I’m sure many people where bemused or even flabbergasted at the headline food price comparisons of last week which indicated that food prices in Ireland were 19% higher than the European Union (EU) average.

This headline-grabbing insight was further sensationalised by statements that because these figures were based on 2021, before current price inflation deriving from post Covid-19 supply chain challenges and the war in Ukraine, things could only get worse.

Given that our own official Central Statistics Office (CSO) data shows that food prices had fallen by 18% in real terms in Ireland since 2010, this Eurostat analysis seemed not only to contradict official Irish figures, but clearly suggested that future price increases would be difficult, if not politically impossible to secure.

Moreover, if we are at 19% higher than average now, and yet prices have declined in the last 10 years, lord knows how much we were paying the past.

Food price comparisons

Closer examination of the Eurostat analysis however tells a slightly different story and shows the dangers of comparing partial information and sets of indices.

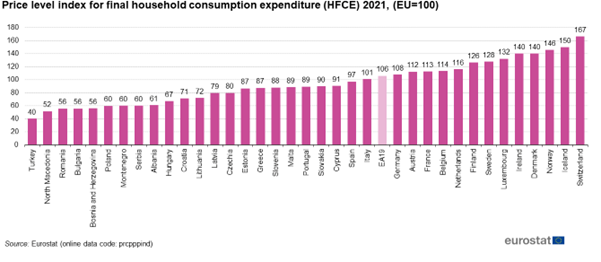

The Eurostat approach to cost comparisons first of all, sets out household expenditure comparisons across all consumer goods across the EU, plus some additional European countries as per the chart below.

Looking closely at this chart shows that the highest cost household consumption expenditure levels (i.e. overall cost of living) in the EU are in Ireland alongside Denmark at 140% of the EU average.

While Ireland and Denmark are the costliest places to live, Bulgaria and Romania are the cheapest at 56% of EU average. So far, so clear.

At a macroeconomy level, the expectation would be that most consumer items in Ireland then would cost 40% more than the EU average in order to get the index figure set out above.

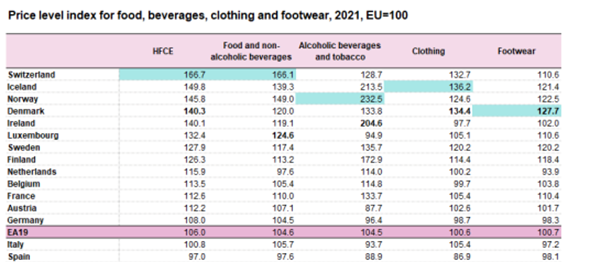

Interestingly then, while the overall cost of living is 40% higher than the EU average, the cost of food and non-alcoholic beverages in Ireland is running, not at 140% of EU average, but at 119% of EU average (see table below).

In essence, like the CSO figures, the Eurostat analysis shows that food prices are lagging behind overall prices / cost of living levels in Ireland.

So, the news story of last week only told half the story on prices and costs in Ireland, by leaving out the overall basis of Eurostat cost comparisons.

Furthermore the real key from an economic welfare perspective is that we know that for a long time Ireland has been a very high cost place to live, and the challenge is for income and social welfare levels to match this high cost.

We know that a lot of this higher cost of living in general (except for food/groceries in Ireland in particular) derives from high distribution costs across a relatively low population density landscape, compared to high density low distribution cost in areas like Holland or Belgium.

Another driver of high Irish cost comes from government consumption taxes on alcohol (highest taxes in the EU), and tobacco, reflected in prices that are 204% or twice the average EU level.

Below cost selling of fresh food

The concern from an agricultural perspective has to be that the half truth ‘story’ behind the price headline will frankly be used to stifle cost recovery in the agri sector.

It will also more systemically be used to justify the ongoing abuse by food retailers that is below cost selling and loss leading.

It is strange and remarkable that while most EU countries and the EU Commission are engaging in discussion around greater awareness of food supply and self sufficiency challenges, debate in Ireland is not just non-existent.

It is constantly overshadowed here in terms of the mainstream media narrative and, I would suggest, lots of misinformation, around the constraining of Irish agricultural output though carbon budgets.

Changing the narrative

The last 2-3 years have shown how the Irish agriculture narrative has been hijacked away from the facts of the ‘food island’.

Irish agriculture is uniquely supporting 260,000 jobs, almost €15 billion in exports, more than €17 billion in Irish Economy spend, and seeing global demand for its largely grass-based food offering increasing.

Yet, this huge plus side of the agricultural sector, including its stellar performance during the Covid-19 pandemic, has been written out of the majority of public debate.

Agriculture needs to review what it wants to say about itself and how others hear this.

A great strength of the messaging of the multinational sector is the positivity of its message, which non-coincidentally means that the sector’s economic impact is consistently overstated.

Agriculture, in my humble opinion, needs to consider how to better frame its economic impact and unique place in the national / rural economy, while not losing sight of its low income challenges in some sectors.

Too often, the agri message is ambiguous about its future, like a restaurant review that says the food here is awful but the real issue is that the portions are too small.