now to protect economic activity and the social fabric of rural towns, villages and its citizens.

“Offloading bank services to An Post just isn’t acceptable. Having An Post and the credit unions there to pick up the pieces as AIB abandons rural communities indeed certainly helps, but many of their offices just aren’t set up for traditional banking interactions.

McDonagh added that significant investment and added resources will be needed by An Post to more fully support the farming community.

“Farmers need to know that their financial provider is there for them when needed and that they have a range of low-cost finance options to meet their personal and business financial needs,” she continued.

“In the past, farmers could rely on localised in-branch knowledge and expertise. Now, you’d hardly know anyone in the bank.

“Bank officials don’t know farmers or understand their business either. If you are not on hold on the phone for hours, you’re driving miles to your nearest branch now and this is unacceptable.

“The diminished level of competition, and indeed traditional service provision, is a particular cause of concern – particularly among our most elderly and vulnerable members,” McDonagh concluded.