Report: Beef production in Ireland down 4% since first half of 2024

Beef production in key producing and consuming regions is expected to contract by 0.8% in 2025 compared to 2024 volumes.

New Zealand is expected to experience the largest percentage drop in production, and the US is expected to see the largest drop in volume, according to thew Global Beef Quarterly Q4 2025 report from RaboResearch.

The contraction in beef production is likely to continue in 2026, with an estimated drop of 3.1%. Key regions where production is expected to decline include Brazil, the US and Canada, according to the research.

European beef outlook

EU27+UK beef production declined by 3.3% year-on-year (YoY) in January through July 2025.

Beef production fell in the Netherlands, down 10% YoY; Germany (-7% YoY); the UK (-5% YoY); Ireland (-4% YoY), Spain (-4% YoY); France (-3% YoY), but increased in Italy (+3% YoY), and Poland (+2% YoY).

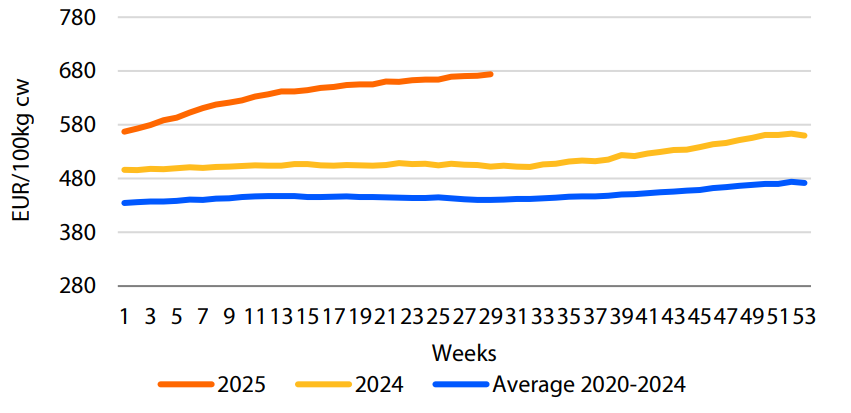

Beef prices continue moving upwards with EU average beef carcass price up 33% YoY, signalling an ongoing limited supply.

RaboResearch expects continued upward pressure on beef prices in a period with seasonally higher demand in Q4, 2025.

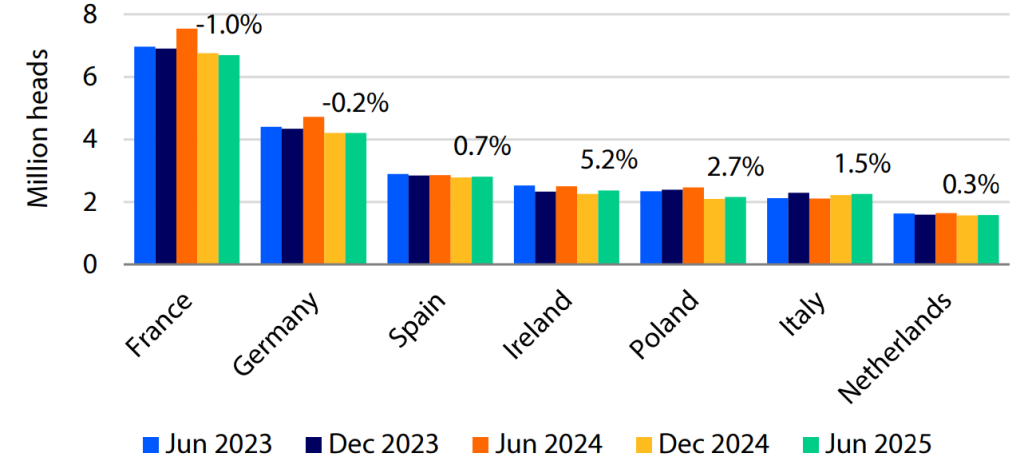

In the 13 EU countries that reported livestock numbers in June 2025, the cow herd increased by 0.9% while the number of live bovine animals rose by 1.1% compared to the end of 2024.

According to the report, this growth partly reflects ongoing recovery from bluetongue outbreaks and seasonal factors, such as in Ireland, where cow numbers surged by 5.2%.

This modest herd expansion could support a rebound in 2026 production, according to RaboResearch.

However, supply is expected to remain limited, as YoY, figures still show a significant contraction, with the cow herd down 7% compared to June 2024 across the EU13.

EU27+UK, exports are down by 13% YoY in the period January through August, while imports increased by 12% YoY.

Major exporters such as Brazil (+12%) Argentina (+19%); Uruguay (+29%); Australia (+31%); and New Zealand (+56%) continue to benefit from the tighter market conditions in Europe.

The European Commission has proposed to postpone the implementation of European Deforestation Regulation (EUDR) for small and micro enterprises by one year until the end of 2026.

For large and medium-sized companies, the EUDR will still apply from December 30, 2025.

However, the commission has proposed a six-month transition period, meaning enforcement measures will only begin from June 30, 2026.

Approval of the proposal by the EU member states and the European Parliament is still pending. If the proposal is positively assessed, no short-term disruption to beef imports on the European market is expected.

Global cattle prices high or rising

Northern hemisphere cattle prices remained elevated in comparison to southern hemisphere prices.

A slight contraction in US and Canadian prices through September and into October may be more a result of seasonal conditions rather than any increase in supply, with production volumes still forecast to contract further, according to the report.

With the exception of Argentina, southern hemisphere cattle prices all edged higher through September and October.

Brazilian beef exports have sustained an exceptional pace through October 2025 setting new records despite the volatility of the global market.

October marked the highest monthly export volume ever recorded, with 353,000 MT, surpassing September's previous record and representing an 18% year-on-year (YOY) increase.

Revenue reached €1.9 billion, up 39% YOY, driven by stronger Chinese demand and growth in other markets.

Year-to-date exports totalled 2.8 million MT, generating $14.2 billion, a growth of 16% in volume and 36% in value compared to the same period in 2024.

RaboResearch has said that this performance positions Brazil to break its annual record from previous year of 2.9 million MT as early as November.

China remains the main buyer, accounting for 187,000mt in October, 48% of shipments, the largest volume on record above 2% higher than September.

Monthly purchases have risen sharply from an average of 100,000mt between January and May to roughly 165,000 metric tons from June to October, suggesting an anticipation of potential trade changes following the Chinese review into imports.

Mexico and Indonesia have emerged as strategic markets for Brazil. Indonesia granted certification for bone-in beef, offal, processed products and prepared meats, expanding beyond boneless beef in October.

Exports jumped from 1,000mt in September to over 8,000mt, making it the eighth largest destination.

Mexico, seeking to diversify amid New World screw worm outbreaks, saw Brazilian beef as a key supply source. In October, it surpassed Chile to become the large, third largest importer.

Record high exports combined with seasonally smaller feedlot cattle supplies and warmer months boosting local consumption, drove live cattle prices higher in late October.

By the third week of November, prices were up 3.8% compared to the previous month. The upward trend is expected to persist, but level out in Q1 2026 as Chinese demand eases ahead of the Lunar New Year.