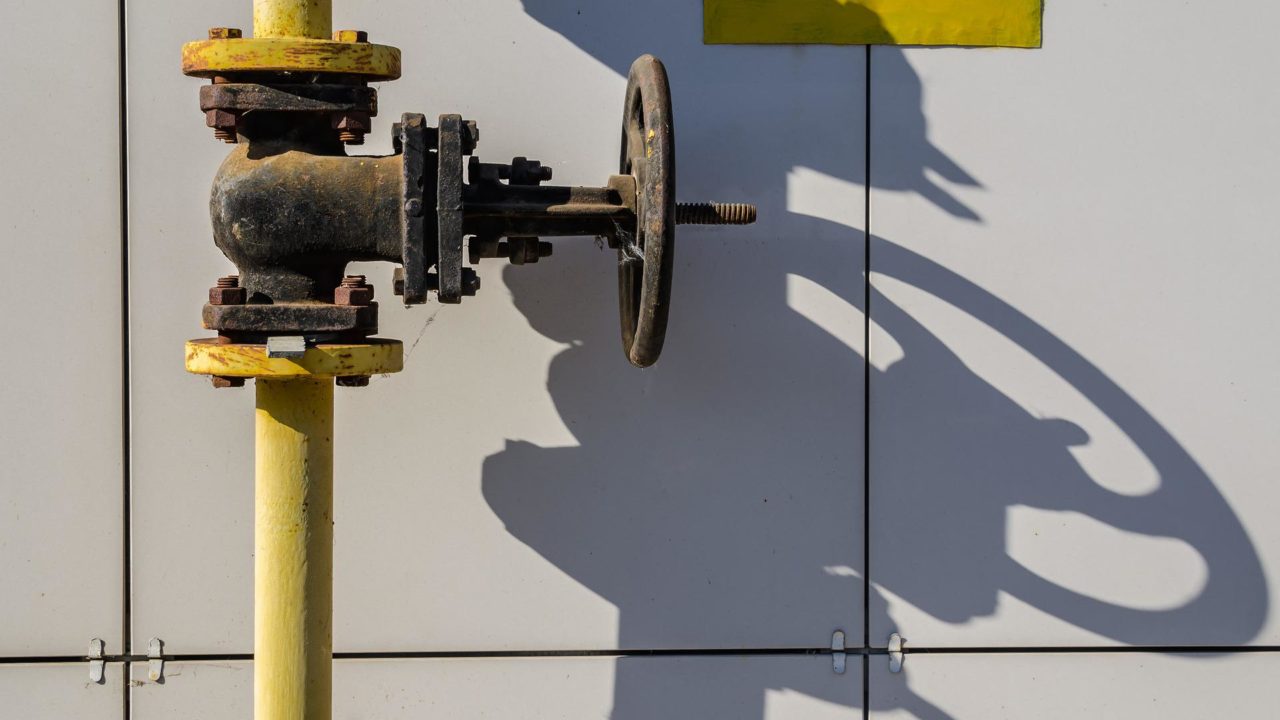

BASF has warned of possible production stoppages at its European plants as a result of restrictions on gas supplies from Russia.

The German chemicals company said that the loss of capacity in Europe could be partially compensated for by increasing production at its other sites.

European Union energy ministers yesterday (Tuesday, July 26) signed off on a voluntary target to reduce gas use by 15% in Europe between August and March.

The voluntary reductions could become legally binding in the event of a supply emergency, subject to approval from a majority of member states.

The EU commission previously warned that the EU faces the risk of further gas supply cuts from Russia; almost half of member states are already reporting a reduction in deliveries.

BASF results

Despite the continued high raw-materials and energy prices, the BASF Group today (Wednesday, July 27) reported strong financial results for the second quarter (Q2) of this year.

The group increased sales by €3.2 billion, when compared with Q2 2021, reaching €23 billion.

This 16.3% increase was driven by the significant price increases which BASF introduced across its divisions.

The company noted that its Agricultural Solutions and Nutrition and Care divisions considerably increased earnings.

Agricultural Solutions recorded sales of €2.5 billion – which is an increase of over 25% compared to Q2 2021.

BASF said the increase could be attributed to “higher prices in all regions and positive currency effects, mainly from the US dollar”.

Compared with Q2 2021, sales in the Nutrition and Care segment rose by 31% to €2.1 billion.

The company has increased its 2022 sales outlook to between €86 billion and €89 billion, up from its previous forecast of between €74 billion and €77 billion.

Earnings before interest and taxes (EBIT) before special items for the year are expected to be between €6.8 billion and €7.2 billion.

“Current developments, mainly driven by the war in Ukraine and its impact on energy and raw-materials prices and the availability of raw materials, especially in Europe, may lead to additional headwinds, deviating from the assumptions presented above,” the company said.

“Further risks could arise from the future course of the Covid-19 pandemic and new measures to contain the number of infections.

“Opportunities could arise from continued high margins, even in the case of an economic slowdown. BASF is responding to the economic slowdown with cost reduction measures,” it added.