Despite continued uncertainty surrounding the Covid-19 pandemic, overall economic growth is expected to be strong this year, according to the Economic and Social Research Institute’s (ESRI’s) Quarterly Economic Commentary, Winter 2021.

It reports that Irish gross domestic product is set to increase by 13.6%, largely due to multinational-related activities, in particular strong export figures.

Meanwhile, the domestic economy is expected to grow by 6.2% in the current year.

In 2022, the ESRI expects a continued strong performance of the economy.

PUP and agriculture, forestry and fishing

Of interest to those in the agricultural sector is a snapshot of pandemic unemployment payments (PUPs) – introduced to provide short-term, emergency income support – taken on one day in November 2021.

On that day – November 30 – 900 individuals within the agriculture, forestry and fishing sector availed of the PUP.

The category, which also takes in mining and quarrying, accounted for just 1.6% of total recipients on that date.

These 900 recipients are among approximately 54,800 people who received the PUP on November 30, and this a fall of around 550,800 in the number of PUP recipients from May 2020.

Trade and Brexit

While strong economic growth is expected next year, the report outlines some potential risks and one of those relates to possible trade complications between the UK and Europe, due to Brexit.

The report states that two possible scenarios might arise, described as follows:

- The UK attempts to renegotiate the trade agreement and/or fails to comply with non-tariff barriers;

- Article 16 is triggered by the UK and is met with retaliatory tariffs, resulting in a wider trade war.

In the former scenario, the report states, there would be a heightened sense of uncertainty regarding the future of trade and checks between goods leaving and entering the EU from Great Britain (GB) would likely have a negative impact on domestic investment.

Another concern, according to the report, is the potential for a rise in trade costs to feed into consumer prices, particularly regarding food products.

In the case of Article 16 being triggered – although unlikely according to the report – there would be a significant negative impact on overall economic activity.

Large increases in trade costs due to tariffs and checks on goods entering GB as well as increases in transport times would disrupt supply chains, leading to declines in both imports to and exports from Ireland.

Exports and imports

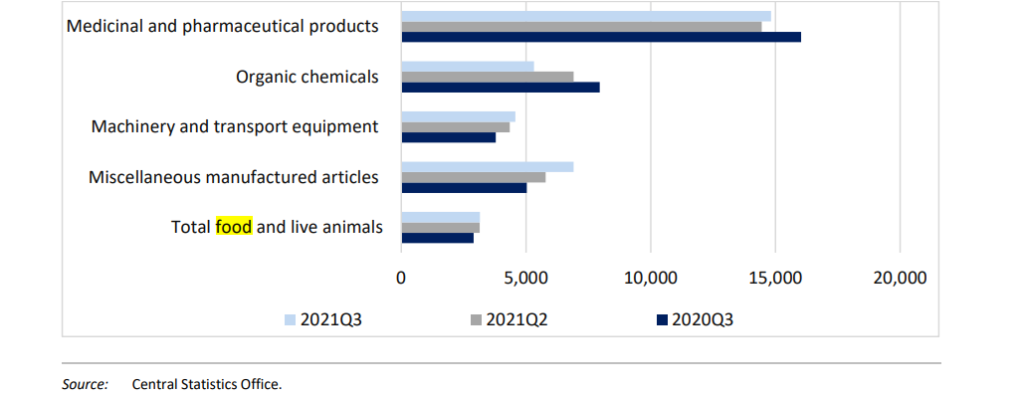

In relation to exports, the report states that they grew by 1.3% in Q3 2021 compared to Q2 2021, on a seasonally adjusted basis.

This meant that Irish net exports in Q3 were €51.8 billion.

Of the commodities included in Irish goods exports, medicinal and pharmaceutical products accounted for the largest share – 36.6% in Q3, 2021.

Exports of machinery and transport equipment increased 37.3% per annum and 19.3 per cent per quarter.

Exports of miscellaneous manufactured articles and total food and live animals also increased on both a quarterly and annual basis.

In terms of imports, machinery and transport, which account for 39% of imports, declined 8.3% per quarter but increased 18.5% per annum.

Quarterly declines also occurred in imports of medicinal and pharmaceutical products (-10%), and total food and live animals (-1.1 %).

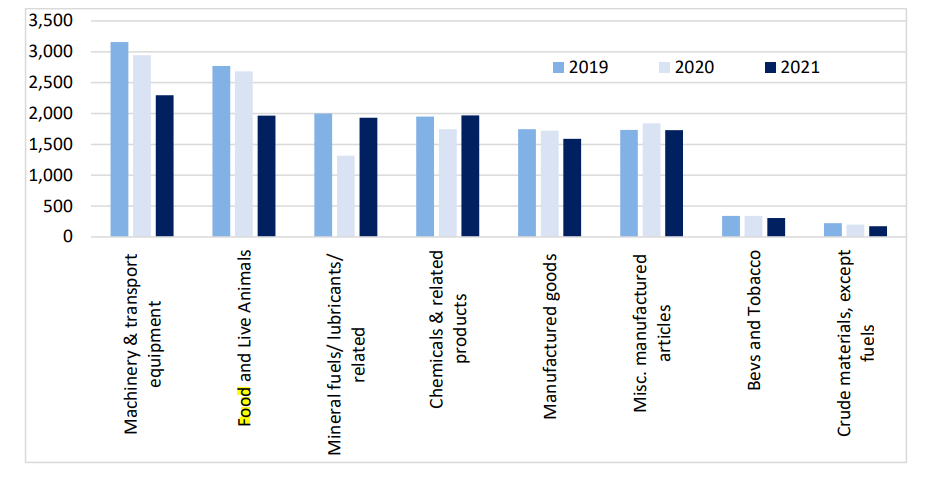

Comparing imports of commodity groups between 2019 and 2021, however, and we see that machinery and transport equipment and food and live animals registered the largest declines, at 27.3% and 29.1%, respectively.

Unemployment and inflation

The unemployment rate is expected to fall to 7.2% in Q4 2021 and average 16.1% for 2021, overall.

Unemployment is set to fall further into 2022 and will average just under 6% for the year, assuming no major deterioration the Covid-19 situation. However, more stringent public-health measures to manage rising infection levels is a “considerable” risk for 2022.

The ESRI expects inflationary pressures to ease considerably in the second half of 2022, however, increases in prices next year are set to be greater than previously thought.

At present, the ESRI expects an inflation rate of 2.4% in 2021 and 4% in 2022, with inflation falling back close to 2% by Q4 2022.

The pace of economic recovery has contributed to a smaller deficit in 2021 than expected.

This comes at a time when significant investment is likely in the years ahead in areas such as housing, climate change, and healthcare.