Milk Price Tracker: Huge reduction in milk prices for August supplies

The latest Milk Price Tracker – brought to you by Agriland and the Irish Creamery Milk Suppliers’ Association (ICMSA) – details milk prices from the most significant Irish dairy co-ops for the month of August.

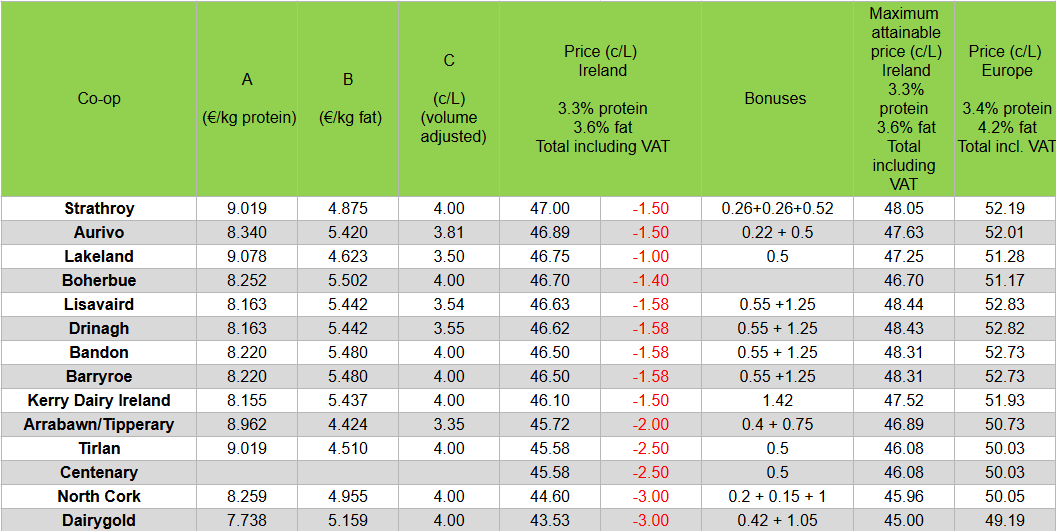

The co-ops within the Milk Price Tracker are ranked from highest to lowest price for base milk price only.

It is important to note that the cent-per-litre (c/L) milk prices shown in the table below are calculated using the widely accepted milk pricing system.

The conversion factor used is 1.03, which means that 1L of milk corresponds to 1.03kg of milk.

It is Agriland and ICMSA policy not to include support payments, bonuses, or additional payments in the calculation of the base milk price.

August Milk Price Tracker

After the majority of the cooperatives decreased their milk price for July supplies, the worrying trend has escalated as all have dropped the base milk price for August supplies.

The biggest drop in milk price saw North Cork and Dairygold both drop their base milk price by 3.00c/L which now sees Dairygold at the bottom of the table with a base price of 43.53c/L and North Cork sit second from the bottom with a base price of 44.60c/L.

Tirlán also significantly slashed its base price by dropping 2.5c/L, which sees Tirlán and Centenary third from the bottom with a base price of 45.58c/L.

Strathroy remains at the top of the table with a base milk price of 47c/L despite cutting its milk price by 1.5c/L.

The smallest drop in milk price this month was by Lakeland Dairies, as it dropped milk price by 1c/L which saw the co-op make the biggest jump in the tracker this month, climbing from fifth-last to third in the table.

The falling milk price has been put down to an increased global supply and the sharp drop in butter and cheese prices.

High milk prices will drive production globally, and better weather across the world is pumping extra supply on the market.

Many co-ops have said that the main reason for these price reductions is due to the sharp decline in recent weeks in international market prices for products such as butter and cheese.

This sharp decline is stemming from a resurgence in global milk supply as, due to good weather across the globe, volume and solids began to recover in the second quarter of the year.

These price drops are concerning, as it is understood that dairy markets are not expected to show immediate signs of recovery over the coming months.

It is particularly worrying for liquid milk suppliers, who hope to get paid a premium price for the extra costs incurred for producing milk over the winter months. Just as producer groups will be detailing to co-ops what they need and just as cows start calving, milk price is getting slashed.

The latest results on the Global Dairy Trade (GDT) have shown a slight decline in the index figure, marking three decreases in a row.

After the latest auction on Tuesday, September 16, the index is down by 0.8%, representing an average price of €3,434 per metric tonne (mt) of product sold.

August bonuses and penalties

Further details of bonuses and penalties for the Milk Price Tracker can be found by clicking here.

With regard to the latest Milk Price Tracker for August, the following explanatory notes (all bonus and penalty payments are based on manufacturing milk) apply.

Unconditional bonuses:

- North Cork is paying a supplementary 0.95c/L (excl. VAT) on August supplies.

Conditional bonuses:

- Arrabawn/Tipperary pays a 0.4c/L (excl. VAT) bonus on all milk with a somatic cell count (SCC) less than 200,000 cells/ml;

- Arrabawn/Tipperary pays a 0.712/L (excl. VAT) sustainability bonus;

- Aurivo is paying a 0.5c/L (excl. VAT) future milk sustainability bonus;

- Aurivo has a milk storage bonus, which is available to suppliers with a minimum annual supply of 160,000L that have enough refrigerated storage capacity to cover seven milkings at peak production. The storage bonus of 0.44c/L was taken from the ‘C’ from September 2021. ‘C’ is 3.813;

- Aurivo has a 0.21c/L (excl. VAT) protein bonus available for every 0.05% protein achieved, above the co-op average protein %, in an individual month;

- Carbery Group pays a bonus of 0.5c/L (excl. VAT) from March to October and a 0.88c/L (excl. VAT) bonus from November to February to suppliers who achieve an SCC of less than 200,000 cells/ml;

- In September 2022, Carbery began to pay a sustainability bonus of 0.5c/L to farmers who have committed to Carbery’s futureproof programme. This is 1.25c/L for 2025 and is paid on all milk supplied by farmers who have signed a sustainability pledge and complete three actions. This is paid in January each year;

- Dairygold has a maximum bonus attainable by farmers who achieve the minimum requirements for six criteria (total bacteria count (TBC); thermoduric; sediment; SCC; lactose and inhibitors). This cumulatively amounts to 0.4c/L (excl. VAT);

- Dairygold has a 1.06c/L grassroots sustainability bonus payment for water quality, protected urea, soil health, education, milk recording, herd health and Sustainable Dairy Assurance Scheme (SDAS);

- Kerry Dairy Ireland is paying a sustainability bonus of 1.35c/L (excl VAT) for a range of measures. This payment was introduced in January 2025. This includes the 0.4c/L (excl. VAT) bonus on all milk with an SCC less than 200,000 cells/ml and 0.1c/L (excl. VAT) for SDAS;

- Lakeland is paying a 0.47c/L (excl. VAT) milk sustainability bonus;

- North Cork pays a 0.2c/L (excl. VAT) bonus on all milk with an SCC of less than 200,000 cells/ml;

- North Cork pays a 0.135c/L (excl. VAT) bonus if four milk recordings are carried out in the year. It will be paid the following January;

- Strathroy pays a 0.25c/L (excl. VAT) bonus on all milk with an SCC of less than 200,000 cells/ml;

- Strathroy also pays a 0.25c/L (excl. VAT) bonus on all milk with a TBC of less than 10,000 cells/ml;

- Strathroy pays a 0.5c/L (excl. VAT) sustainability bonus, this was introduced in January 2024;

- Tirlán is paying a sustainability action payment of 0.47c/L (excl. VAT).