Clearly, in the midst of Covid-19, Brexit and climate change, challenges and opportunities abound for the Irish economy and the agriculture and food sector.

The recently-announced budget demonstrated a measure of government support for the agricultural sector and for farm incomes in particular.

The Food Wise 2025 strategy needs to build on this support and double down on the opportunities and challenges facing the agri-food sector, including decarbonisation of the processing sector and investment in market diversification – if the supposed “opportunities” are to be maximised.

The range of supports for farmers in last week’s budget was real, substantial and intended to send a clear signal that the government not only recognises the challenges facing the agricultural sector from Covid-19, Brexit and climate change but also recognises the unique impact the agri-food sector has.

This pragmatic approach to the fundamentals of the Irish economy is very welcome.

2 key concepts

There are two key concepts behind the government’s action.

Firstly, the consensus emerging from the International Monetary Fund (IMF) and World Bank – in guiding the response to the Covid-19 induced recession – suggests that targeted government supports have a vital role to play. This is in stark contrast to the catastrophic approach to the recession / banking crisis of 2008-2013. Austerity and laissez-faire (‘do nothing’) economics are consigned to the past.

Secondly, in a specific ‘Irish economy’ sense, the government is targeting sectors that are “job-rich” – sectors with significant multiplier effects.

As I’ve alluded to in recent articles, the performance of the multinational sector – particularly in pharmaceutical and digital – is welcome. However, its footprint – in terms of ‘Irish economy’ spend – is light. This assertion is based on estimates from government departments – indicating a spend of €23 billion in the ‘Irish economy’ versus €220 billion in exports and profit repatriation.

How much ‘pull’?

Clearly the ‘pull’ these sectors (i.e. multinational pharmaceutical and digital entities) across the Irish economy as a whole is limited.

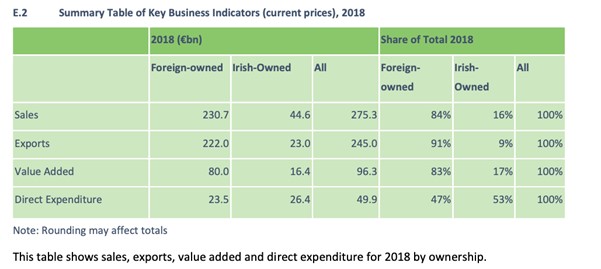

The contrast between the turnover figures for the FDI (Foreign Direct Investment) sector and its ‘Irish economy’ footprint are best illustrated by this chart and table (below).

The first table shows that sales and exports for the multinational sector are in excess of €220 billion. By contrast, ‘Irish economy’ expenditure was just €23 billion.

For indigenous Irish-owned sectors, which are dominated by food and drink manufacturing exports, turnover runs to €23 billion. However, ‘Irish economy’ expenditure is €26 billion.

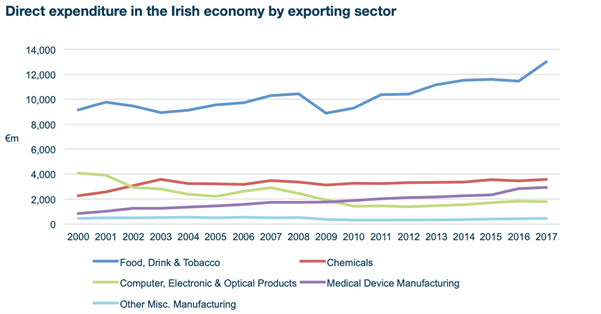

Indeed, as the chart shows, ‘Irish economy’ expenditure by the food and drink industry runs at five times that of the next biggest ‘Irish economy’ spender – the pharmaceutical sector.

The recent budget represents an important first step in focusing on ‘Irish economy’ impacts.

The Food Wise 2025 strategy, which is due to be finalised over the coming weeks, can build on this. It can do so by focusing on investment supports for trade diversification, including a state-backed trade credit scheme (which exists in many EU countries and in the UK).

It can also do so by supporting ‘green gas’ investments in dairy processing, which could decarbonise milk processing while reducing Irish agriculture’s overall carbon emissions by 8%.

Let’s see what happens…

Ciaran Fitzgerald is a leading agri-food economist and former chairman of Meat Industry Ireland (MII).