COMMENT: There are about 450 days to go until the abolition of milk quotas in Europe.

Over the coming weeks Agriland will run a series of articles looking at various aspects of the Irish dairy industry in the run-up to the abolition of milk quotas in March 2015.

There is a general consensus that the abolition of milk quotas will have a positive impact on the Irish dairy industry. But this expansion may not be for everybody. Lets explore this thought using available information.

Is a production increase of 50 per cent possible by 2020?

If historical Irish and New Zealand trends are anything to go by, the answer is yes!

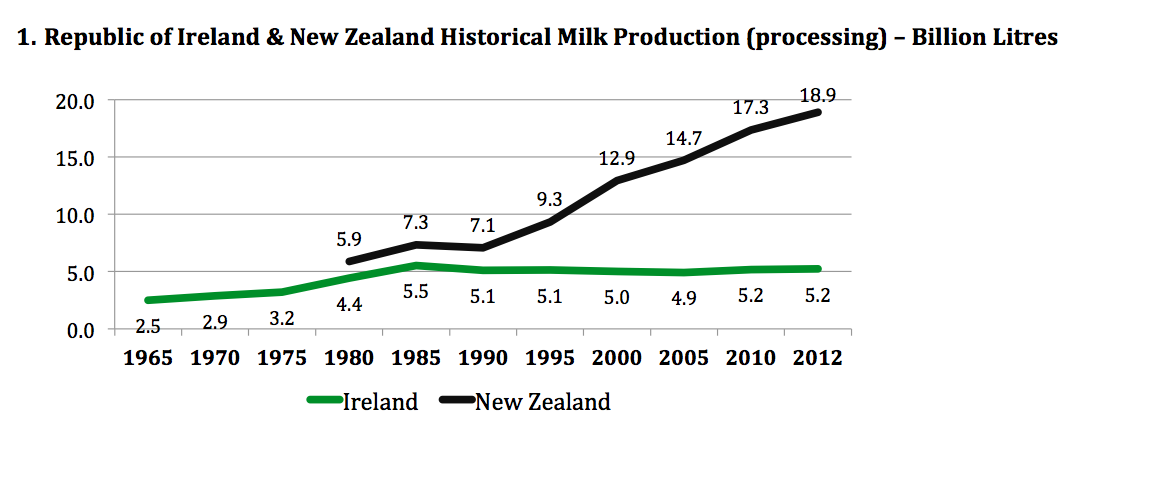

Between 1970 to the introduction of dairy quotas in the early 1980s, Irish milk production almost doubled. However, the brakes were firmly put on this expansion with the introduction of EEC milk quotas in the 1980s.

Consequently, annual Irish milk production has largely remained constant between five to 5.5 billion litres per annum. Elsewhere in the world, countries such as New Zealand have had no such impediments on milk supply growth. In fact, current New Zealand milk processing volumes are two and half times larger than the 1990 output. Click on the graph below:

Please click here for additional supporting charts and graphs.

Will all the dairy farmers in Ireland today be reaping the benefits in 2020?

Unfortunately, the answer here is no. The are number of supporting pieces of information here:

• Declining dairy farm numbers – The number of dairy farmers across Ireland and Europe continues to decline. There were approximately 65,000 dairy farmers in Ireland in 1985. There are just over 19,000 today and Teagasc expects this number to be 16,500 in 2020. In essence, about three to five per cent of farmers are exiting milk production every year since 1985.

• Average herd size increasing – The average herd size continues to grow. Access to land is going to become a growing issue. The average size of dairy herds increased from 27.1 dairy cows in 1991 to 37.0 in 2000, to just over 60 cows today. Given the trends seen in other parts of the world, we could expect average dairy herd sizes to be pushing closer to 100 cows over the next decade. The Teagasc Dairy Roadmap indicates average herd sizes in 2020 to be close to 85 cows.

Are you competitive?

• Latest Predictions – Looking at Teagasc’s latest analysis for the competitiveness of Irish dairy farming by 2020, predicts farmers will be making on average margin of €909 per hectare, with the top farmers earning €2,320 per hectare (based on a milk price of 28 cents). A statistical analysis of this data would indicate close on 10 per cent of Irish farmers could still be losing money in 2020 based on a milk price of 28 cents per litre

• Have you completed a business plan? – A related article on Agriland a number of months ago, gives further food for thought on this topic. It is available here.

Next in the series: Herd performance – Why it matters!

Tom O’Callaghan has 15 years of global experience in the agri-food sector, including dairy, meat, consumer package goods, bio-fuels and farming-owned co-operatives. He is currently focusing on emerging area of improving efficiency through agri-analytics and is advising on agri-food and farm efficiency expansion across Eastern Europe and former Soviet Union countries. He is also the former ceo of ICOS.