Farmers, an agricultural contractor and a veterinary surgeon have all featured on a list of tax defaulters for the first quarter of 2017. The list was released this afternoon by the Revenue.

The tax defaulters list is published in two parts. Part One lists persons upon whom a fine or other penalty was imposed by a court.

The following categories are included in this section:

- Failure to file a return;

- Filing an incorrect return;

- Illegal selling of tobacco;

- Cigarette smuggling;

- Various excise and licensing offences.

A total of 18 farmers and one veterinary surgeon were fined for failing to lodge Income Tax returns to Revenue in the first quarter of the year.

Fines ranged in amounts from €1,250 to €10,750; with the total amount of fines adding up to €74,000.

Meanwhile, Michael Kelly – an agricultural contractor – from Garryarthur, Kilfinane in Co. Limerick was fined €2,500 for failing to lodge VAT returns.

A farmer – named Peter Mackle – from Killyneil, Silverstream, Tyholland in Co. Monaghan was also sentenced to 21 months imprisonment for an oil laundering offence.

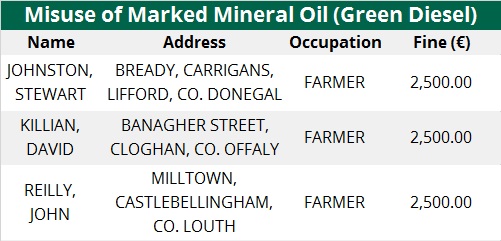

A total of three farmers made the tax defaulters list for the misuse of marked mineral oil (green diesel). These farmers were all fined €2,500.

The second part of the tax defaulters list also includes persons in the case of whom a penalty was determined by a court during the period January 1, 2017, to March 31, 2017.

Settlements are published when the extensive voluntary disclosure options are not availed of and the default arises as a result of careless or deliberate behaviour, according to Revenue.

A total 86 cases were published today in the second part of the tax defaulters list, with the settlement amounts from these cases equalling €14.4 million.

Pj Davis – a farmer from Kilberry, Athy in Co. Kildare – was ordered to pay Revenue €40,100 following a revenue audit due to the undeclaration of VAT.

Meanwhile, a farmer and turf supplier in Co. Laois was fined €81,939.53. Brendan Scully Jnr. from Coolagh, Clonaslee was also fined following a revenue audit due to the undeclaration of VAT.