Glanbia plc has released its financial results for the first half year of the 2020 financial year (HY 2020), noting a “resilient operating performance while navigating the challenges resulting from the Covid-19 pandemic”.

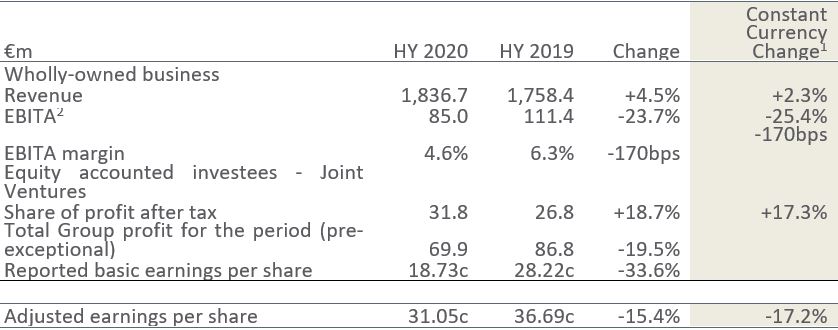

All activities within the Glanbia group continued throughout HY 2020 (the year up until July 4). Adjusted earnings per share were found to be 31.05c, a decline of 17.2% on constant currency.

Meanwhile, the group’s net debt improved by €126.7 million versus the preceding half year.

Other key points of the group’s half-year 2020 results include:

- Wholly-owned revenues stood at around €1.84 billion (HY 2019: Around €1.76 billion), up 2.3% (constant currency) on the prior half year;

- Wholly-owned EBITA (earnings before interest, taxes and amortisation) pre-exceptional stood at €85 million (HY 2019: €111.4 million), down 25.4% (constant currency) on the prior half year;

- Glanbia Performance Nutrition (GPN) EBITA was notably impacted by Covid-19, with conditions “improving as the period ended”. The GPN transformation project was expanded;

- Glanbia Nutritionals delivered EBITA in line with the prior half year;

- Joint ventures delivered a “robust performance”, with pre-exceptional share of profit after tax of €31.8 million, up €5 million on the prior half year;

- Exceptional items after tax amounted to €14.6 million; primarily relating to the GPN transformation project.

Basic earnings per share were 18.73c (HY 209: 28.22c), a decline of 33.6% (reported) on the prior half year. An interim dividend of 10.68c per share (HY 2019: 10.68c) was recommended by the board, representing a payout ratio of 34.4%.

Announcing the results today, Wednesday, August 12, the group also announced an agreement to acquire Foodarom for CAN$60 million, a specialist flavours solutions business based in Canada.

“In my entire career at Glanbia, I have never been prouder of my colleagues, whose response to the extraordinary challenges of 2020 have been exemplary. I am hugely appreciative of the agility, dedication and commitment that Glanbia employees and particularly our frontline workers, suppliers, and customer partners showed,” said Siobhán Talbot, Glanbia managing director.

In the first six months of 2020, wholly-owned revenues grew by 2.3%, on a constant currency basis. Glanbia Nutritionals [“GN”] delivered a good performance with earnings in line with the prior year, as key end market demand sustained throughout 2020.

“GPN was impacted by Covid-19, with international market disruption and challenges in the North American specialty and distributor channels. As a result, adjusted earnings per share declined in the period by 17.2% on a constant currency basis. The issues encountered by GPN were most pronounced in Q2 [quarter 2], with performance improving as the period ended,” Talbot added.

She concluded: “While the short-term outlook remains uncertain, the board is confident that Glanbia has the portfolio, the consumer insight and the operational expertise to succeed in this new environment.”

The group’s 2020 financial half-year results summary is as follows: