Brexit contributed to a reduction in the import of food and live animals from Great Britain, valued at about €1.2 billion in 2021, according to a recently published report from the Irish Maritime Development Office (IMDO).

This represents a decline of 36% in such imports, when compared to the previous year.

The report revealed that Great Britain was the only major import partner to record a decline in import value in 2021.

It noted that the imposition of customs controls on trade between Great Britain and members of the EU Single Market, as a result of Brexit “constitute barriers to trade, making it more difficult for Ireland to trade with its largest importing partner. These barriers contributed to the significant decline in imports from Great Britain in 2021.”

New import partners

And it was case of Great Britain’s loss is Canada and the Netherland’s gain.

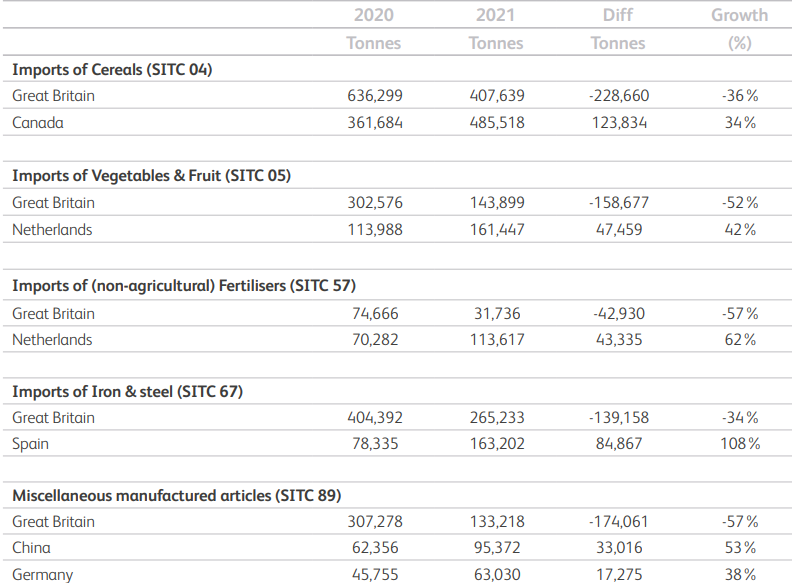

A closer look at the import categories and from where they came revealed that, in the case of cereals, there was a 36% drop in imports from Great Britain in 2021 when compared to 2020. However, imports of cereals from Canada grew by 34% in the same period.

Imports of vegetables and fruit from Great Britain dropped by 52% from 2020 to 2021, but went up by 42% from the Netherlands.

Food and live animals – what is the composition?

According to the report, in the food-and-live-animals category, five products consistently make up 90% of the overall grouping: animal feeds; cereals; vegetables and fruit; dairy products and eggs; and sugar products.

According to the report, the value of imports, generally, from Great Britain fell by 13%, or approximately €2.4 billion.

This decline came, predominantly, from categories such as food and live animals, and manufactured goods.

Total imports

In 2021, imports of food and live animals declined by 8%, generally, equivalent to 740,000 tonnes.

The largest decline was in cereals, which fell by 13%, or 313,000 tonnes.

Imports of vegetables and fruit fell by 9%, or 100,000 tonnes, while imports of dairy products and eggs fell by 15%, or 140,000 tonnes.

When combined, these three products accounted for 75% of the overall decline in this category in 2021.

In all, this is the lowest volume of food and live animal imports since 2016.

Much of this decline was driven by fewer imports of these products from Great Britain in 2021.

Northern Ireland

Outside of construction materials, imports of animal feed increased by 17%from Northern Ireland – equivalent to an additional 97,000 tonnes – in 2021.

Alongside the significant decline in imports from Great Britain, imports from Northern Ireland in 2021 rose at their fastest pace, however, in more than a decade – by 25% or 572,000 tonnes.

“This raised the question as to whether some Irish imports from Great Britain were indirectly transiting through Northern Ireland, via Northern Irish ports,” the report stated.

“Under the Northern Ireland protocol, goods entering Northern Ireland must continue to follow EU product standards, which means Northern Ireland, effectively, remains in the EU Single Market for goods.

“Goods arriving in Northern Ireland from Great Britain must submit declarations for those goods and pay an EU tariff/duty, if applicable.”

US

Imports of non-energy products from the US were driven predominantly by animal feed, which grew by over 160,000 tonnes.

Bulk products

The volume of Irish ‘merchandise’ imports has fluctuated in recent years, according to the report.

In 2018, import volumes rose to record levels, due mainly to a national fodder crisis that necessitated agricultural stockpiling of bulk products such as animal feed.

In 2019, volumes underwent a correction and declined by 5%.

Dry bulk refers to raw materials for industrial or agricultural purposes, such as fertiliser, animal feeds and iron ores.

In the dry bulk sector, one million additional tonnes were handled in 2021 compared to 2007 – an increase of 7%.

This has been driven in part by the increase in Ireland’s population, which according

to the CSO, is estimated to have increased by 15% between 2007 and 2021.

A larger population will increase the country’s need for essential raw materials in the dry bulk market, such as grains and fertiliser for food production.