Dairy market analyst: Milk price to range between 36-37c/L until May

Dairy market analyst, Chris Walkland has said his 'best guess' is that the base milk price could range between 36-37c/L into May.

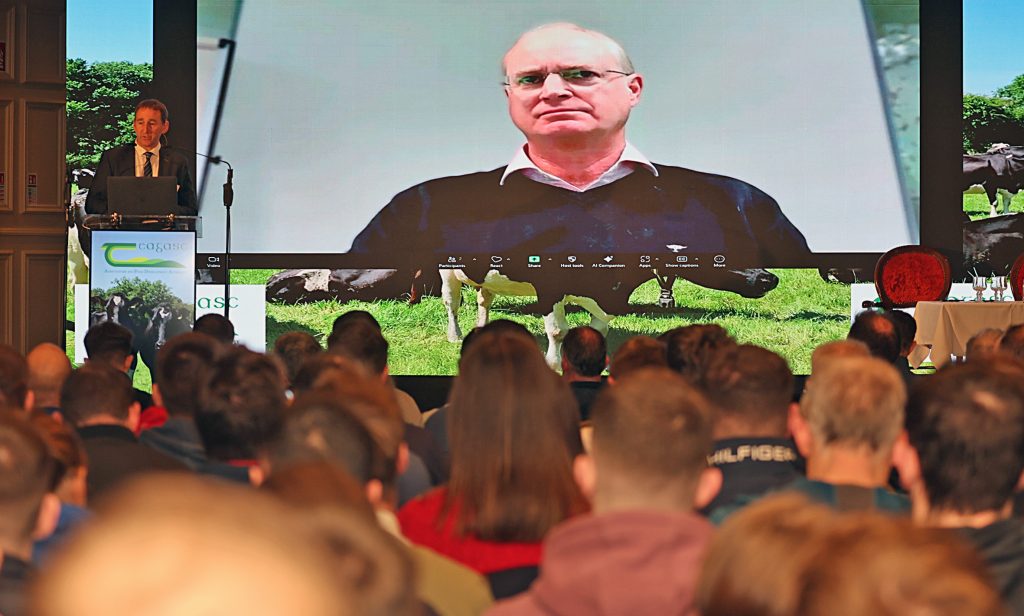

Walkland was speaking about the Irish and international dairy markets via video link at the National Dairy Conference in both Tipperary and Cavan this week.

Walkland has predicted the base milk price go to 36-37c/L for the first half of 2026, and could hit a low of 34c/L, with no signs of an improvement until the third quarter of 2026.

He said: "If I get all of the forward prices I can get and put them into a big milk price feeder wagon, turn the handle and spit out the price, what I'm getting is a range of prices from 37c/L to 36c/L."

He followed this up by saying: "The cure for high prices is low prices, and the cure for low prices is high prices".

Walkland has based these prices off his in-depth knowledge of the UK market, and converted the UK prices over to euro to get an estimate.

Production costs

With the average cost of milk production coming in at between 37-42c/L in 2025, dairy farmers will feel the squeeze next spring if the base price drops below production.

Following six consecutive reductions in global dairy trade (GDT), Walkland noted that this is the worst drop since 2018.

However, the analyst highlighted that the "good new is the US will cull hard and fast" as milk prices continue to drop globally, taking away from the oversupply of milk.

Dairy market

Walkland said this drastic crash in price is due to a global oversupply, referring to it as a 'tsunami of milk'.

He said this paired with early product offloads in fear of tariffs and an "end of year sale" in which he described as where co-ops "offload stock to make their books look good".

The analyst said that while this milk was building up over the summer, the 'traders' were on holidays and did not notice.

He said when they did notice, there was a sudden halt in trading which has hit markets around the world, and can be seen with the likes of butter moving over 39% in price since early summer.

Co-ops

Walkland questioned why farmers were not warned about the crash, saying it was obvious in August that there would be 10c/L reductions rather than 3c/L.

He recognised that nobody likes to give bad news, but said co-ops need to get better at warning farmers of sudden downturns in the market.

Prices have crashed in the Ireland, the UK, The Netherlands, Denmark and beyond, and even the New-Zealand based co-op Fonterra has narrowed its farmgate milk price.

Walkland highlighted how Germany and France are the only countries which have not yet dropped their milk price, but expects them to do so in the near future.