Batteries fade, autonomy slows but hybrids surge in machinery outlook

There is nothing original in the observation that farming is changing - that is what it does - but spotting particular trends in the machinery sector is the tricky bit.

In the farm machinery world, 2025 saw some developments which we will be seeing and hearing more of in 2026 and beyond, while other advances from the past are fading from the scene.

As noted in the various reports from Agritechnica 2025, one big item of news is the flourishing of hybrid drive, as the promise of batteries fades and manufacturers no longer feel quite so encumbered by the demand to rid the world of diesels.

Machinery remains diesel-powered

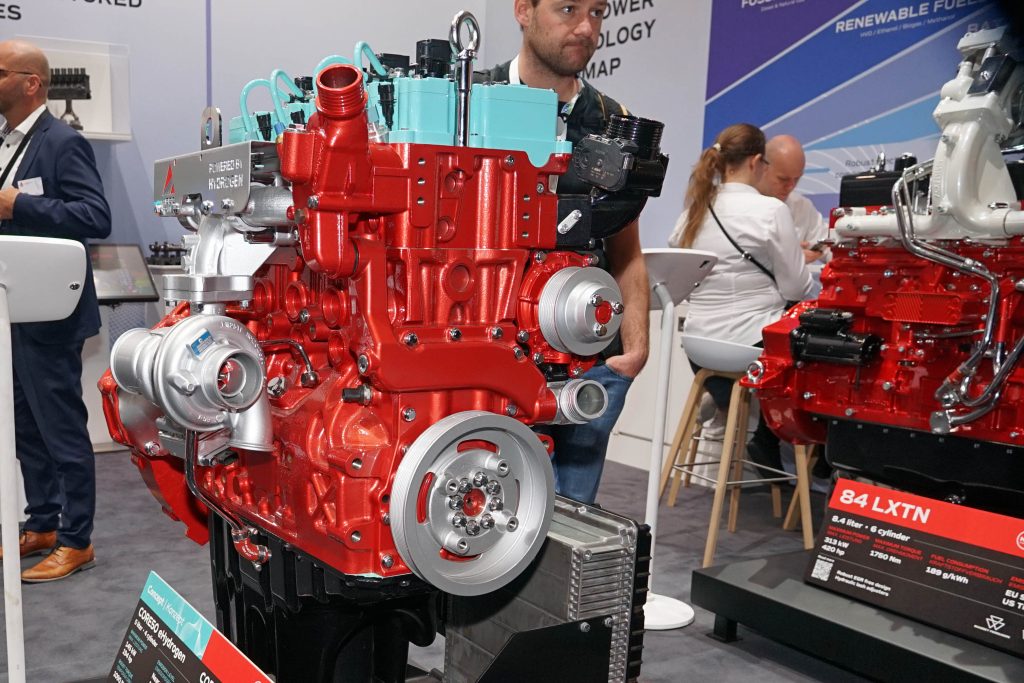

There was never any great faith amongst the tractor manufacturers that diesel was about to disappear from the scene anyway, with AGCO in particular doubling down on internal combustion engine (ICE) development.

However, CNH sold its engine production business to India and Deutz, which has been in the diesel engine business ever since they were first invented, and is reported to be scaling back on large engine development.

These two items came together with the launch of the latest Deutz 8 series, which offer 300hp+, but from an FPT engine, which itself has just become part of Tata Motors.

It should be noted though that Deutz Engines and Deutz Tractors are two separate companies, yet the tractor company had remained loyal to its old engine division until recently.

John Deere has no such qualms about big engines. Its collaboration with Liehberr keeps bearing fruit, with the company's first forage harvester of over 1,000hp, announced in June, having a Liebherr V12 at its heart.

Krone has also opted for the brand with its latest Big X, which is powered by a straight six Liebherr of 834hp.

Liebherr was always a little obscure and somewhat unknown in the farm machinery trade, but now may be its chance to shine as the engine-building business gets to grips with these new arrangements.

Electrical energy shortage

Big Tech has great plans for AI and data banks, both of which consume enormous amounts of energy - energy that is supplied through the grid, while the grid is coming to rely more on renewables, which are unreliable.

The drive for battery-powered vehicles, including tractors, may well founder on the lack of generating capacity and the inability of the grid to cope with the increased demand of both big tech and battery-powered transportation.

Diesel and hybrid

Claas is one company that has stuck with diesel engines for its foray into autonomy, as have Krone and Lemken with their Combined Powers robotic tractor.

Fendt has consciously not incorporated batteries into its latest autonomous tractor, the Xaver, which is orientated towards secondary cultivation and crop care.

The company emphasises the machine's light weight, which is reliant on it being ICE-powered.

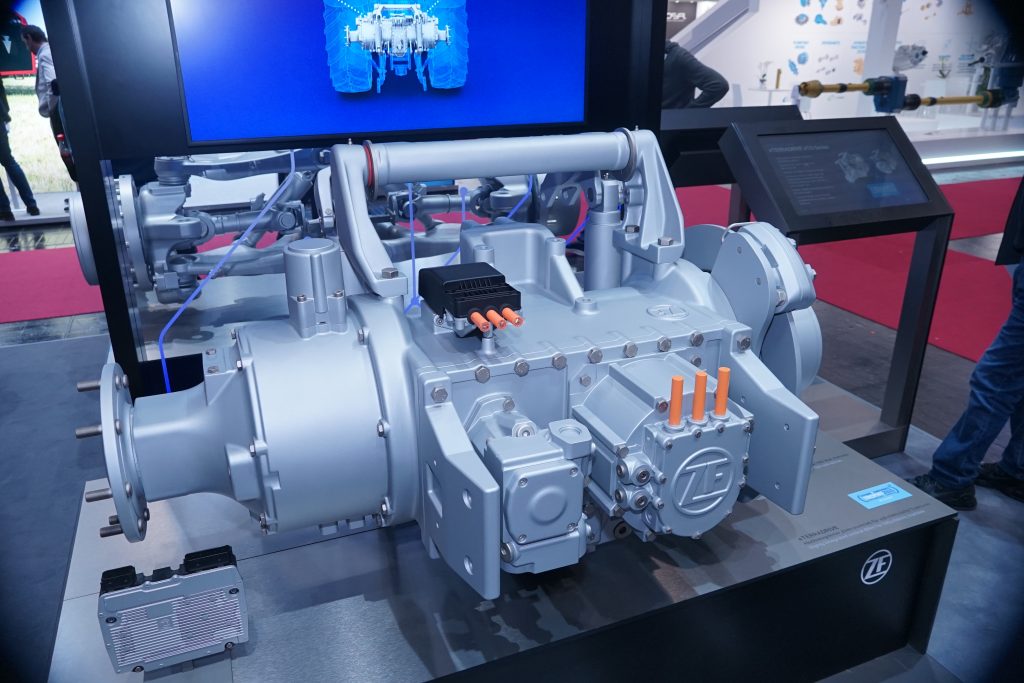

Yet the exploration of electrical power appears to have encouraged the development of hybrid drive, an idea that has been kicking around for a while and it now seems to be enjoying the light of day.

This was most ably demonstrated by Zoomlion at Agritechnica, which presented to the world both a 400hp hybrid tractor and a mid-sized hybrid combine harvester.

Sobering thought

These were not half-hearted concepts but machines that were claimed to be ready for production.

While we may be impressed with their design, another, quieter, message was being passed on - one that all western manufacturers should take on board

This is that large Chinese engineering companies have tremendous resources, and if they decide to do something they will just get on and do it.

There appears to be no hesitation with the Chinese, the collective mindset is one of progress first and foremost while other considerations may be taken into account afterwards, if at all.

Western manufacturers may presently look askance at the country's attempts to build tractors, but the place is a powerhouse that dwarfs any single company over here.

Autonomy

Automation is always a factor when looking ahead, yet the promises of full field autonomy of two or three years ago have faded as the reality of trying to integrate robots into real life farming situations stalls the ambitions of both start-ups and established tractor companies.

The situation is very similar to that of autonomous cars.

It's all perfectly possible on paper and it's 90% possible on the ground, but getting full autonomy, that last 10%, over the line is not the cakewalk once envisaged.

Yes, there are autonomous taxis operating in various countries but they are limited to certain areas and even roads.

Likewise there are robots operating autonomously in fields, but they are by no means ubiquitous, cheap or without their problems - a situation which is unlikely to change overnight.

Cost of machinery

Likely movement in price is always a question that is asked at the start of a new season.

On this, it is most certain that there will be no dramatic drops.

Once it was mainly the cost of the raw materials which dictated the price of the finished article, but now it is energy, labour and technology that have the greater effect and none of these will be coming down any time soon.

Instead, if you are looking to reduce spend on machinery, then it may be a case of looking at equipment from non-traditional sources such as the Asian bloc.

While this was something laughable even just a year or so ago, that might be changing sooner than imagined.