Health challenges impact global pork industry growth

The global pork industry is navigating an uncertain outlook, with limited sow herd growth reflecting the impact of fluctuating trade dynamics and ongoing health challenges.

That's according to a RaboResearch report which outlined that despite these headwinds, the sector is focusing on productivity improvements and strategic market expansion to maintain profitability and meet demand.

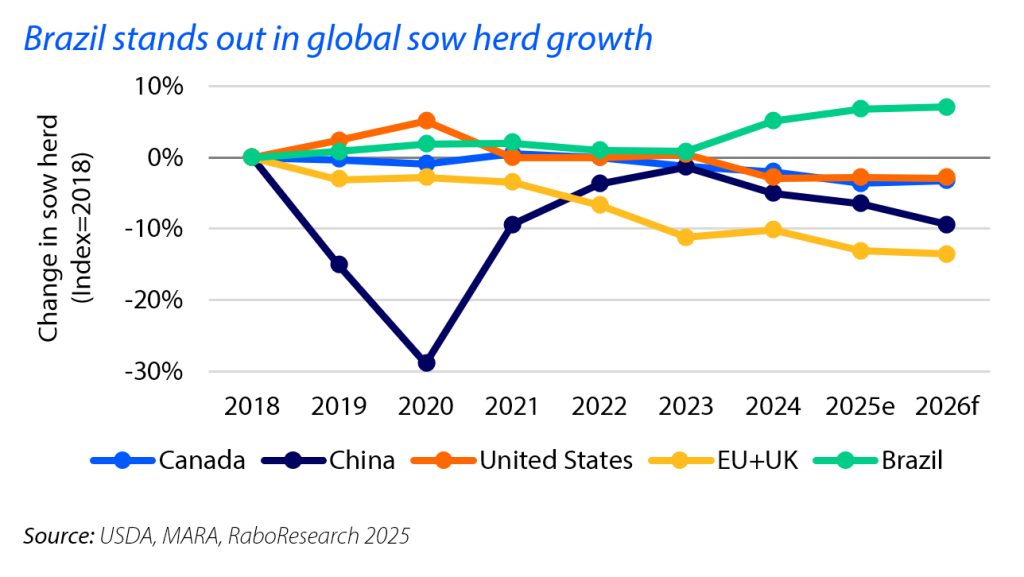

The global sow herd is projected to decline in 2026, as producers face heightened uncertainty.

While tighter competing meat supplies and lower feed costs will support a favourable margin environment for most producers, the industry remains cautious on herd expansion, according to the report.

Senior analyst – animal protein for RaboResearch, Christine McCracken said: “The industry is increasingly prioritising productivity enhancements, herd health, and optimising carcass weights to counterbalance limited herd growth."

Notably, China’s policy to reduce sow numbers by one million, approximately 2.5% of its current base, will result in a 1% reduction in global sow numbers.

However, Brazil's continued sow herd growth, fuelled by favourable margins and robust export growth, partially offsets this decline.

Pork trade remains unstable

Global pork trade has seen a 3% year-over-year increase through June, with expectations to end 2025 at, or slightly above, previous levels.

Brazil stands out as a key beneficiary, poised to expand its market share from 12% to 15% of total global pork volumes by 2025.

According to McCracken, this success is attributed to Brazil's strategic efforts to broaden market access and diversify export relationships.

Meanwhile, geopolitical tensions persist, with the US and EU facing trade challenges with key export markets, including China.

Health concerns

Herd health was a significant disruptor of production and trade over the past year, but the early signs point to a more stable outlook in 2026, according to the report.

Disease losses earlier in 2025 have constrained pork supplies in most of the top production regions.

African swine fever (ASF) continues to pose challenges, particularly in Vietnam, which reported over 970 cases and the loss of over 100,000 pigs in 2025.

Despite efforts to enhance biosecurity and implement vaccine protocols, the virus remains difficult to control.

Europe also faces ASF challenges, with Romania and Germany experiencing new outbreaks in their commercial herds.

Additionally, foot-and-mouth disease (FMD) and porcine reproductive and respiratory syndrome (PRRSv) are impacting production, with PRRSv driving notable losses in North American and European markets.

Pork prices

“Pork prices are strong as demand growth outpaces supply in most markets," McCracken continued.

"Key production regions, including the EU and North America, have seen pork inventories drop, leading to price increases of 10% and 21% year-to-date, respectively."

At the same time, China's pork prices have dropped 42% year-over-year due to increased production efficiency.

While pork consumption remains steady, inflationary pressures could dampen sales in late 2025 and early 2026, according to the research.

Despite these economic challenges, limited global beef and chicken supplies are expected to support pork consumption, although premium and export-dependent cuts may face downward pressure.