Bord Bia: Irish dairy exports up 14% to €7.3 billion in 2025

Irish dairy exports were valued at a record €7.3 billion in 2025, according to the latest data from Bord Bia.

The Export Performance and Prospects Report 2025/2026, published today (Wednesday, January 7) shows this was a 14% increase on 2024.

Last year, Ireland exported over 1.6 million tonnes of dairy products to some 142 markets worldwide.

Exports

Europe, the UK and North America accounted for an increased share of Irish dairy exports, reaching €5.4 billion or 72% of total dairy exports, up from 71% in 2024.

Exports to the EU were worth €3.1 billion, up 20% on 2024, exports to the UK were valued at €1.3 billion (up 18%) and the North American export share was €1 billion (up 11%).

The report pointed to lower EU milk supply in the first six months of the year, along with the strength of grass-fed Irish dairy in the US among the key drivers for growth.

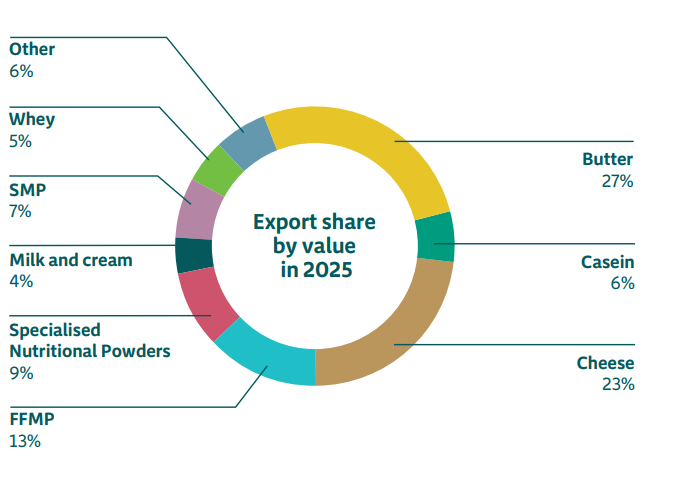

In 2025, Irish butter exports exceeded €2 billion for the first time, with year-on-year growth of €380 million (24%) driven by strong European prices in the year up to October.

In the year to September, the Central Statistics Office (CSO) said butter production was running 8% ahead of 2024.

Bord Bia noted that the sharp drop in European butter prices from quarter 3 (Q3) was too late to significantly impact overall 2025 export figures. However, it warned that this will be a factor in the first half of 2026.

Dairy

Cheese exports increased by 19% and contributed €1.7 billion to overall dairy exports.

Europe was the key driver of this performance, with exports increasing by over 30%.

Exports of fat-filled milk powder (FFMP) were 16% ahead of 2024 at €975 million, with the most significant growth was in Europe.

The report shows that exports of specialised nutritional powders were back around 25% at €630 million due to declining demand in Asia.

Casein exports were valued at €470 million, while skim milk powder (SMP) exports grew by 30% to €530 million, but whole milk powder (WMP) was down €30 million to €95 million.

Exports of whey performed strongly, driven by better market values to reach €360 million, up €60 million on the previous year.

Yoghurts saw 5% growth in export value and exceeded €50 million for the first time.

Bord Bia

David Kennedy, head of dairy at Bord Bia, said that CSO data for 2025 shows milk collections were on track for a record year of approximately 8.8 billion litres.

Collections were boosted by good weather in the spring and summer which supported grass growth.

"In short, butter and cheddar were the powerhouses behind dairy price movement in 2025, perhaps underpinned by lower EU production in the first six months of the year.

"This trend was reversed in the second half of the year as butter devalued rapidly, with global supply improvements impacting demand," he said.

A significant fall in cheddar prices also "had a very significant impact on the valorisation of Irish milk, which was reflected in farm gate prices declining over the autumn".

Outlook

Kennedy said that from a milk supply perspective, 2025 will be seen as "an almost optimal year from a weather perspective" making a potential supply increase this year unlikely.

He said key dairy suppliers and customers, who were exposed to the unexpected volatility in 2025, will tread carefully until market conditions stabilise.

"Should commodity prices remain at Q4 2025 levels, it is likely that price-sensitive regions like the Middle East, North Africa, West Africa and Southeast Asia could return to the market, helping to stimulate wider global demand," he said.

Kennedy noted that the diversified nature of the Irish dairy industry, along with its sustainability credentials, "positions it well to navigate an uncertain global market in 2026".