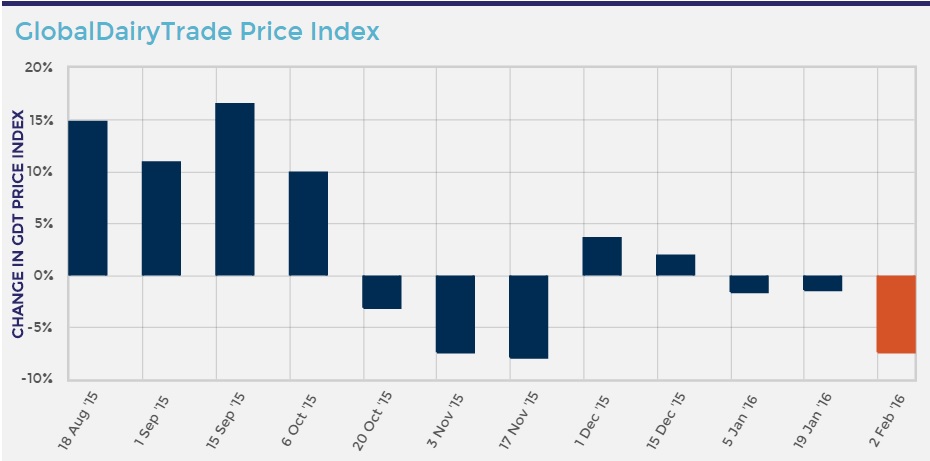

Dairy product prices decreased by 7.4% at today’s Global Dairy Trade (GDT) auction.

This is the third consecutive drop in 2016.

All dairy products recorded declines at the latest auction. Whole milk powder (WMP) recorded the biggest deficit with a decline of 10.4%.

Butter and butter milk powder (BMP) were also down 8.3% and 6.7% respectively.

Skimmed milk powder (SMP) recorded a drop of 2.2%.

The last two Global Dairy Trade auctions also recorded declines of 1.4% and 1.6% respectively.

Key Results

- AMF index down 6.6%, average price US$3,486/MT

- Butter index down 8.3%, average price US$2,905/MT

- BMP index down 6.7%, average price US$1,513/MT

- Ched index down 4.2%, average price US$2,807/MT

- LAC index down 2.6%, average price US$577/MT

- RenCas index down 3.7%, average price US$4,362/MT

- SMP index down 2.2%, average price US$1,792/MT

- WMP index down 10.4%, average price US$1,952/MT

Dairy prices may not lift until 2017

Meanwhile, dairy prices may not bounce back until next year, Rabobank’s Dairy Global Strategist, Kevin Bellamy has told Agriland.

The Netherlands-based strategist said that Rabobank did say that prices should improve in the latter half of 2016, but as time goes on it becomes more difficult for them to see dairy prices react.

“I think everyone has become more bearish in the last month, as the demand situation has got a little bit weaker.

“A lot of people are saying the recovery may take place very late in 2016, or else may not happen at all [this year].”

“We’ve seen a lot more milk come out of Europe but we’ve been able to export it, thanks to the weakness of the euro against the Dollar.

“So we haven’t seen stocks build-up or prices fall in the same way they have in New Zealand, for example.”

He said that it’s going to be a difficult year for dairy all around the world.

“As quotas were removed from European dairy farmers last year, they will still be trying to find the optimum production, which will take a couple of years until we reach a new norm.”