Report: Global cattle prices rise as volumes contract

According to a RaboResearch report, geopolitics and seasonal conditions are shaping global beef trade flows.

Global cattle prices keep rising as global production volumes are contracting.

Imports from Brazil into the US were up 25% compared to last year in the first six months of 2025.

However, higher tariffs will have a material impact on the trade between Brazil and the US, according to the report.

In Europe, the tight market is also attracting higher imports.

Global cattle prices continue rising

Global cattle prices have all continued their rise through the second quarter (Q2) of 2025, according to RaboResearch.

Senior analyst – animal protein for RaboResearch, Angus Gidley-Baird said: “Northern Hemisphere countries continue to stand out at record prices.

“But prices in the US and Canada have moderated in recent weeks, suggesting some of the heat is going out of the market.

"Meanwhile, prices in Southern Hemisphere countries continue to increase.

"The reduced volumes of beef in the North American market, plus what appears to be a slight improvement in the Chinese market have generated stronger demand for Southern Hemisphere beef suppliers.

This demand is now flowing through to cattle prices," he added.

Production volumes continue contracting

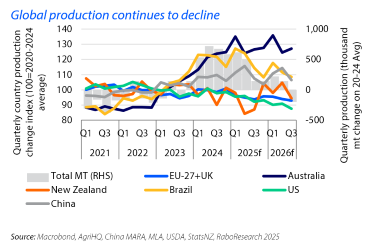

Led by contractions in Europe, New Zealand, and the US, global beef production has continued to decline into Q2 with total volumes down in the first half of the year.

Australia and China have increased production in the first six months of the year compared to 2024.

RaboResearch analysts believe that production is likely to continue following these trends, with an overall contraction of 2% expected for 2025.

US tariffs starting to impact Brazil beef trade

The latest round of tariffs included an additional 40% on the already existing 10% and 26.4% on Brazilian beef imports.

Brazil supplied a record volume of beef into the US in the first half of 2025, and RaboResearch believes this additional tariff will have a material impact on the trade between Brazil and the US.

Nearly a month after the US began applying further import tariffs on Brazilian beef, shipments remain strong in a year-on-year comparison, the report indicated.

Shipments to the US have remained relatively stable even after the tariffs have taken effect.

“Projections of rising live cattle prices in Brazil for the second half of the year may explain the current appetite from American importers for Brazilian beef,” Gidley-Baird continued.

"But we believe the volume [of] US imports from Brazil may drop an estimated 10,000mt to 15,000mt per month as we progress through the remainder of the year.”

Declining volumes from Brazil to the US lead to changes in cuts

The main challenge with declining volumes to the US lies in operational adjustments at processing plants, the research indicates.

Consumers in Brazil prefer hindquarter cuts, making the export markets a valuable outlet for processors.

The US is Brazil’s largest buyer of trimmings, and redirecting this volume to other markets would require changes in how cuts are processed.

Markets like China, the Middle East, and Egypt have historically been major importers of forequarter cuts from Brazil.

Europe's cattle market

The supply of cattle continues to be limited with EU27+UK cattle production down 3.7% in the year-to-date (YTD).

In the first five months of 2025, the largest YTD declines in production were recorded in The Netherlands (-13%); Belgium (-7%); Germany (-7%); Spain (-5%); France (-4%); UK (-3%) and Ireland (-0.6%), while Poland increased production (+3%).

High prices have motivated farmers to pull cattle forward for slaughter at a younger age and lower weight.

This might ease scarcity of supply in the short run, but will result in lower slaughter in the following months, the report stated.

The EU average carcass price continued to climb higher, up 34% year-on-year (YOY) in week 30, 2025.

Cow prices eased slightly on seasonally lower demand in north-western Europe, but supply is expected to remain limited in Q3 2025.

Ongoing buetongue outbreaks remain an issue in the UK, affecting dairy and beef production.

However, the situation is more favourable in the EU27 with a limited number of outbreaks in the period between January and August, 2025.

In June 2025, lumpy skin disease made its first ever occurrence in Italy and France.

In Italy, 40 cases have so far been recorded. Most cases are concentrated on the island of Sardinia.

In France, outbreaks occurred (51 to date) in the south, close to the Swiss border.

As a precautionary measure, Switzerland had commenced vaccination against the virus.

According to RaboResearch, a number of countries outside the EU, including the UK, Australia and Canada, introduced import restrictions to certain bovine products, such as live animals, raw milk and hides.

EU27+UK imports showed softening in May 2025, with a month-on-month (MOM) decline of 11%.

However, YTD volumes were up by 9%.

Exports, on the other hand, were up 2% MOM in May 2025 but the decline for the year-to-date was material (-12%) as supply remains a limitation.