EU faces challenges in increasing potato yield and production area - research

The EU and US both face challenges in increasing potato yields and production areas, as their current yields already exceed the global average.

According to the World Potato Map recently published by RaboResearch, the global potato market is experiencing a significant transformation, with frozen potato products taking center stage.

"As consumers embraced the convenience of fries and other processed potato products, international trade skyrocketed in the period 2019 to 2024, reshaping the landscape of potato production and processing," the research said.

"During this period, fast-growing markets like China and India turned from net importers into net exporters of frozen processed potato products.

"No longer limited to traditional potato-consuming regions like North America and northwestern Europe, frozen fries have become increasingly popular in other areas including the Middle East and Asia.

"This has driven a major change in the global potato market – particularly in the processed products segment."

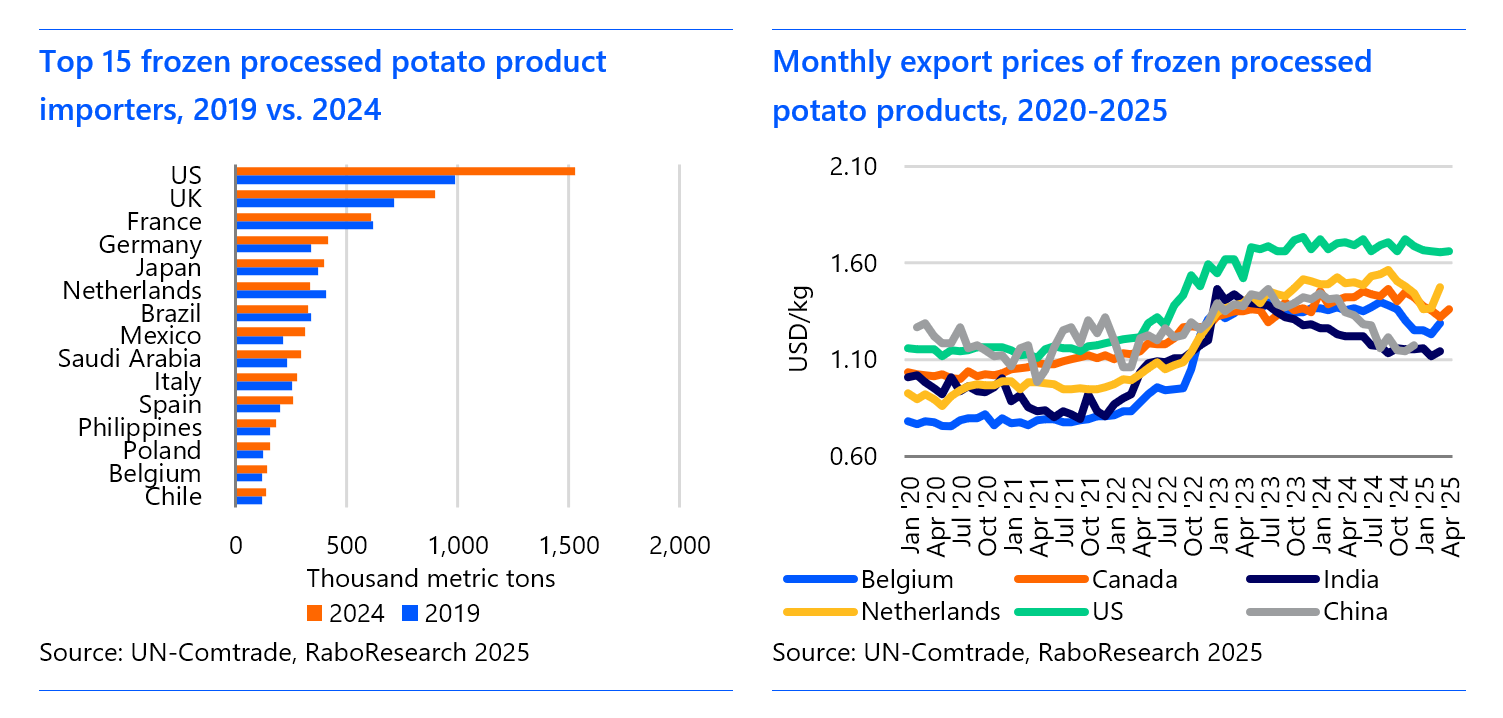

Between 2019 and 2024, the export value of frozen potato products soared from $7.7 billion to $13.2 billion.

“Both a growing market and higher prices drove the surge in export value, as costs for growing and processing potatoes increased substantially across the world,” Cindy van Rijswick, global strategist for fresh produce at RaboResearch said.

This growth was also fueled by increased imports in countries such as the US, the UK, Mexico, Saudi Arabia, Germany, and Spain.

Potato processing expands

As potato processing expands across Europe, North America, and Asia, the industry now faces the challenge of ensuring that demand keeps pace with the rapidly growing supply of frozen processed products, RaboResearch said.

"China and India are strengthening their competitive edge, transitioning from net importers to net exporters of frozen processed products.

"With impressive growth rates, both countries have expanded their domestic processing capacity, serving both local and regional markets.

"China's processing industry reached an impressive compound annual growth rate of 79% between 2019 and 2024, and India and Egypt followed suit with 45% and 16%, respectively.

"We expect these emerging players to continue expanding their processing capacity and export volumes, capitalizing on rising demand in the Middle East and Asia."

EU faces challenges

Global potato production is estimated at 372 million metric tonnes in 2024, with China and India leading the charge.

As these nations continue to expand their shares, the EU and US face challenges in increasing yields and production areas, as their current yields already exceed the global average.

“Rising costs have affected every player in the global potato supply chain, from growers to processors to consumers,” van Rijswick said.

“The prices of seed potatoes, raw potatoes, energy, and other inputs have driven up production, processing, storage, and distribution costs.”

The Netherlands stands as a global leader in seed potato exports, accounting for about half of global exports.

However, maintaining this dominant position will be increasingly challenging, due to regulatory constraints on resources like crop protection and water quality, and climate changes, RaboResearch said.