Analysis: Butter market continues to weaken

The butter market continues to weaken despite the seasonal period in which additional demand would typically provide support, according to DCA Market Intelligence.

DCA Market Intelligence B.V. is a leading price reporting agency (PRA), specialising in independent benchmark assessments and market analysis within the international agri-food business.

In the weeks leading up to Christmas, retail and foodservice channels usually absorb higher volumes, but this year the effect is barely visible.

Instead, prices have continued to fall steadily, highlighting the depth of the current structural surplus.

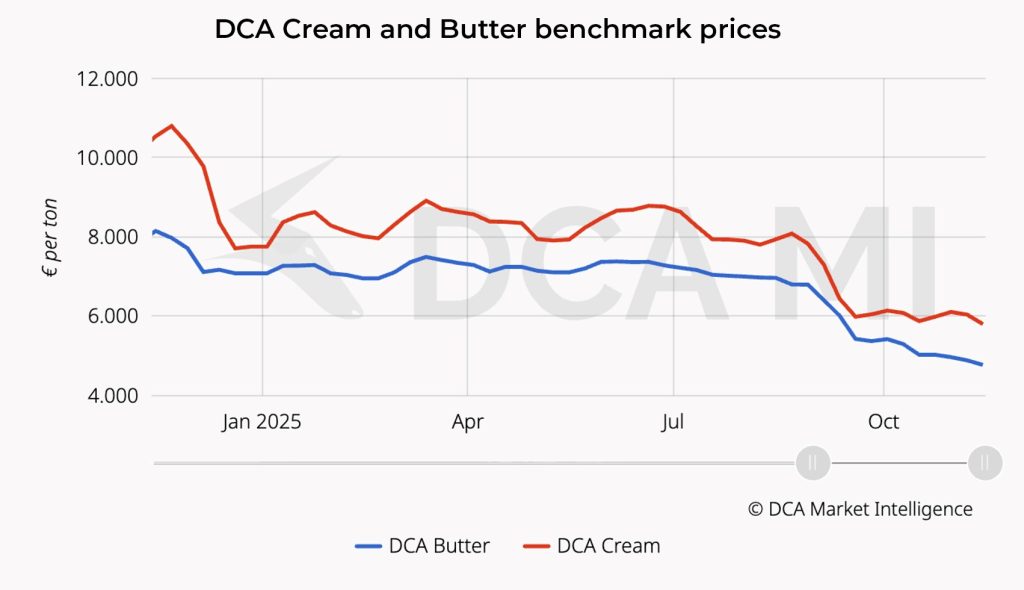

This week's DCA butter price has now fallen for almost 20 consecutive weeks, reaching €4,785/t, its lowest level since autumn 2023.

Current fundamentals suggest the market could still move lower, as no clear signals of tightening have yet emerged.

Butter markets

Frozen butter stocks remain substantial and many producers and traders are actively looking to reduce inventories in a market where confidence in price improvement is limited.

As a result, the expected seasonal uplift has so far failed to materialise, according to DCA.

The continuous pressure on butter is also weighing on related product categories, with the cream market showing further weakness and liquid dairy supply across north-west Europe remaining more than sufficient relative to demand.

Foil cheese market

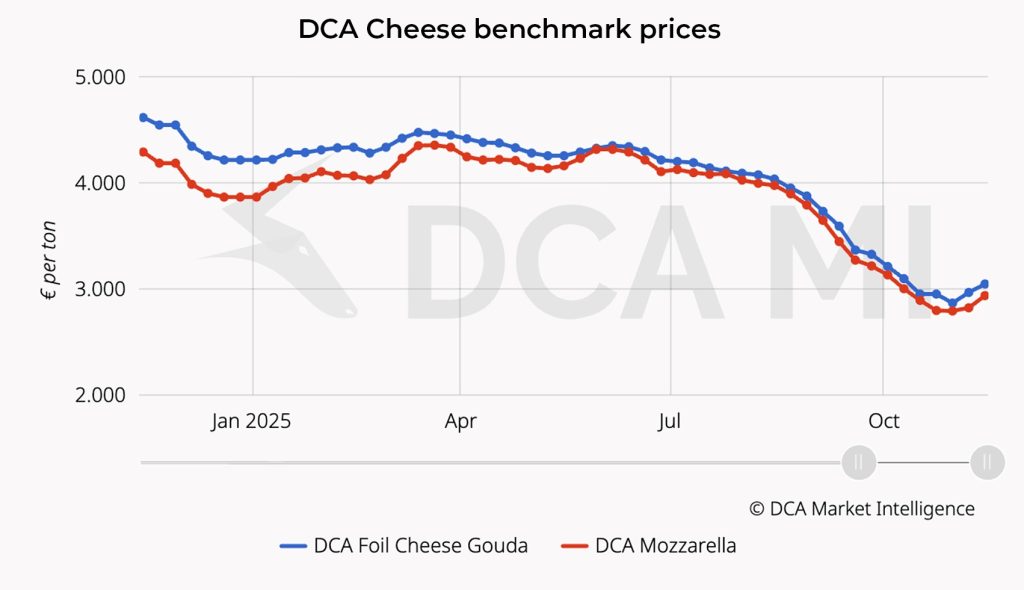

While butter shows little response to holiday demand, the foil cheese market is benefiting more clearly from the seasonal peak.

DCA’s foil cheese price has moved back above €3,000/t for the first time in weeks as buyers secure volumes ahead of December.

However, high milk availability continues to shape expectations. Dutch milk supply in October reached the highest level ever recorded, which means significant volumes will soon enter the cheese market.

Combined with a logistically challenging holiday period, the sustainability of current firmness remains uncertain.

Clarity in international dairy markets

In response to rising volatility in the dairy market, DCA Market Intelligence has introduced its new Butter Production Forecast.

The tool aims to provide more transparency around short- and medium-term developments at a time when traditional seasonal patterns are becoming less reliable.

It combines historical production data with current market and price indicators from the European dairy chain to calculate expected production volumes.

By opening part of its data to the wider industry, DCA aims to provide a reliable reference point in a market characterised by volatility and rapidly shifting supply–demand dynamics.