A growing “preference” among consumers in the UK to buy beef “sourced” in Britain could pose an issue for the Irish beef industry in 2023, Teagasc has warned.

Traditionally, the UK has been seen as Ireland’s second “home” market, but the latest dynamics in buying patterns may put further pressure on the beef industry to develop new markets to reduce its dependency on the UK market.

The Teagasc 2023 Economic Outlook for Irish Agriculture report highlights that beef retail consumption in the UK fell back in 2022. The report also details that demand switched back towards the “foodservice options”.

In contrast however, UK consumer prices for sirloin/rump steak grew and the Teagasc report details, hit record levels in “sterling terms” during the second half of the year.

“This is a positive development for the beef sector in Ireland given the importance of exports to the UK,” the report said.

The latest report by the Teagasc agricultural economics and farm surveys department underlines that Ireland exports close to 90% of its beef production.

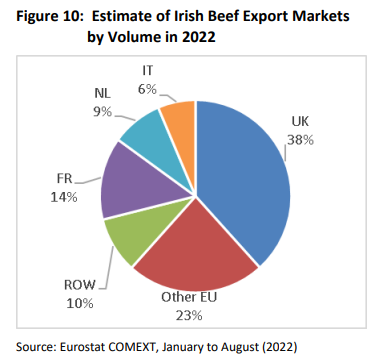

It stated that the UK market remains an important export destination for the Irish sector but suggests there has been a definite decline in export volumes in recent years, with the UK accounting in 2022 for 38% of beef exported.

It also highlighted that at a global level, there continues to be an “important shift” in demand.

Latest export estimates in general for 2022 underline Teagasc’s emphasis on how important the EU is for the Irish sector.

The report shows that beef exports to EU markets have increased in recent years and stressed that in the medium term, consumer demand in the other EU27 member states will “increasingly determine Irish cattle prices”.

It pointed to evidence of rising consumer prices for beef across EU member states particularly in France and Germany, while in the Netherlands, there has also been evidence of “very strong increases in beef and veal consumer prices during 2022”.

In addition to this there has been a consistent rise in UK consumer prices over the last 12 months.

Looking specifically at the UK market, the latest Teagasc report drew attention to the fact that average consumer prices for steak and mince “increased strongly in 2022”.

But, while beef prices in the UK showed a solid rise the impact of sterling’s performance against the euro, they delivered a decidedly negative contribution to prices for the sector in Ireland over the last 12 month period.

However, in its latest outlook report Teagasc sounds an upbeat note about the prospects for the Irish beef sector in the year ahead.

It believes rising consumer prices in key EU export markets will offer fresh opportunities, particularly against the forecasted decline expected in beef production in certain European countries.

European Commission data suggests that overall EU production of beef next year is forecast to be approximately 0.2%lower in 2023.

“Our analysis of trade data indicates that the EU export share is rising significantly and this development can contribute to the future viability of the beef sector in Ireland,” the Teagasc 2023 Economic Outlook for Irish Agriculture report detailed.