The average beef farmer made a loss of €101/ha in 2019 – before taking other incomes into account, according to new research.

The data comes from accountancy practice IFAC which has released preliminary findings from its Irish Farm Report 2020. The report includes a detailed breakdown on the performances across all sectors (this article discusses the beef, dairy and sheep sectors).

Beef

The data shows that this figure is a slight improvement on the beef sector performance in 2018, when the loss stood at €116/ha.

When other farm income is accounted for, the average beef farmer profit (without distinguishing between suckler farming, beef finishing or other systems) is €435/ha. This profit was accounted for by €536/ha in other farm income, a figure which increased by €70/ha last year compared to 2018, due to higher EU payments.

Without this other income, 66% of beef farmers would not have made a profit in 2019.

Looking at the top 25% of beef farmers surveyed, they made an average profit of €251/ha (€807/ha when other farm income is counted). This is primarily explained by an above-average gross output (€1,357/ha before costs, compared to an average of €978/ha before costs across all beef farmers surveyed).

52% of beef farmers surveyed were full-time farmers.

The average beef farmer in 2019 borrowed €34,112 (an increase of 23%); invested €13,054 excluding land (an increase of 43%); saw their bank balance increase by 8%; and owed 25% less than 2018. 43% of beef farmers had no borrowings in 2019, and 41% made no investment.

Fixed assets for beef farmers broke down as follows: €3,437 in building fixtures and fittings; €1,310 in land reclamation, roadways and yards; and €8,307 in plant and machinery. 2% of beef farmers bought land last year, at an average cost of €119,000.

Dairy

Predictably, it was a much brighter story on the dairy side, with the average net margin for dairy farmers increasing by 17.9% compared to last year (€804/ha increasing to €948/ha, not including other farm income).

This increase was driven by a reduction in cost, with the average cost of producing a litre of milk dropping by 6.7%. This drop was itself largely accounted for by a 39% decrease in feed costs in 2019 compared to 2018.

When other farm income is added into the mix (which worked out as €398/ha), the average dairy farmer profit (after costs) was €1,346/ha. For the top 25% of dairy farmers, their gross output was 30% higher than the average dairy farmer (€4,817/ha vs €3,701/ha), but their costs were also higher, increasing by 12%.

A farmer in the top 25% had a final farm profit (plus other income) of €2,180/ha.

The profit per litre of milk worked out as 12.7c/L (or 17c/L for the top 25%), compared to 11.4c/L in 2018.

31% of dairy farmers surveyed operated as limited companies.

The average dairy farmer in 2019 borrowed €134,412 (an increase of 15%); invested €47,756 excluding land (an increase of 44%); saw their bank balance increase by 9%, and owed 8% less than in 2018. 17% of dairy farmers had no borrowings in 2018.

Fixed assets for dairy farmers broke down as follows: €23,625 in building fixtures and fittings; €3,940 in land reclamation, roadways and yards; and €20,191 in plant and machinery. 4% of dairy farmers bought land last year, at an average cost of €192,000.

Sheep

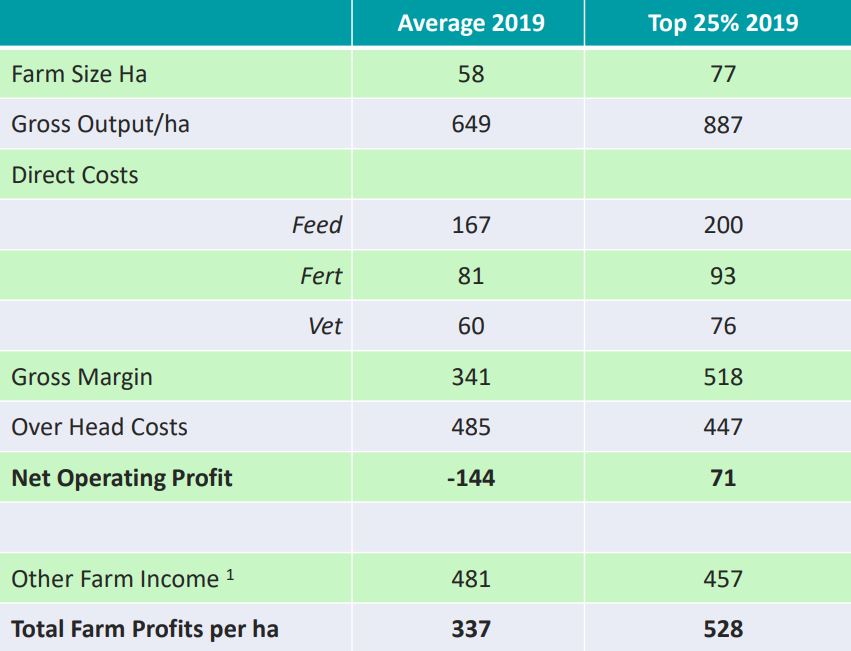

Finally, turning to the sheep sector, farmers here saw an average net loss of €144/ha (including costs) which, when other farm income of €481/ha (on average) is factored in, resulted in a total farm profit of €337/ha.

Gross output for the average sheep farmer was €649/ha, against direct costs of €308/ha and over-head costs of €485/ha.

For the top 25% of sheep farmers, they made an average total farm profit of 528/ha, accounted for by €457/ha in other income and a €71/ha profit before other income.

For this top cohort of sheep farmers, gross output was €887/ha, against direct costs of €369/ha and over-head costs €447/ha.

59% of sheep farmers surveyed were full time farmers.