Glanbia launches new cheap loan fund for farmers (Here's how it works)

Glanbia, along with a number of partners, has launched plans for a new €100m ‘Glanbia MilkFlex Fund’.

The fund it says will offer flexible, competitively priced loans to Glanbia milk suppliers with loan repayments which can vary according to movements in milk price.

Glanbia Co-operative Society has teamed up with the Ireland Strategic Investment Fund, Rabobank and Finance Ireland on the initiative.

How it works

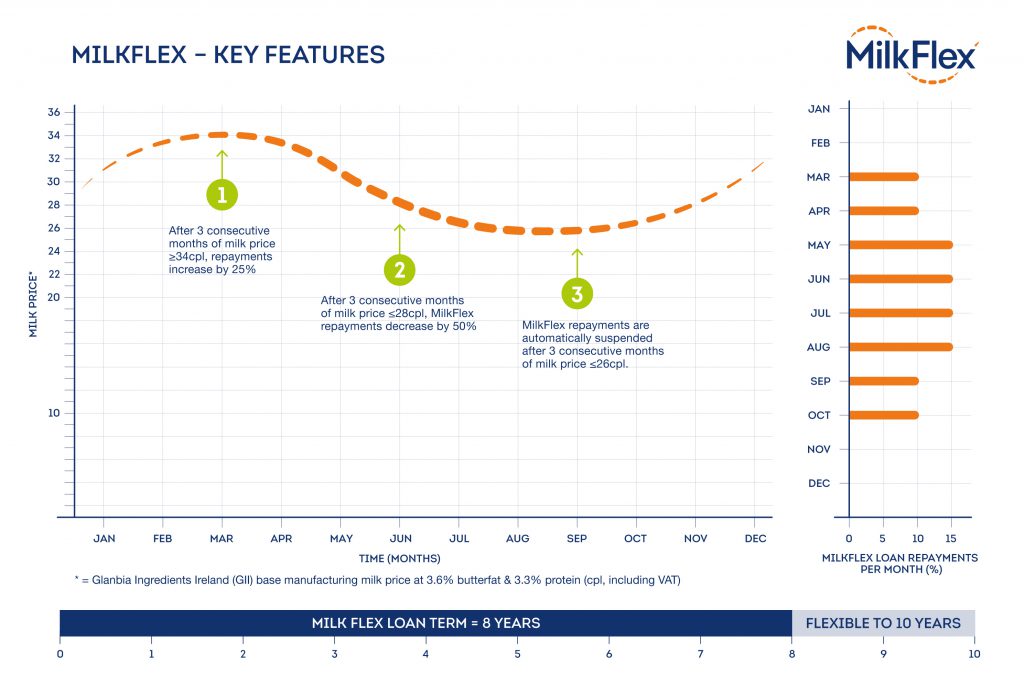

A key feature of this innovative loan product is that it will have inbuilt ‘flex triggers’ that can adjust the repayment terms in line with movements in Glanbia Ingredients Ireland’s (GII) manufacturing milk price, thereby providing farmers with cash flow relief when most needed.

Rabobank, the Ireland Strategic Investment Fund, Finance Ireland and Glanbia Co-Operative Society plan to invest in the Fund while Finance Ireland will also originate the loans and manage all aspects of the Fund.

Interest rate

Subject to underwriting criteria, the interest rate charged on the loans will be a variable rate of 3.75% above the monthly Euribor cost of funds (with a Euribor floor of zero).

The loans will have a standard term of eight years, but may be extended by up to a maximum of a further two years when volatility triggers are enacted.

The key features of the proposed loan product are:

- Should the GII manufacturing milk price fall below 28 cent per litre (cpl) (including VAT) for three consecutive months, both principal and interest repayments, where due, will be automatically adjusted downwards by 50% for the following six months. This mechanism can be activated a maximum of four times during the term of the loan;

- Should the GII manufacturing milk price fall below 26 cpl (including VAT) for three consecutive months, all loan repayments, where due, will be automatically suspended for six months. This mechanism can be activated a maximum of two times during the term of the loan;

- Should the GII manufacturing price rise above 34 cpl (including VAT) for three consecutive months, loan repayments, where due, will increase by 25% for the following six months. This mechanism can be activated a maximum of four times during the term of the loan;

- Upon an outbreak of a notifiable disease which reduces a borrower’s milk volume output materially on the previous year, the loan repayments will be suspended for the following six months;

- The loans will have a standard term of eight years, but may be extended by up to a maximum of a further two years.

- A loan set-up cost of 1.25% will be deducted from the approved loan.

From a milk supplier perspective, other key features of the Glanbia MilkFlex Fund include:

- Loan repayments will be automatically deducted from the supplier’s milk receipts by GII. The profile of repayments will reflect the seasonal milk supply curve, with no loan repayments – interest or principal – during the low milk production months from November to February inclusive;

- Loans will be available for amounts of between €25,000 and €300,000;

- Loans will be unsecured however repayments will be made by as a priority deduction from milk payments;

- Loans can be drawn down for investment in on-farm productive assets to support an existing or growing dairy farm enterprise (including livestock, milking platform infrastructure and land improvement);

- Lending decisions will be based on the merit of a farmer’s business plan as opposed to the asset value of their farm, subject to meeting eligibility and underwriting criteria;

- There will be an amount set aside within the Fund for new entrants to dairy farming;

- In order to qualify for access to the Glanbia MilkFlex Fund, a supplier must maintain a valid Milk Supply Agreement (MSA) with GII for the term of the loan.

Subject to completion of the legal documentation, it is expected that the Fund will be made available to farmers from May 2016.

Finance Ireland will host a series of workshops in the GII catchment area in April to provide information to milk suppliers interested in making an application for funding from the Glanbia MilkFlex Fund.

Finance Ireland will manage the origination of loans from the Fund and will require a clear business case in order to justify the lending decision. Each applicant must meet eligibility and underwriting criteria. None of the other investors will be involved in lending decisions, or in the provision of advice or otherwise to individual suppliers in relation to participating in the Fund.

The detailed terms and conditions on which the loans will be made available will be set out in documentation to be sent to milk suppliers on behalf of the Fund.

Comments and Reaction

Siobhan Talbot, Group Managing Director of Glanbia

“The creation of the Glanbia MilkFlex Fund complements our existing successful Fixed Milk Price schemes, by delivering competitively priced and appropriately structured dairy farm finance.

“This product is designed to match the cash flow generated by a dairy farm enterprise, with no repayments during certain times of low prices and increased repayments at times of high prices. We are very appreciative of the support of our partners – the Ireland Strategic Investment Fund, Rabobank and Finance Ireland – in bringing the Glanbia MilkFlex Fund to market.”

[/colored_box]