Proteins accounted for the greatest share of operator food purchases in 2021, according to Bord Bia’s 2021 Irish Foodservice Market Insights Report published today (Wednesday, December 8).

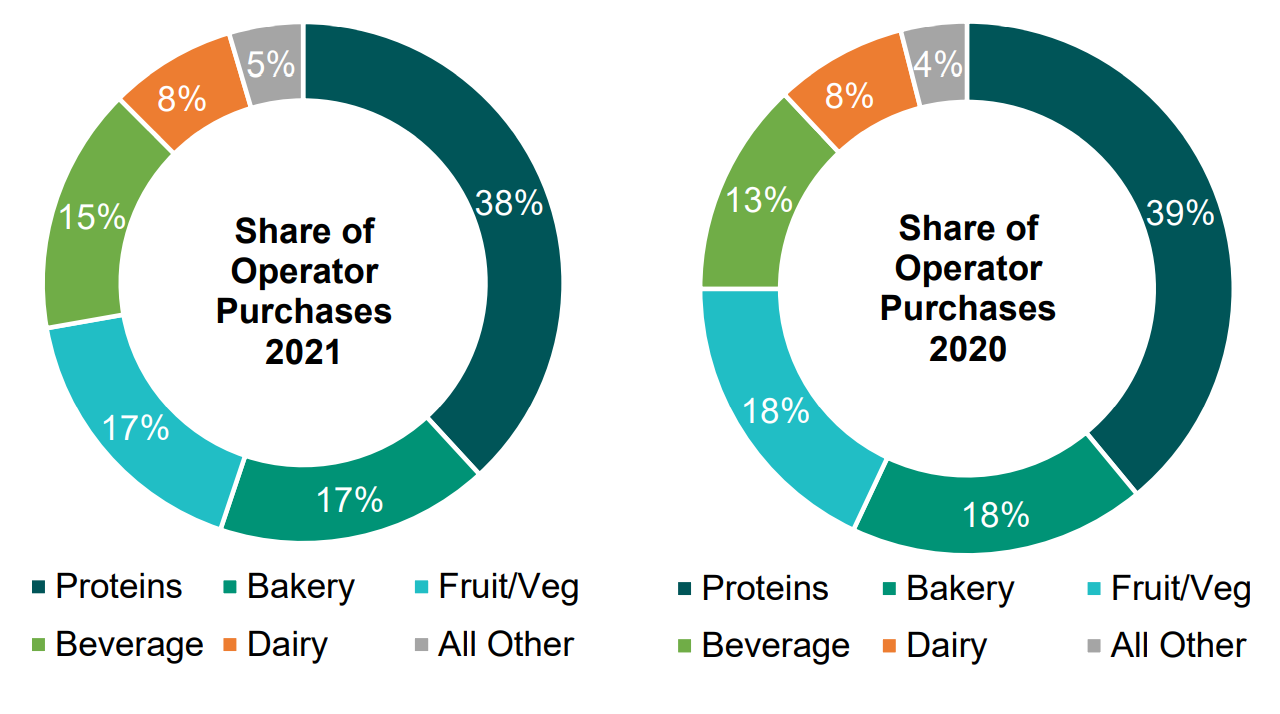

According to the report, proteins made up 38% of the total value of such purchases this year – a figure, which is stable relative to last year.

What is foodservice?

This is a term used to describe all food and drink consumed and prepared outside the home. It includes everything from restaurants, pubs, hotels and coffee shops to workplaces and hospitals.

Fruit, vegetables, poultry, beef and bread/bakery (non-sweet) account for approximately half of operator purchases, the report revealed.

While these top-four categories have held their position for some time, the overall for these categories has fallen slightly, while growth is recorded in other categories.

The figures shown below include all purchases on the island of Ireland and are an aggregate of both ROI purchases as well as purchases made in Northern Ireland (with the value converted to Euro).

They also include all food and non-alcohol beverage items.

Foodservice value

The report found that the value of the Irish foodservice for 2021 is estimated to reach €5.15 billion.

The findings of the report will be shared at Bord Bia’s virtual foodservice seminar, taking place in the RDS today.

This is a moderate year-on-year growth of 14.6%, but it remains 41% off pre-pandemic turnover levels.

The report also explored consumer attitudes to eating out, with three in four Irish adults (73%) reporting having missed dining in restaurants, pubs and cafes as a result of Covid-19.

This makes eating out the most missed social activity, compared to shopping for leisure (59%), concerts, sports and live events (57%), and spending time with colleagues (45%).

Sustainability also remains important and almost half (45%) say that in a post-pandemic world, they will be more likely to choose options that are kinder to the environment, with packaging a key influence on this.

Similarly, ‘support for local’ has been bolstered by the pandemic and half of all adults, especially those in the older demographic (57% over the age of 50), are more likely to choose a foodservice option that supports local business and the community.

Foodservice of the future

The report identifies eight critical factors facing the foodservice industry, which are set to continue into the future, one of them being ‘changing consumer priorities’.

It explains that healthier food choices, sustainability and ‘support for local’ will all play a greater role in consumers choosing a retail outlet in future.

Expanding on this, the report states that “while veganism is still relatively low among consumers, the flexitarian demand for plant-based products has been elevated and will continue to grow”.

In response, the report states, “suppliers must be prepared to show transparency relative to local sourcing, sustainability and environmental metrics”.

Environmental and carbon footprints, as well as packaging, are key areas where suppliers can aid their operator customers with their sustainability targets.

Tara McCarthy, CEO, Bord Bia said:

“There is no doubt that suppliers can play an important role in helping operators to navigate ongoing challenges facing the sector and we would encourage them to work collaboratively in helping to identify future solutions.

“This could include creating labour-saving products; providing transparency around environmental, sustainability and provenance messages; enhancing communications around supply chain issues; and developing new products that meet the needs of hybrid workers or delivery customers.

“It is reassuring to see that, for consumers, sustainability and supporting local remain important considerations in choosing foodservice options, trends that are also being reflected in some of our recent global consumer insight studies.”