Dairy product prices rose 2.6% at today’s Global Dairy Trade auction, following a fall in prices at the last auction on May 3.

Butter Milk Powder posted the highest increase, with the index up 16.2% followed by Anhydrous Milk Fat with an increase of 4.9%.

Skimmed Milk Powder was down 0.9% while Whole Milk Powder was up 3.0%.

Earlier this week, New Zealand bank ASB suggested that skimmed milk powder (SMP) would pace overall dairy prices by approximately 4-6%.

In its latest dairy futures outlook it expected whole milk powder (WMP) prices to be up by 2-4% at the auction.

Key Results

- AMF index up 4.9%, average price US$3,340/MT

- Butter index up 3.8%, average price US$2,697/MT

- BMP index up 16.2%, average price US$1,545/MT

- Ched index down 0.8%, average price US$2,693/MT

- LAC index up 3.9%, average price US$713/MT

- RenCas index up 0.3%, average price US$5,060/MT

- SMP index down 0.9%, average price US$1,658/MT

- WMP index up 3.0%, average price US$2,252/MT

‘Dairy price recovery is two steps forward, one step back’

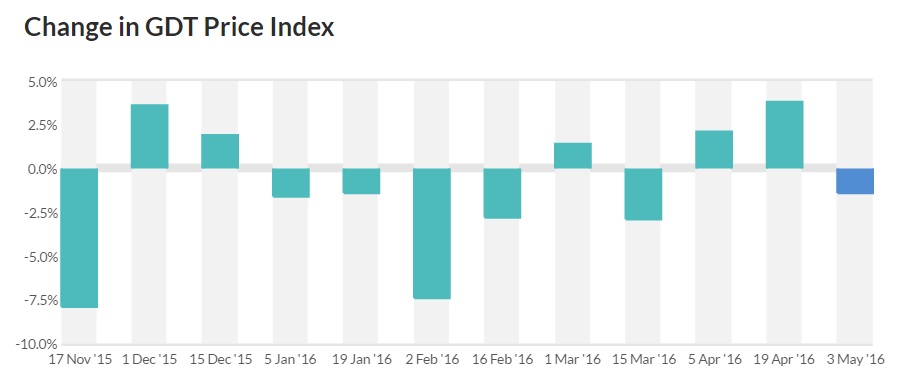

At this early stage of the dairy price recovery, it’s very much a case of two steps forward, one step back, according to Nathan Penny, Rural Economist with New Zealand’s ASB Bank.

He says a prime example of this is the drop in dairy prices at the Global Dairy Trade auction on May 3 which followed two positive price auctions.

The price recovery is predicated on a global production growth weakening, but Penny says that at this juncture dairy buyers are not convinced this supply correction is happening.

The Rural Economist says that indeed, recent production data, particularly out of the EU, have been unconvincing on this front, however, ASB anticipates that this picture will change.

Through the middle of 2016, monthly EU production data will slow towards zero on an annual change basis – changes which we foreshadowed in a report a month ago.

“However, Fonterra’s opening 2016/17 season milk price forecast (due later this month) will precede these data.

“As a result, we expect Fonterra to set its opening forecast near $5.00/kg. But if production growth data are confirmed weak in later months as we suspect, prices will recover during the season.

“On this basis, we expect the milk price will ultimately end the 2016/17 season at around $6.00/kg.”