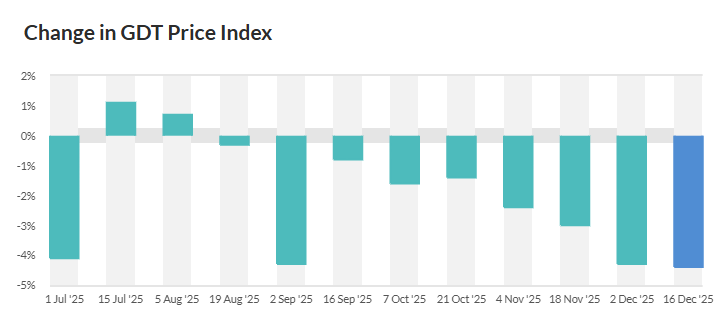

Final GDT auction of 2025 sees yet another fall in dairy prices

The final Global Dairy Trade (GDT) auction of the year delivered little festive cheer today (Tuesday, December 16) on dairy prices.

The GDT price index fell by a further 4.4% to 1,008 - down from 1,054 earlier this month.

It marks the ninth consecutive fall in the GDT index.

There were a total of 156 bidders in the event which saw 33,974 metric ton (MT) of product sold.

The average selling price was €2,843 per metric ton in the auction, which lasted for nearly two hours, during which there were 120 winning bidders and 17 bidding rounds.

The GDT auction, which is held twice in every month, is a trading platform for core dairy products.

According to Cristina Alvarado, head of dairy insights with New Zealand’s Stock Exchange (NZX), the latest GDT event "delivered a more bearish outcome than expected".

But she warned that the results reflect the "persistent supply-side pressure in global dairy markets, as milk availability continuesto run high across several key producing regions".

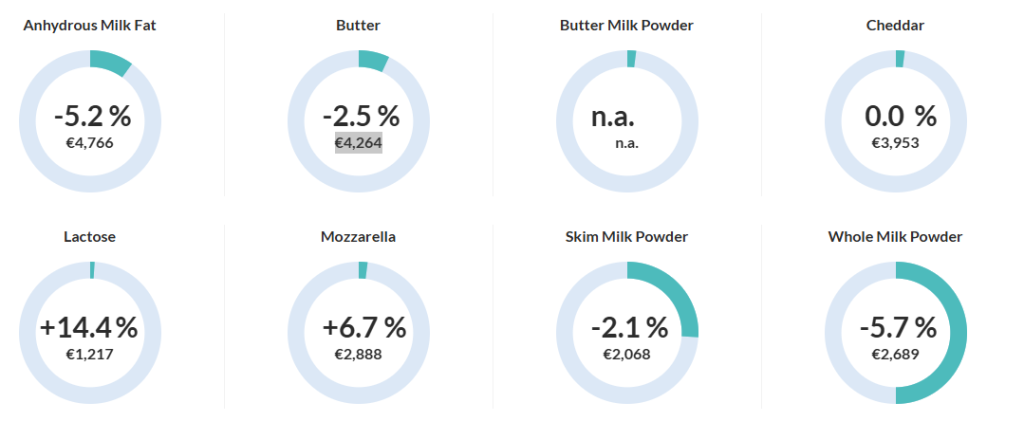

Today's auction saw lactose prices rise by a substantial 14.4% to €1,217/mt.

In contrast whole milk powder prices fell by 5.7% to €2,689/mt.

However butter prices which have slumped in recent auctions continued on a downward trend falling by 2.5% to €4,264/mt.

GDT auction

In the graphic (below) the shaded dials indicate the proportion of each product group sold versus total quantity sold during the previous 12 months, with a three month lag.

Figures within the dials represent the percentage change in GDT price index and the weighted average price.

Milk supply

The final GDT auction of 2025 took place against the backdrop of various analysts warning that global milk supply is now in excess of demand.

According to the latest Global Dairy Quarterly report published by Rabobank global dairy markets softened through quarter three of this year and "fell sharply in quarter four".

Researchers have indicated that global milk production is "on track to finish strong in 2025".

They highlighted in the latest report that the EU and UK posted their strongest growth since 2017 for the month of October while there has also been suring US milk flows and farmers in New Zealand have also been "setting new milk solids each month from May to September 2025".

Rabobank researchers have warned that the global dairy market will face a "period of weaker commodity prices in the face of ample milk supplies into 2026 and exportable surpluses".