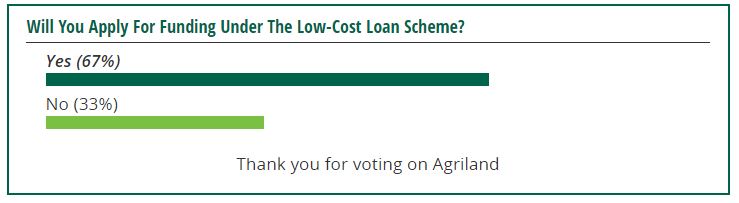

Some 67% or two out of three farmers will apply to seek funding under the low-cost loan scheme, known as the Agri Cashflow Loan Scheme, a recent Agriland poll has found.

The low-cost loan scheme, which was announced in Budget 2017, will allow farmers to borrow funds at an interest rate of 2.95%.

It is anticipated that the scheme, which will allow farmers to access unsecured loans up to a maximum of €150,000, will open for applications early this year.

The Minister for Agriculture, Michael Creed has previously encouraged farmers to consider their cash flow and borrowings, as the €150m funded scheme will be operated on a first-come, first-served basis.

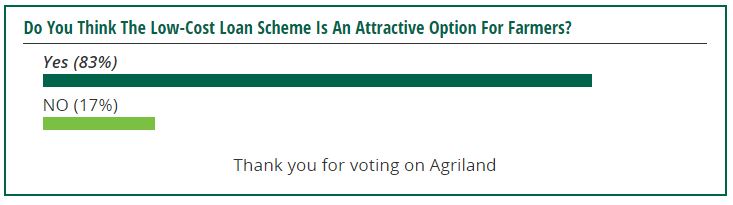

Meanwhile, over 80% of the participants in the Agriland poll believe it is an attractive option for farmers, while just 17% think otherwise.

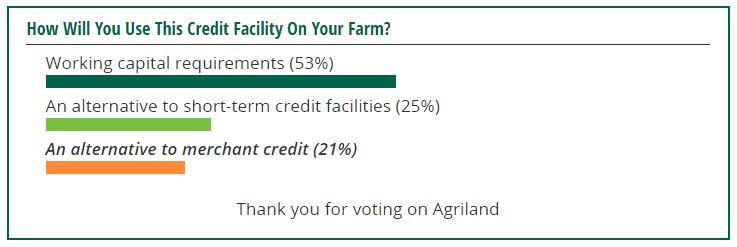

In addition, the poll results also show how farmers who apply for this method of credit plan to use the funding on their farms.

The results show that 53% of farmers intend on using the low-cost loan scheme to fund working capital requirements on there farm.

Furthermore, one in four respondents said that they will use the money as an alternative to short-term credit facilities, followed closely by 21% of farmers who wish to use the funding as an alternative to merchant credit.

The Strategic Banking Corporation of Ireland (SBCI), who will operate the method of credit, had previously invited banks and other lenders to take part in the scheme.

It is envisaged that AIB, Bank of Ireland and Ulster Bank will be among the finance organisations selected to deliver the project – the Agriculture Cashflow Support Loan Scheme.