The Brazilian beef industry: Just how big is it?

The scale of the Brazilian meat production and processing sector is simply massive.

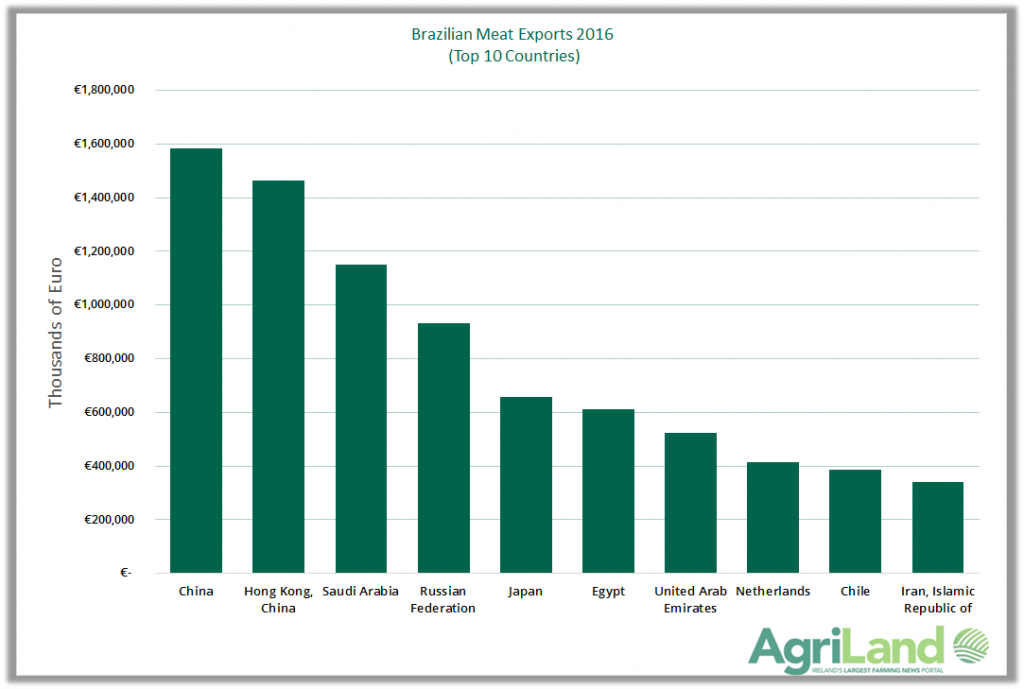

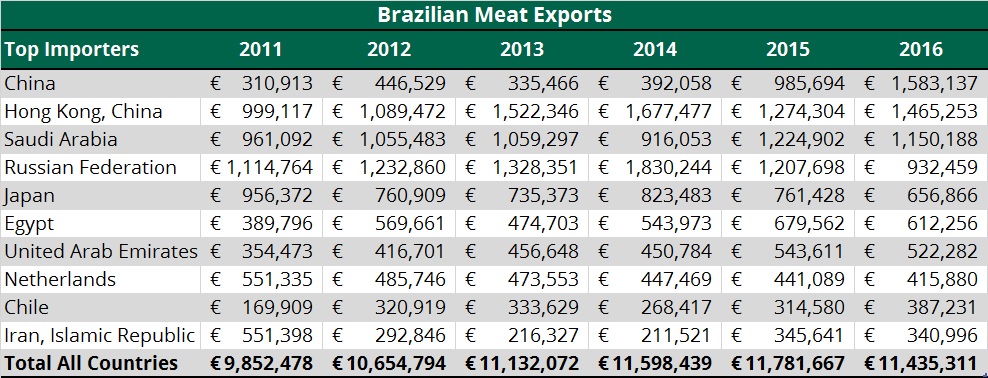

Total meat exports from Brazil amounted to just short of €12 billion in 2016. The top markets for this output were: China (€1.6 billion); Hong Kong (€1.46 billion); Saudi Arabia (€1.15 billion); and the Russian Federation (€932m). Total meat exports from Brazil to China almost trebled between 2014 and 2015.

Brazil is home to 209m head of cattle, grazing 167m ha. The overall stocking density is 1.25head/ha. Brazil’s cattle/beef industry generates about 360,000 direct jobs.

In 2015, Brazilian beef production amounted 9.56t million carcass-weight equivalent (CWE). Total slaughterings amounted to 39.16m head. Beef exports amounted to 1.88t million CWE that year, accounting for 19.63% of total production. This was valued at €4.31 billion.

Beef exports accounted for 3% of all Brazilian export revenues in 2015. In the same year, Brazil’s beef sector accounted for 14% of global beef output. The US accounted for 15% of total world output.

Total meat output from the EU amounted to €82 billion in 2015. The figure for beef was €26 billion, which amounted to 10.8% of total global output.

It has been estimated that 96% of all Brazil’s beef output is grass-based. Current research is focused on allowing Brazilian farmers to become more efficient – chiefly from a grass utilisation point of view. The development of paddock-based systems is now a key priority. The more intensive use of existing grassland should reduce the pressure to deforest further.

Brazil’s cattle industry is centred in the mid-west of the country, with the Matto Grosso du Sol region playing a particularly important role. Alas, drought is a major impediment to the growth of the sector. Lack of rain in the country’s most intensive livestock regions has significantly impacted beef output during the past three years.