Did you know that the Dutch horticultural sector is significantly more profitable than dairy or arable farming there? Like, 133 times more profitable?

Or, that it is valued at around 23 times that of Ireland’s, despite it cultivating only around 29% more land? To put some figures on that, that is – €10.6 billion in 2020 compared to €0.5 billion in 2019 for the Netherlands and Ireland, respectively.

So, when the recently published report, Opportunities for the Irish horticulture sector – prepared by KPMG for the Department of Agriculture, Food and the Marine – featured a ‘learnings’ section from the Netherlands, it was hardly surprising.

Looking at the Dutch model, the report highlighted some key areas – opportunities, if you will – which Ireland could replicate to grow the sector here.

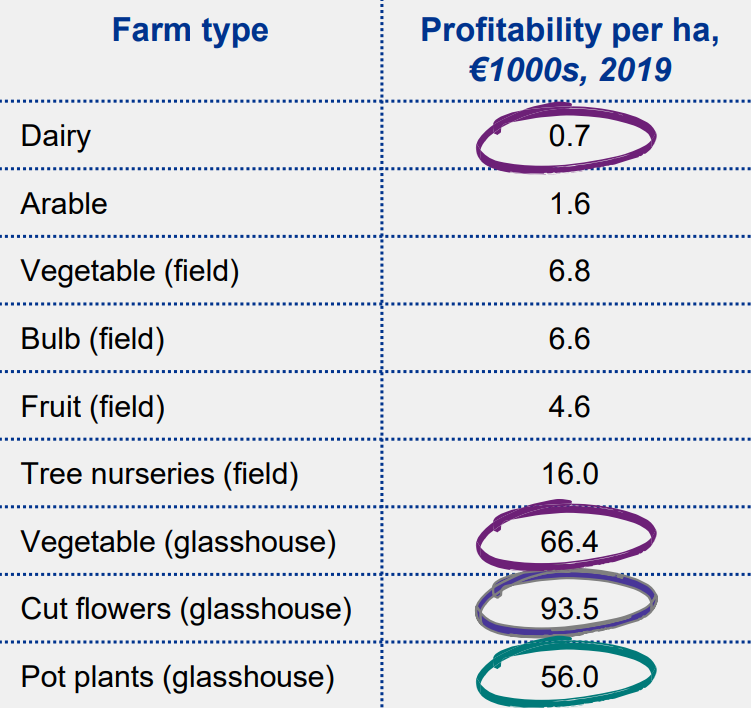

And the table above illustrates why that just might pay off.

On average, green-house cut-flower producers in the Netherlands earn approximately €176,000, after expenses, which is around 133 times more profitable, per hectare, than dairy.

This is partly attributable to the efficiency of Dutch glasshouses, which is discussed more below.

Did you know?

- The Netherlands is the world’s second-largest exporter of agricultural products after the US and is a top-five global exporter in all main horticulture sub-sectors: number one for trees and plants; number three for vegetables and number four for fruit.

- The Netherlands’ horticulture market – worth €10.6 billion in 2020 – is valued at around 23 times that of Ireland’s (€0.5 billion in 2019) despite it cultivating only around 29% more land using horticulture.

- The Dutch horticulture sector is significantly more profitable than dairy or arable farming; cut flowers lead the way, being around133 times more profitable per hectare than dairy.

Glasshouses

Embracing the glasshouse model and developing circular bioeconomy opportunities are some of the things that have helped the Netherlands become global leaders in horticulture innovation, and from where Ireland can learn a thing or two.

The Netherlands, according to the report, has pioneered a “sustainable precision-farming model using glasshouses” – more than 9,000ha of high-tech, climate-neutral glasshouses to be precise.

So what? So many vegetables, that’s what!

These horticulture crops are grown in climate-controlled conditions, facilitating precision harvesting with reduced use of water and fertiliser.

At optimal growing conditions, each glasshouse acre can produce the same lettuce yield as 10 outdoor acres.

Sustainable glasshouse technologies are stimulated by Dutch government subsidies such as ‘The glasshouse as a source of energy’ programme, which uses solar panels to create energy and innovative heat exchangers to save energy consumed, with the surplus being used for other purposes

Embracing glasshouses transformed Dutch horticulture and could be a gamechanger for Irish horticulture too.

But, the report advises, this will require capital investment supported by investment in skills, research, and innovation.

Did you know

- Dutch horticulture products were exported to up to 180 countries in 2020

- Germany is the largest importer of Dutch horticulture products, with a value of around €8 billion in 2020, representing around 33% of total Dutch horticulture exports.

- The majority of Dutch trade is with neighbouring markets (within 1,300 km).

- While the Netherlands have a dominant larger neighbour for export potential (similar to UK for Ireland), they have meaningfully diversified beyond that market.

Clustering

Two heads are better than one to explore a concept and develop it. The Dutch have run with this idea – and some – with their clustering of horticultural production and agri-food businesses, also known as greenports.

There are five designated greenports in the Netherlands across vegetables, cut

flowers, and pot-plant production.

These Dutch greenports drive collaboration within the industry, and the basic premise around this cluster design is to increase economies of scale and efficiency in transport and logistics.

Ireland, the report observes, should aim to grow its horticulture sector in clusters such as these, as they enhance knowledge exchange, product commercialisation, revenue and job growth.

Circular agri-economy

The Netherlands has recognised the growing importance of circular agriculture and

is developing expertise in the area, the report states.

Circular agriculture aims to keep residuals of agricultural biomass and food processing and re-use them as renewable resources – this cuts waste, leads to less imports, and reduces the need for fertilisers.

The Dutch Ministry of Agriculture recently launched a plan of action to

support the transition to circular agriculture.

The Netherlands has established experimental ‘lighthouse farms’ or test farms to build their knowledge and prepare for the global shift to circular farming.

The Dutch approach to knowledge-building through test farms will ensure they are

prepared for the transition to circular farming, and Ireland should follow suit, the reports states.

Research and funding are key

In addition, the report highlights the importance of research and development (R&D) and funding to drive ahead with horticultural innovations, as the Dutch have.

There is a rich “research ecosystem” there facilitated by Foodvalley, which is a knowledge-intensive agri-food ecosystem comprising a cluster of agricultural start-ups and experimental farms, with Wageningen University & Research (WUR) at its centre.

Five of the top global agri-food companies possess R&D facilities there, driving technical innovations in the agricultural industry, such as robot fruit pickers, water and waste recycling, and glasshouses which produce more energy than they consume.

WUR has a number of active research streams split across food production of the future, nutrition and health, green transitions, nature conservation and ecology

and rural/urban environments.

Research stakeholders in Ireland, the report states, should consider if a new institution is required or whether an existing college in Ireland can achieve similar.

The Netherlands’ government offers a number of funding options to drive innovation, both globally and locally, and Ireland could offer a variety of funding options to encourage development and adoption of innovative technologies.